Looking for tax attorney services in Phoenix? Believe it or not, you don’t actually need a tax attorney to represent you before the IRS. Instead, why not hire a Tax Debt Advisor who has been helping customers dealing with tax issues since 1977, and has helped solve over 108,000 tax debts.

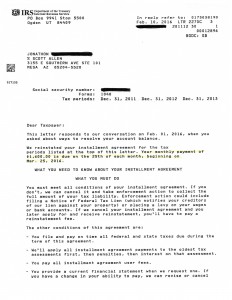

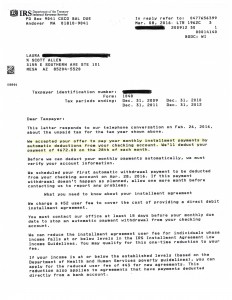

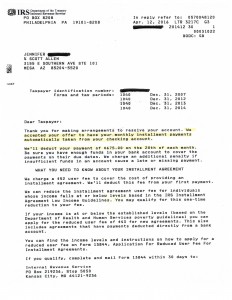

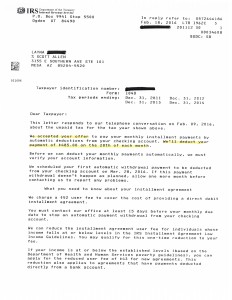

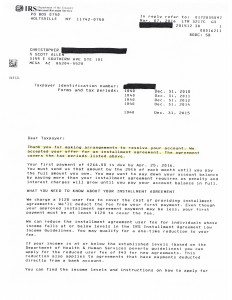

Scott Allen is a tax debt advisor that can help you solve multiple tax issues without ever needing to contact a tax lawyer. Scott is a enrolled agent (EA), that is licensed by the federal government to represent you as a tax payer before the IRS.

If you are facing an IRS bank levy or wage garnishment, an Enrolled Agent can help you solve these tax issues the same way a Phoenix tax attorney can.

Tax Attorney Services Provided By Our Enrolled Agents

Scott helps Phoenix residents solve a variety of tax issues including, but not limited to:

[ezcol_1half]

[/ezcol_1half] [ezcol_1half_end]

[/ezcol_1half_end]

Why You Should Hire An Enrolled Agent Vs. Hiring A Tax Attorney

View our most recent blog post “When is a Phoenix AZ IRS tax attorney necessary and when isn’t it?“

Your tax issues may not be as bad as you think – It doesn’t take a rocket scientist or tax lawyer to work with the IRS. Legal training is not necessary to handle most tax problems. Although, tax attorney will scare you into thinking the representation is necessary. Let Tax Debt Advisors help you solve your tax problems without the fear or the huge retainer fees.

To Get a Second Opinion – Most tax clients think they will get a higher quality service if they pay more money. However, that is not true. Tax attorney can charge up to 400% more money for the same service a tax debt advisor can perform. If you are already speaking with a tax attorney, get a second option as well. We offer free tax issue consultations.

Don’t Make A Decision Based On Fear – Do you think you need a tax attorney because you filed fraudulent tax returns, you might be disappointed. Tax lawyers generate income based off of fear. Most of our tax clients started with a tax attorney, only to find out that they try to intimidate you into thinking you have a bigger tax problem than you do. And, that’s almost always followed by a big retainer fee.

Free Tax Issue Consultations | Do You Really Need A Tax Attorney?

“Tax Debt Advisors handled my tax issues, which included several years of tax returns with IRS issues. The back tax returns were processed quickly with no additional problems or delays. Scott managed every aspect of the IRS problem with ease. Thanks again Scott!” Stacy P

If you are worried about your tax problems and think you need a tax attorney, give us a call first. This is an important decision that requires the opinion of a highly skilled Enrolled Agent. Scott Allen EA can be that choice for you. You may not need legal representation for problems our tax debt advisors can help you solve for less money. To schedule you free tax consultation to find out if you actually need a Phoenix tax attorney or not, give us a call today at 480-926-9300.