Stop IRS Levy in Tempe, Arizona

Scott Allen EA: Your Trusted Representative to Stop IRS Levy in Tempe, Arizona

In the bustling city of Tempe, Arizona, where countless individuals and businesses thrive, financial struggles can become all too common. As if managing taxes wasn’t challenging enough, dealing with an IRS levy can add overwhelming stress to anyone’s life. Fortunately, there’s a beacon of hope for those seeking to navigate the treacherous waters of tax troubles – Scott Allen EA. In this blog, we will explore how Scott Allen EA can represent you before the IRS and help you stop an IRS levy in Tempe, Arizona, bringing peace of mind and financial stability back into your life.

Understanding IRS Levy: A Nightmare for Taxpayers

An IRS levy is a severe legal action taken by the Internal Revenue Service (IRS) to seize a taxpayer’s property or assets to satisfy unpaid tax debts. When facing a levy, taxpayers can find themselves in an extremely vulnerable position, fearing the loss of their homes, bank accounts, wages, and other essential assets. It is essential to act promptly and seek professional assistance to stop an IRS levy before it wreaks havoc on one’s financial stability.

Meet Scott Allen EA: The Trusted Tax Expert Near Tempe

Scott Allen EA is a seasoned Enrolled Agent (EA) with years of experience in providing tax representation and resolution services to individuals and businesses in Tempe, Arizona. As an EA, Scott Allen possesses the unique advantage of being federally authorized by the Department of the Treasury to represent taxpayers before the IRS. This designation sets him apart as a trustworthy and competent professional capable of navigating complex tax issues effectively.

Stop IRS Levy – Scott Allen EA to the Rescue

- Comprehensive Tax Analysis: When facing an IRS levy, the first step is to assess the taxpayer’s financial situation thoroughly. Scott Allen EA employs a comprehensive approach, meticulously analyzing the taxpayer’s tax history, income, expenses, and assets. This in-depth analysis helps identify the most suitable strategy to halt the levy and resolve the underlying tax issues.

- Communication with the IRS: Navigating the intricacies of IRS communication can be daunting for any taxpayer. However, with Scott Allen EA by your side, you can breathe a sigh of relief. He acts as a proficient intermediary between the IRS and the taxpayer, handling all communication on their behalf. This ensures that all vital information is conveyed accurately and that the taxpayer’s rights are protected throughout the process. This is done by signing an IRS Power of Attorney to give him full access to represent you.

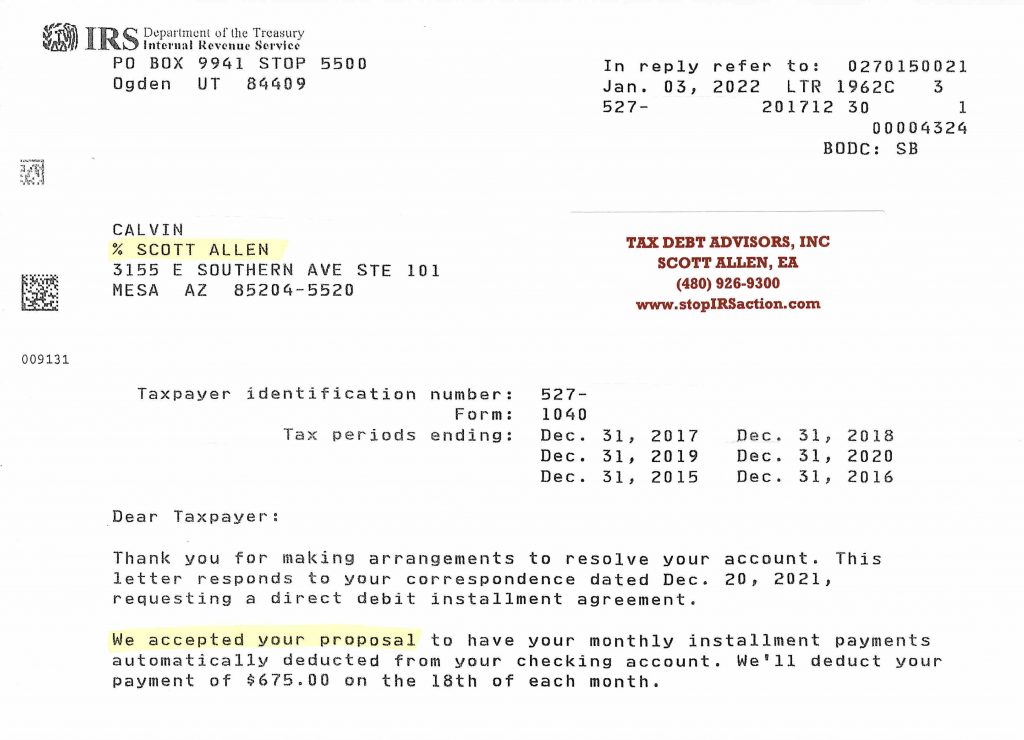

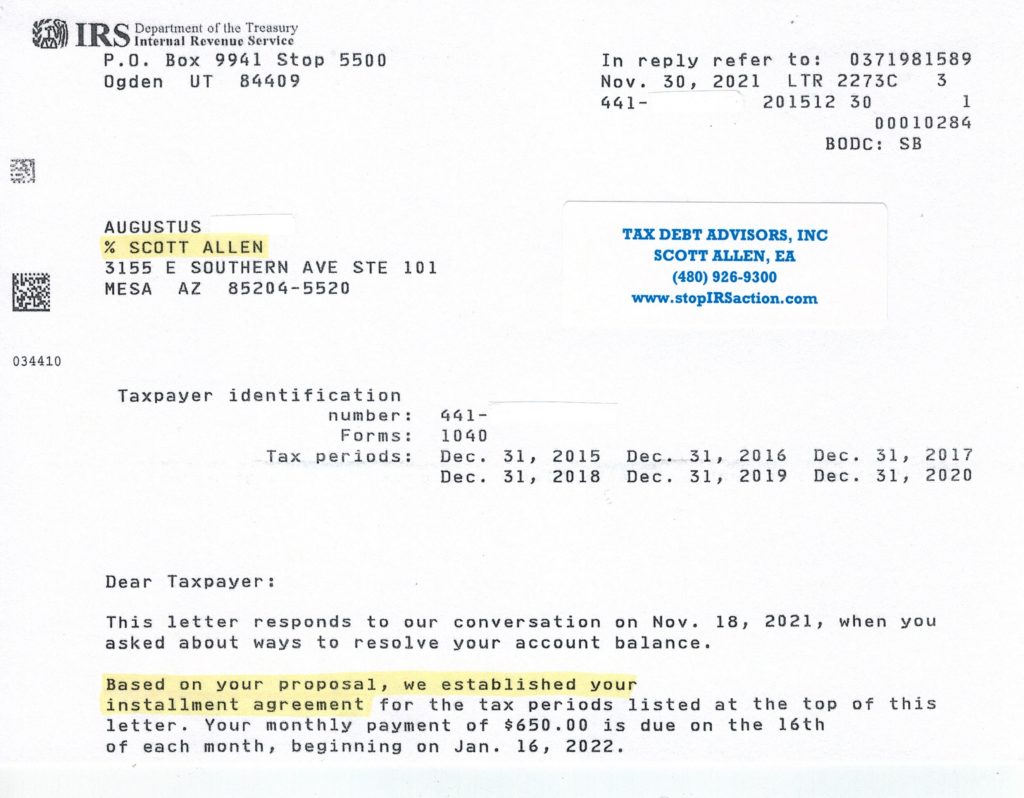

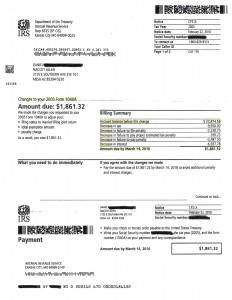

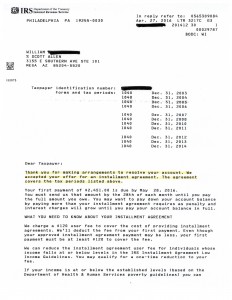

- Seeking Levy Release: One of the primary objectives of Scott Allen EA is to secure the release of the IRS levy. He diligently negotiates with the IRS to reach a favorable resolution, aiming to release the levy and put an end to the taxpayer’s financial distress. Whether it involves arranging an installment agreement, proposing an offer in compromise, or exploring other suitable alternatives, Scott Allen EA pursues the best possible outcome for his clients.

- Expert Legal Representation: In situations where the IRS levy may not be justified or appropriate, Scott Allen EA is prepared to provide expert legal representation. He has a deep understanding of tax laws, regulations, and IRS procedures, allowing him to build strong cases to defend the taxpayer’s rights and assets. Having Scott Allen EA on your side empowers you with the confidence to face the IRS with a robust defense.

- Long-term Tax Planning: While stopping an IRS levy is a critical short-term goal, Scott Allen EA goes above and beyond by providing long-term tax planning. By implementing strategic tax planning strategies, he helps taxpayers prevent future tax problems and ensures compliance with tax laws, keeping financial troubles at bay.

In times of financial distress caused by an impending IRS levy, Scott Allen EA emerges as a beacon of hope for taxpayers in Tempe, Arizona. His vast experience, comprehensive tax analysis, expert representation, and dedication to resolving tax issues make him a trusted ally for anyone facing IRS problems. Whether he is hired to stop IRS levy in Tempe, Arizona, negotiating with the IRS, or providing long-term tax planning, Scott Allen EA is a reliable partner to reclaim financial stability and peace of mind.

If you find yourself in the throes of an IRS levy, don’t hesitate to seek the services of Scott Allen EA. With his expertise and determination, you can be confident in your ability to navigate the complexities of tax troubles and emerge victorious. Remember, the path to financial freedom starts with a single step towards Scott Allen EA’s guidance and representation. Stop the IRS levy in Tempe, Arizona, and pave the way to a brighter financial future. He does not charge for an initial consultation to meet with you.

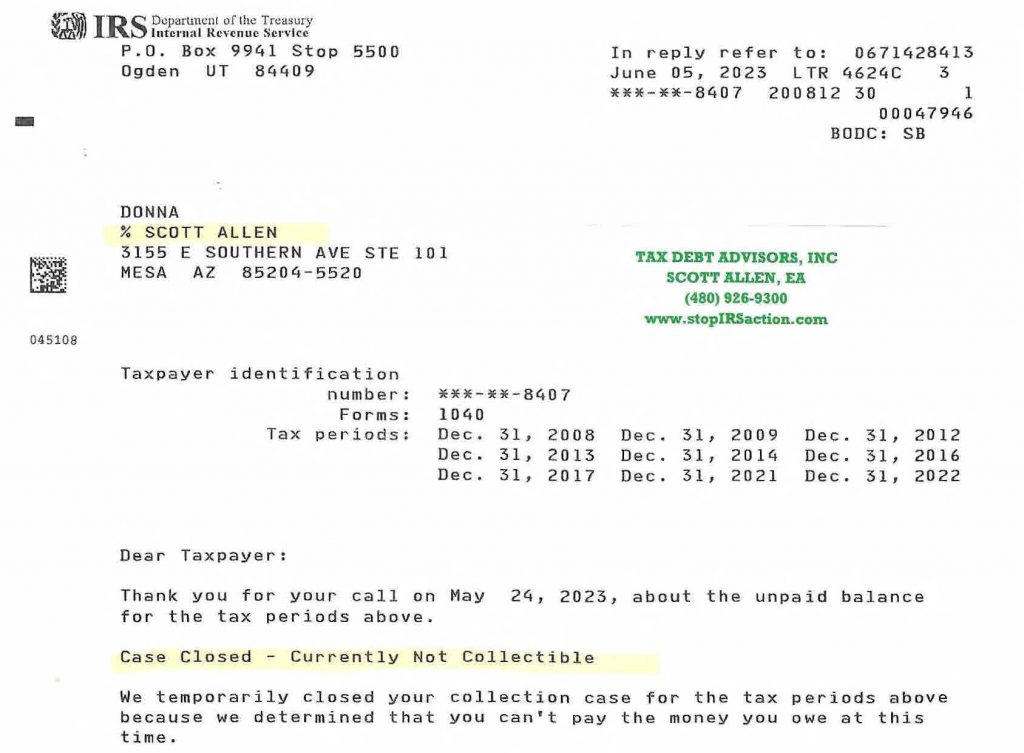

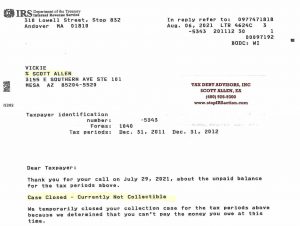

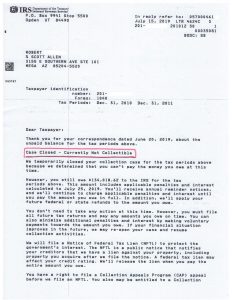

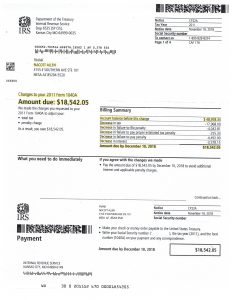

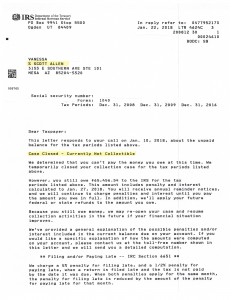

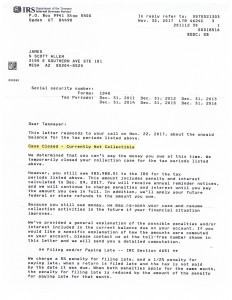

See how Scott Allen EA was about his represent his client Donna. Faced with an aggressive IRS agent, he was able to stop IRS levy in Tempe, Arizona nd negotaite all nine years of her $88,799.53 debt into a currently non collectible status. Dont believe it!? View the approval from the IRS below.