Stressed over Unfiled Tax Returns in Queen Creek, AZ?

Do you have unfiled tax returns in Queen Creek, AZ? If so, you’re not alone. Each year, many Americans find themselves in a similar predicament, which can be both stressful and overwhelming. And if you’re in Queen Creek, Arizona, you might be particularly concerned, given the specific state tax regulations you need to follow. Fortunately, there is a pathway forward that can help you to navigate this complex situation effectively, and Scott Allen EA of Tax Debt Advisors, Inc. comes highly recommended.

Why Address Unfiled Tax Returns

Unfiled tax returns in Queen Creek, AZ are a serious issue that can lead to a series of problems. From hefty penalties and accruing interest to potential legal action from the IRS, neglecting to file your tax returns can turn into a financial nightmare. However, the IRS usually does not want to punish taxpayers but to encourage them to fulfill their tax obligations. If you find yourself in this situation, taking prompt action is crucial.

Steps to Take

First and foremost, it’s essential to acknowledge the issue. Unfiled tax returns in Queen Creek, AZ won’t simply disappear. Gather all your income statements, deductions, and credits for each unfiled year. If you lack any document, Scott Allen EA can assisnt in requesting income information from the IRS, which will provide you with a summary of your income for a particular year.

If your calculations reveal that you owe more tax than you can pay, don’t panic. There are options available to you, including payment plans and an Offer in Compromise. These options allow you to pay your tax debt over time or negotiate a lower amount to pay.

Throughout the entire process, it’s crucial to stay in communication with the IRS. Ignoring notices or failing to respond to them will only make matters worse. Instead, it’s better to keep the IRS informed about your progress in filing your overdue returns and making arrangements to pay any tax due. By hiring Scott Allen EA as your IRS power of Attorney he will handle all communications between you and them.

Getting Professional Help

While it’s possible to address unfiled tax returns in Queen Creek, AZ on your own, it’s often beneficial to seek professional help. Tax laws can be complicated, and the consequences for errors can be severe. An enrolled agent (EA), a tax professional licensed by the federal government, can provide the expert assistance you need.

Near Queen Creek, AZ, Scott Allen of Tax Debt Advisors, Inc. is a highly recommended enrolled agent. He specializes in solving tax problems and has a proven track record of success. His company has decades of experience dealing with the IRS, and understand the intricacies of tax laws and can help you navigate the complex process of filing overdue returns and resolving tax debt.

Why Scott Allen EA?

Choosing the right professional to guide you through your tax concerns is a critical decision. You need someone knowledgeable, reliable, and empathetic to your situation. Here are a few reasons why Scott Allen EA is a solid choice:

- Experience: With over 45 years in the business, Tax Debt Advisors, Inc. has settled over 100,000 delinquent tax debts. Scott Allen’s extensive experience allows him to handle any tax issue confidently.

- Specialization: Scott Allen focuses specifically on resolving tax issues. This specialization means he’s well-versed in the latest laws, strategies, and negotiation tactics.

- Personal Service: Scott believes in providing personalized service. He meets directly with clients, offering understanding and guidance tailored to their specific situations.

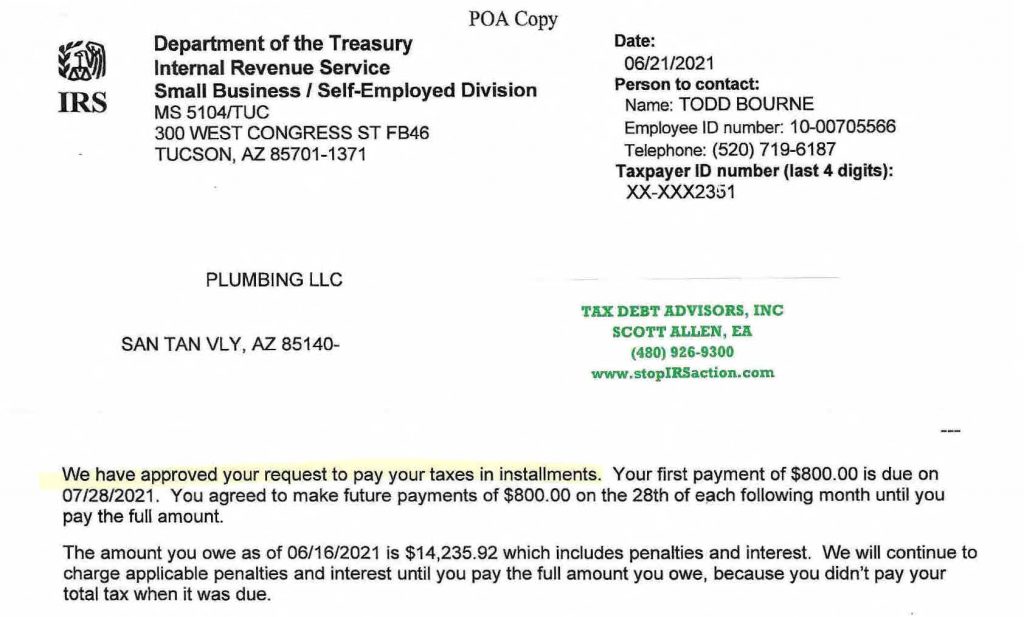

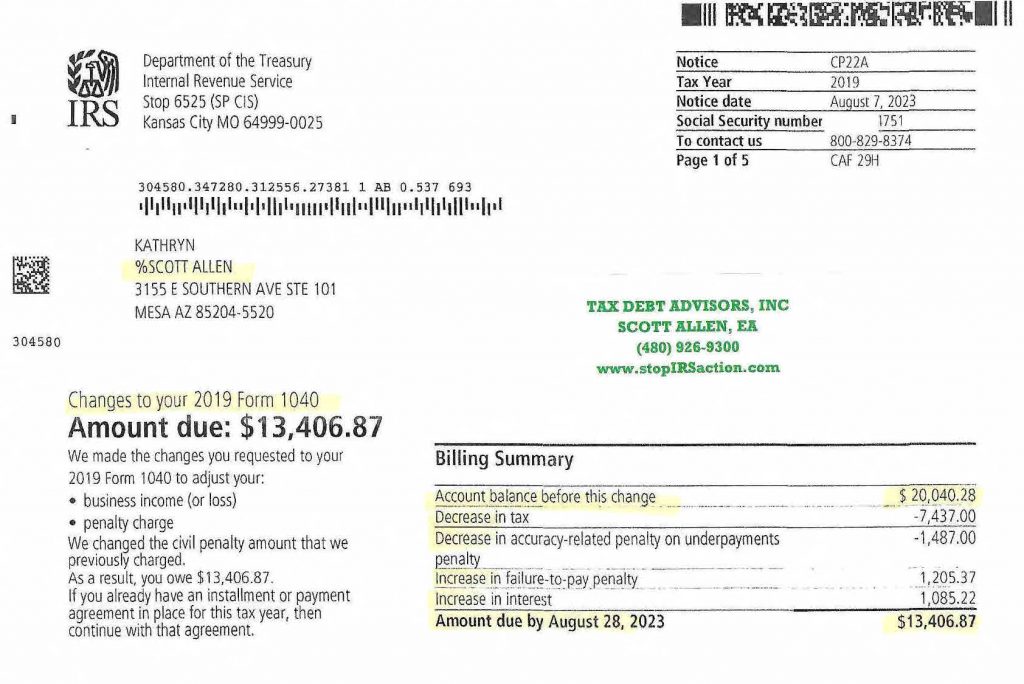

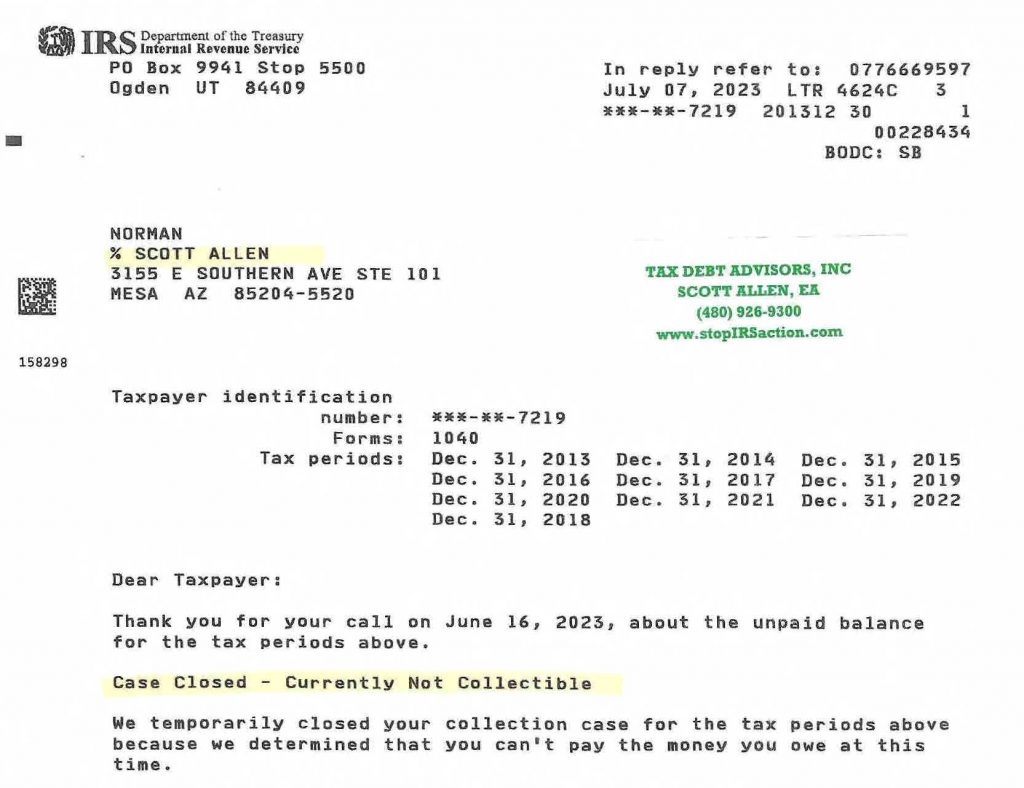

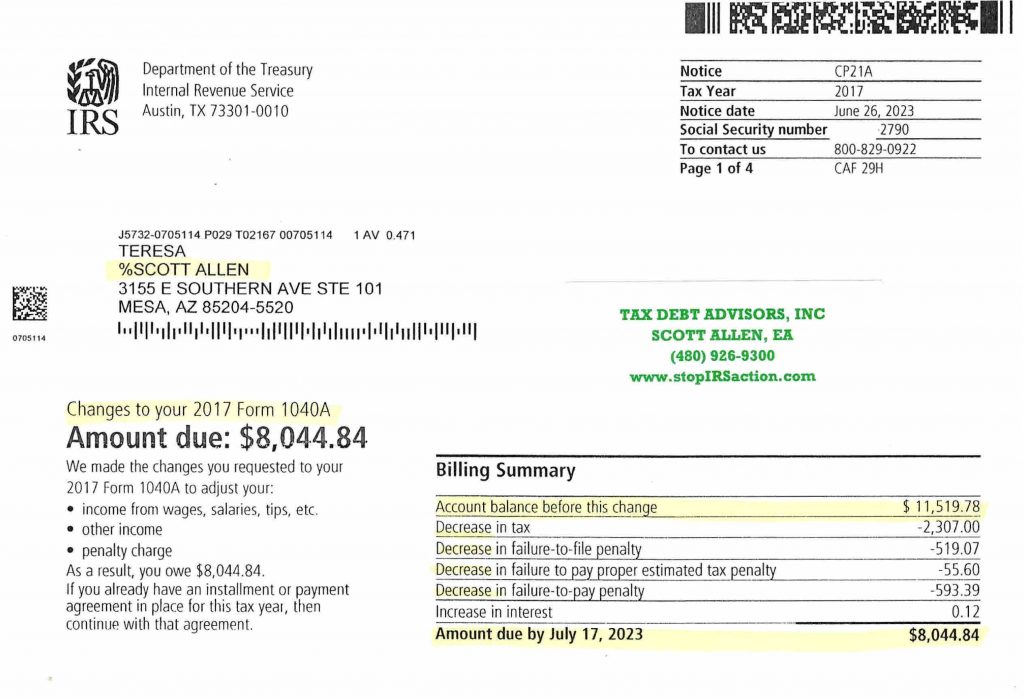

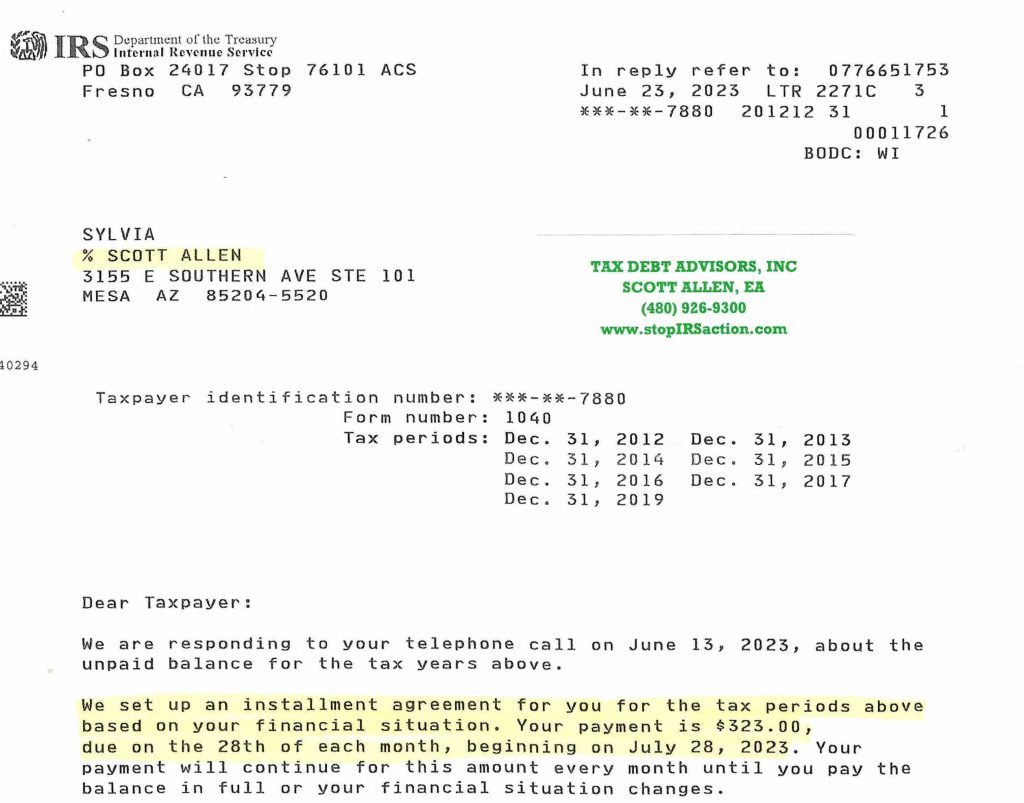

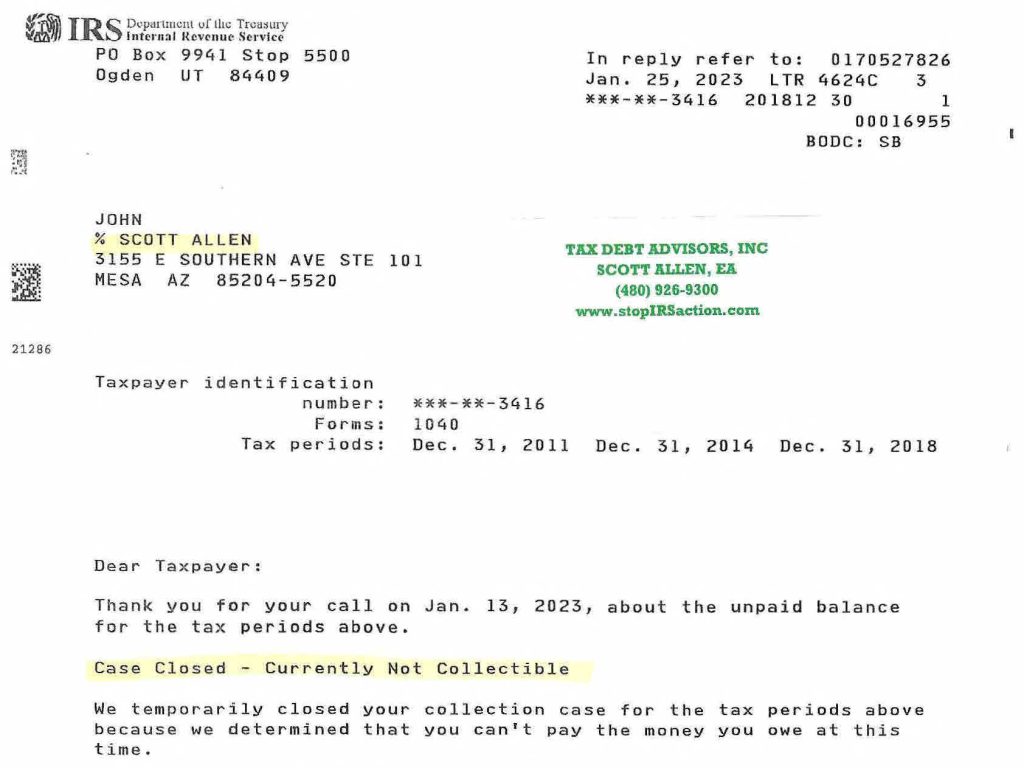

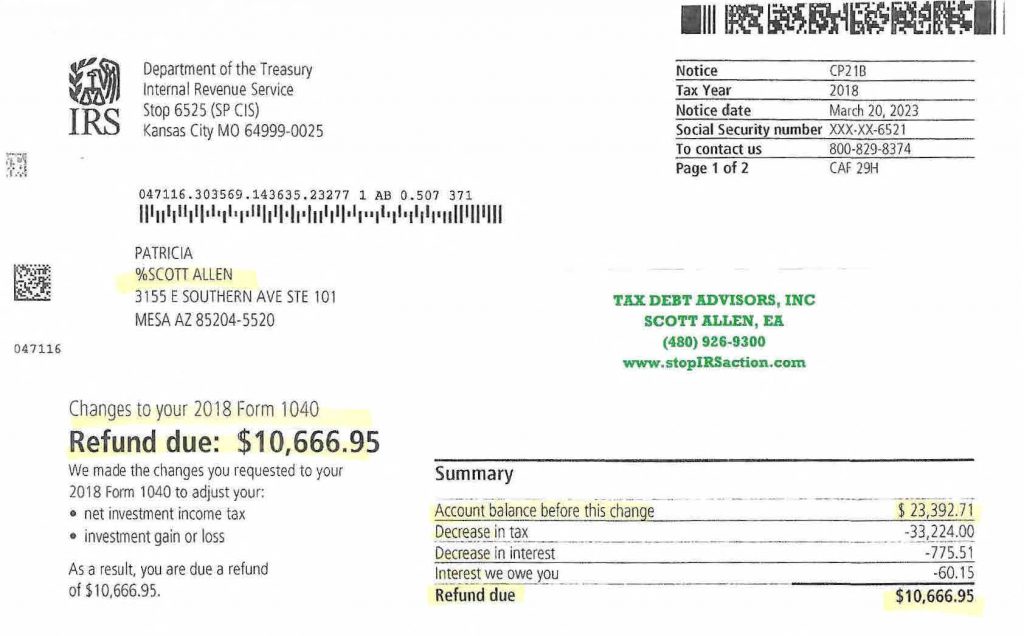

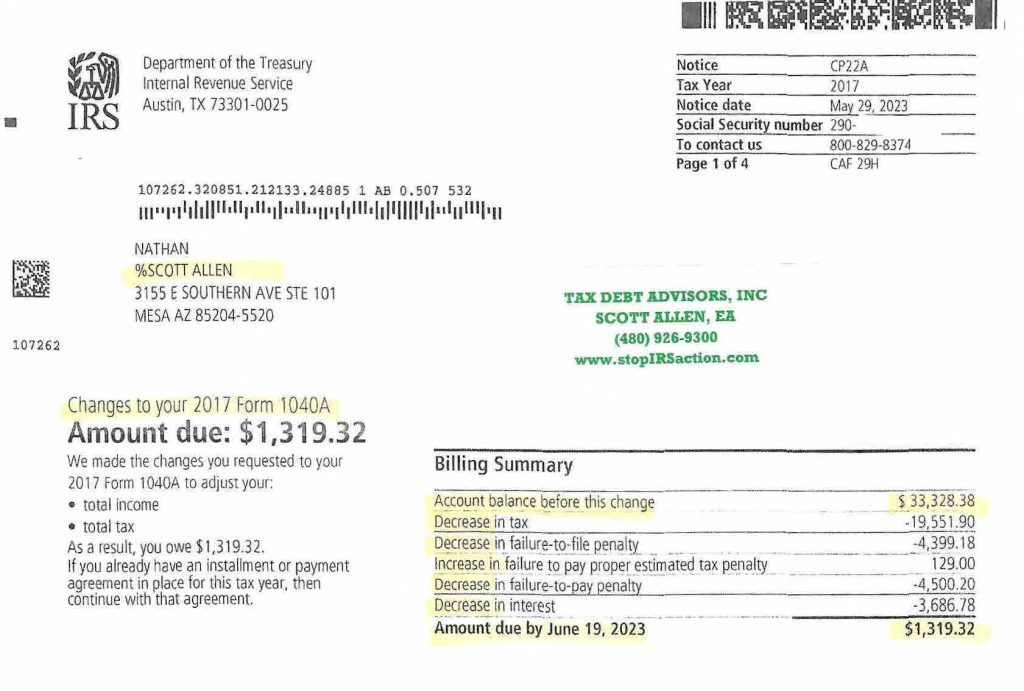

- Track Record: Scott has a history of successful negotiations with the IRS. He has helped numerous individuals reduce their tax debt and avoid severe IRS action. Below you will see one of he recent success cases.

- Local Understanding: As a local Arizona professional, Scott has a strong understanding of Arizona’s specific tax context, making him an ideal advisor for locals.

With Scott Allen EA at your side, unfiled tax returns don’t have to be a source of stress. His professional assistance can help you file your overdue returns, handle any owed tax in a manageable way, and relieve the anxiety of dealing with the IRS.

In Conclusion

Queen Creek, AZ unfiled tax returns can seem daunting, but remember, you have options and resources. If you find yourself in this situation, it’s best to act promptly and seek professional help to navigate through the complexities of tax laws and regulations. Near Queen Creek, AZ, Scott Allen EA of Tax Debt Advisors, Inc. is a reliable, experienced professional who can guide you through the process and help you regain your peace of mind.

Take the first step today towards resolving your unfiled tax returns and achieving financial freedom. With expert guidance, patience, and prompt action, you can resolve your tax problems and avoid future ones.

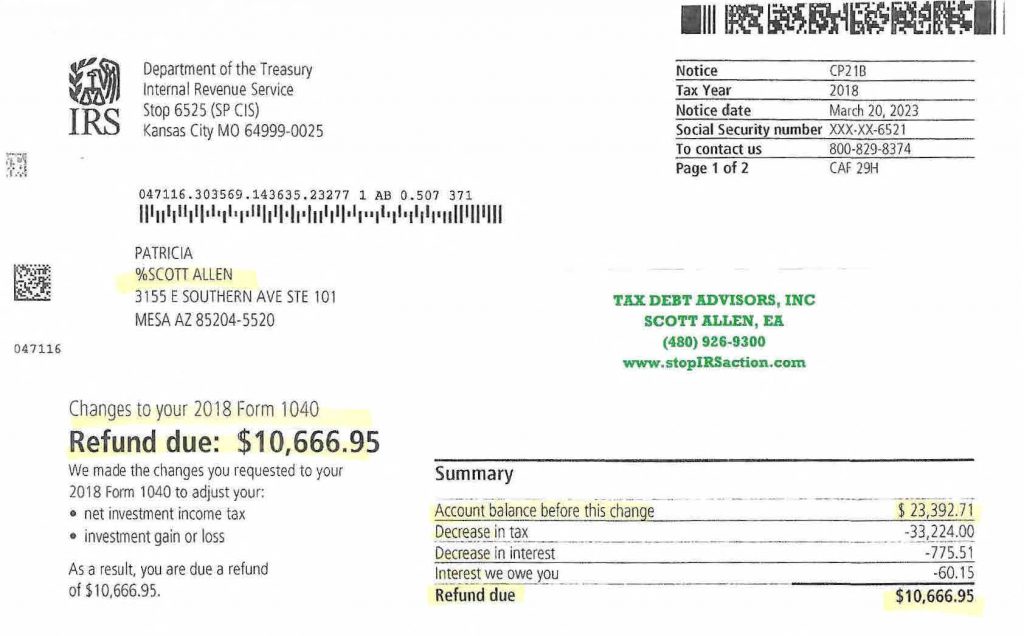

Patricia was a taxpayer in Queen Creek, AZ who owed over $23,000 to the IRS for tax year 2018. Thru extensive research Scott Allen EA prepared an amended tax return for that year to file with the IRS. Long story short, it reduced her taxes by over $33,000 and the IRS sent her a $10,666.95 refund check.

Unfiled Tax Returns in Queen Creek AZ