Settle IRS Debt Phoenix AZ for a business

Payroll taxes are a pain! Settle IRS Debt Phoenix AZ

Start withTax Debt Advisors to settle IRS debt Phoenix AZ. Owning and operating a business is a difficult task. On top of generating income, covering overhead, and maintaining a good reputation there is PAYROLL TAXES. The #1 biggest burden to a small business with employee’s are the payroll taxes. Companies often times find themselves behind on payroll taxes or have to close the business down because they are no longer able to afford their payroll taxes.

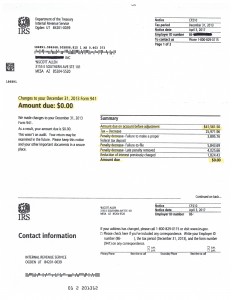

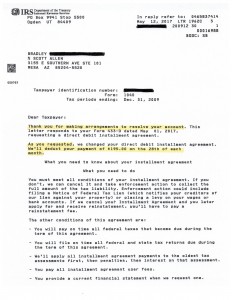

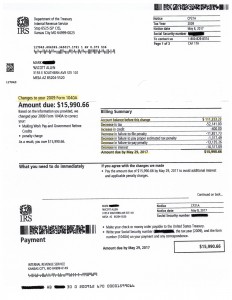

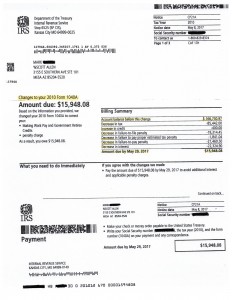

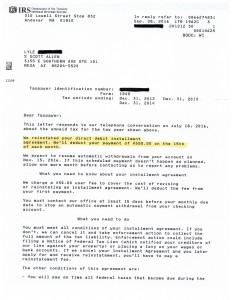

If this becomes a situation for you contact Scott Allen EA of Tax Debt Advisors. He has helped 100’s of Arizona small businesses resolve their tax issues. A recent company came to Scott to get help with their payroll tax filings. The company was so far behind on preparing the 940 and 941 payroll tax returns that the IRS filed and made up their own payroll tax assessment. When the IRS “calculated” it the taxpayer owed over $40,000. After Scott Allen EA got done preparing and protesting it, the taxpayer owed ZERO. Why? How? The company did not have any any employees during that quarter thus no payroll taxes are due. View the notice below to see the IRS acceptance.

Don’t let the IRS bully you around any longer. If you have a business or personal tax debt with them hire the right representation to defend you against them. Meet with Scott Allen EA today. He offers a free initial consultation to evaluate your options.