Success in 2015: Tax Debt Advisors Reviews

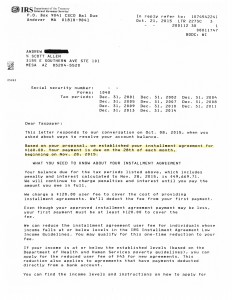

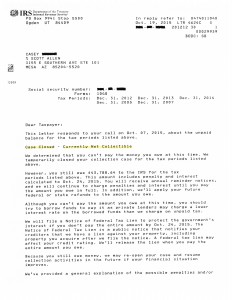

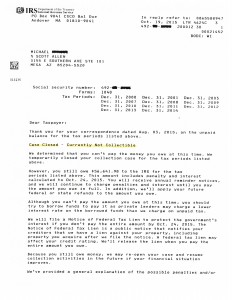

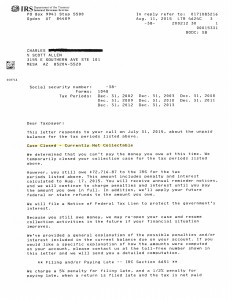

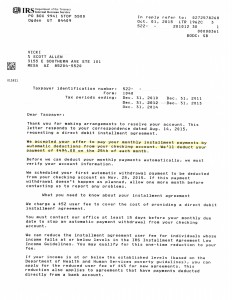

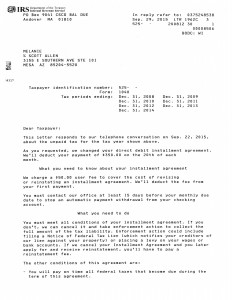

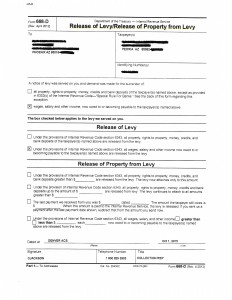

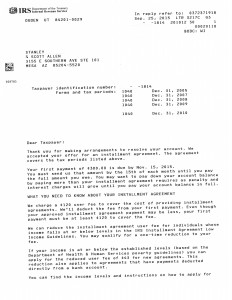

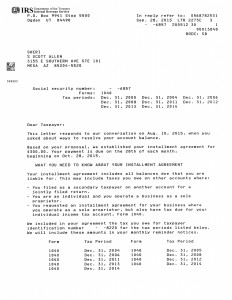

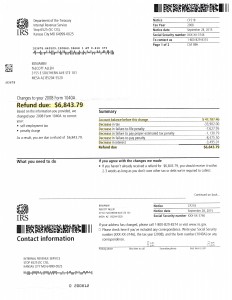

On October 21, 2015 their company was able to aggressively negotiate a $160/month payment plan for Andrew. When a taxpayer owes the IRS over $50,000 it is important that you hire someone competent with the Internal Revenue Code that maximizes the law to their advantage. We have several Tax Debt Advisors Reviews for you to browse along with other important information on their website. You will find it very handy and applicable to you.

If you have a serious IRS matter that needs to be addressed, look to Scott Allen EA of Tax Debt Advisors as your choice. His family business began back in 1977 and has been open and actively operating ever since. Did you know there is more then one way to resolve your IRS debt? Below is a summary list of those different settlement options with the IRS.

1. Let it expire

2. Suspend it

3. Adjust it

4. Pay it

5. Compromise it

6. Discharge it

Contact the IRS (or better yet have Scott Allen EA do that for you) before they decide to contact you first. It can save you lots of stress and you may be surprised on the result you can get by being proactive on your issues. Scott Allen EA can be contacted by calling 480-926-9300 and getting that appointment with him scheduled today. He will only take on your case if it is in your best interest. Let one of the many Tax Debt Advisors reviews be one for you.

His current office address: 3155 E Southern Ave #101 Mesa, AZ 85204