Settle IRS Debts Phoenix: December 2016

Settle IRS Debts Phoenix the right way

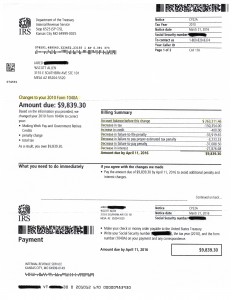

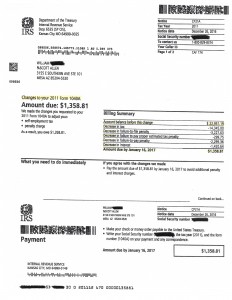

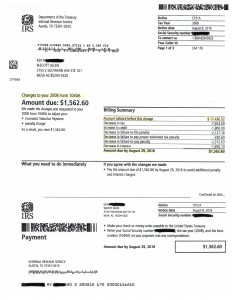

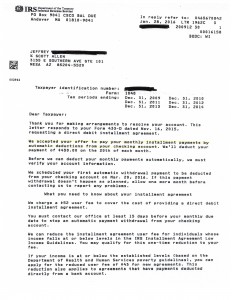

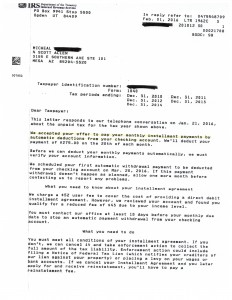

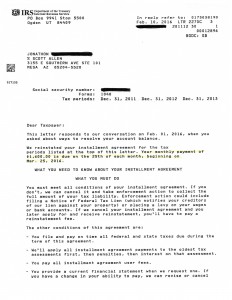

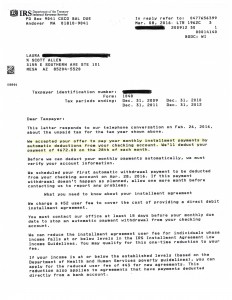

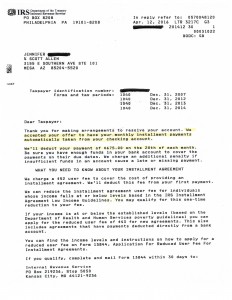

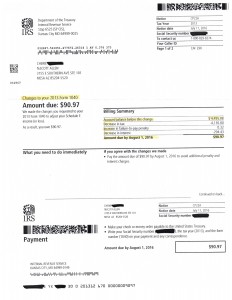

Do you have to settle IRS debts Phoenix and don’t know how to get started? May I suggest to you to call Tax Debt Advisors at 480-926-9300. Just see what they did for their client Jared. View the notice below and see the savings of over $253,000 in taxes, interest, and penalties. Everyone’s results are different, but why not speak with Scott Allen EA of Tax Debt Advisors and see what he can do for you. If you are currently using someone to help with your tax matter but are unsure if you are being represented properly, speak with Scott Allen EA and get knowledge of all available options to you. Don’t just hope you have the right guy, know you have the right guy. Meet with Scott Allen EA for a free consultation. He will not take your case unless it is in your best interest…guaranteed!