Gilbert AZ IRS Currently Non Collectible Status

Gilbert AZ IRS Currently Non Collectible Status

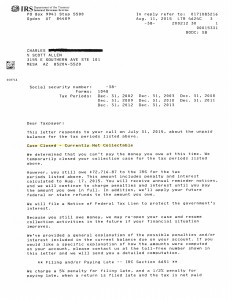

If you are seeking a Gilbert AZ IRS currently non collectible status for your outstanding debt contact Tax Debt Advisors, Inc. They specialize in reviewing your case with the IRS in determining what is your best settlement option. It is important to keep in mind that you cannot select the option you want but that you have to qualify for it. By clicking on the image below you can view a recent success of a Gilbert AZ IRS currently non collectible status that was negotiated on their clients debt.

Based on Charles and his wife’s current financial status Scott Allen EA was able to legally posture their finances to show that they did not have any ability to pay anything on their IRS debt at the present time. However, their IRS debt did not go away but is suspended. It is still there, but its been determined that they qualify for a “zero dollar a month payment plan”. It can either be a temporary or a more permanent solution depending on their specific situation. The IRS will always file a tax lien on any taxpayer who is in a non collectible status. Often times taxpayers will confuse a tax lien with a tax levy. A lien is a mark on your credit score that shows up if you try to borrow money. In a properly negotiated Gilbert AZ IRS currently non collectible status the IRS does not have a power to do any levies or garnishments against you wages or bank accounts.

To find out what the process is to get into a proper settlement option with the IRS schedule an appointment with Scott Allen EA. He will meet with you for a free initial consultation. The first thing he will need to make sure of is that you are in compliance with the IRS in all aspects so that a currently non collectible status can be established. After you receive that acceptance letter from the IRS similar to Charles’s (shown above) its important that you do not allow yourself to fall out of compliance.