Do I need to file back taxes in Mesa AZ?

Tax Debt Advisors can help you file back taxes in Mesa AZ

They are many reasons taxpayers get behind on filing and paying their income taxes. Some people simply just don’t know where to turn to file back taxes in Mesa AZ. Tax Debt Advisors have been assisting taxpayers with their back tax problems since 1977. As a family owned business resolving tax issues is their specialty. Their average client has not filed tax returns in about six years and/or owes the IRS more then $50,000.

What are the steps to beginning the process and ultimately getting is resolved.

- You need to have a tax professional who can represent you before the IRS has Power of Attorney. With this they can communicate and update the IRS with your progress from beginning to end. This will insure you gather up all the information and documentation to prepare the tax returns correctly and limiting the chances of audits and mistakes. A hold will be placed on all collection activity to give you time to accomplish steps two and three. Scott Allen EA is the right choice to complete this step.

- Here is where you will get all the tax returns prepared whether it be one tax return or eight years of back tax returns. The IRS is working aggressively to get taxpayers to file these returns. Click here to learn more about that. Typically you will start with the oldest year first and work your way through until caught up. This will get you in compliance with the IRS. Scott Allen EA is the right choice to complete this step.

- Now that all your tax returns are filed and pending acceptance you can begin to work towards a settlement. One settlement or agreement is done for all the years you owe for. Financial information will need to be gathered to determine what options you qualify for and which ones you do not. Scott Allen is the right choice to complete this step.

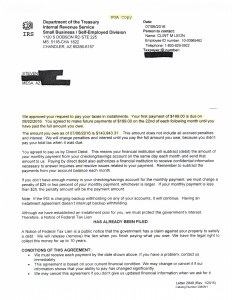

Below is an image of a recent success by Scott Allen EA for his client Steven. Steven was behind on several years of taxes. By clicking on the image you can view what his monthly payment plan settlement is on the total debt to the IRS. Not everyone’s settlement is the same but this is a great example of a taxpayer thinking “the world is ending for him” and didn’t know what to do. Now he is back to stable employment settling his debt for less then a couple hundred dollars a month. Meet with Scott Allen EA of Tax Debt Advisors today so he can complete the three step process for you.

Four years later and Scott Allen EA is still working hard for his clients!

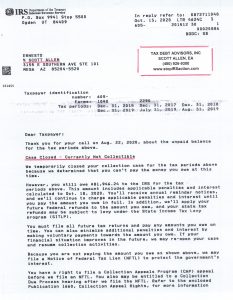

Ernesto was a client who had to file back taxes in Mesa AZ and negotiate an aggressive settlement. He owed the IRS over $80,000 and had no way of paying it back. After evaluating his options and financial status it was determined that he would qualify for a currently non collectible status with the IRS. This status means that Ernesto does not have to make any payments on his back taxes. The IRS will not pursue any collection activity as long as he files and pays his future taxes on time each year. Scott Allen EA looks forward to doing his tax return early next tax season so he does not default the agreement.

See Ernesto’s settlement approval below.