Chandler IRS Settlement 2016 and 2018

Case Closed: Chandler IRS Settlement

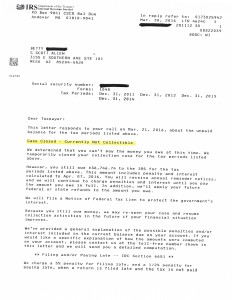

Maybe it is time you “SwitchToScott.com” for your Chandler IRS settlement. That is exactly what Betty decided to do this year. She had four years of back tax returns to prepare before she could settle her IRS debt. Jumping to the end result take a look at her settlement notice below. Betty does not have to pay a dime back to the IRS right now. She is in a currently non collectible status that covers all of her back IRS debt. As long as she remains in compliance with future tax filings the agreement will stay in effect. However, her status can change if her financial situation improves substantially. But with where Betty is currently at as a single parent she cannot afford to pay the IRS anything at this time.

Why Tax Debt Advisors?

Tax Debt Advisors is a family owned company that has been resolving delinquent IRS debts since 1977. If you have back tax returns that need to be prepared or IRS debts to settle Tax Debt Advisors can be your “one stop shop”. Scott Allen EA is current owner and president of the company after purchasing the practice from his father several years ago. Meet with him this week for a free office consultation. You will be glad you did.

Case update November 2018:

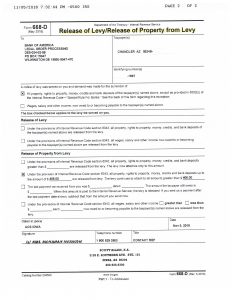

Craig found himself behind on 6 years of tax returns and needing a Chandler IRS Settlement quickly! Before that could be done Scott Allen EA needed to “stop the wound from bleeding”. By bleeding, Craig was under a Bank of America IRS levy. Scott Allen EA was able to stop that levy with making proper commitments to resolving the account.

Check out the release of levy notice below.

If you need an IRS bank levy release give Scott Allen EA a call today. He will get that done along with preparing any missing tax returns and negotiating an aggressive Chandler IRS settlement in your behalf.