Successful IRS Audit Reconsideration in Phoenix Arizona

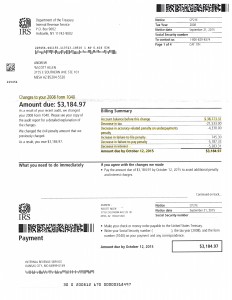

Click on letter to view an actual notice from the IRS of a Successful Phoenix AZ IRS Audit Reconsideration by Tax Debt Advisors, Inc.

Our client, Andrew owed the IRS $38,773 on his 2008 tax return. Upon a successful audit reconsideration in Phoenix AZ he now only owes $3,184 to the IRS. Andrew came into our office after his previous representative failed to respond timely with the necessary documents in hand to show the IRS auditor. Andrew and Scott Allen EA spent 2 hours together before they ever met with the new auditor in preparation that they had all our “ducks in a row”. When they finally had their meeting it was over in less then an hour. The IRS auditor could clearly understand his organized documentation and receipts. Scott Allen EA tell this one advice to anyone who calls telling him they have been audited, “The success of an audit it not in front of the auditor; it is always in the preparation beforehand”. You can never be too prepared. In the preparation your worry and fear will go away.

IRS audit Reconsideration is a very effective strategy when you had a failed audit. But, if it failed due to you not responding to the audit or you didn’t provide all your records to the IRS auditor at the time of the audit. Audit Reconsideration gives you one last opportunity to open up the file again. Its not a quick fix though. Phoenix AZ IRS audit reconsideration can take up to a year to re-open. To determine if you are a good candidate for audit reconsideration call and speak with Scott Allen EA in Arizona today.