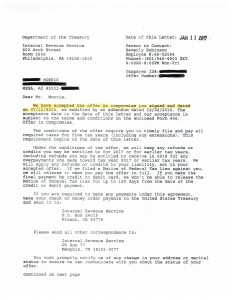

2017 Mesa IRS Offer in Compromise accepted

Is a Mesa IRS Offer in Compromise right for you?

Tax Debt Advisors just finished up a Mesa IRS Offer in Compromise for a client. View the acceptance letter below.

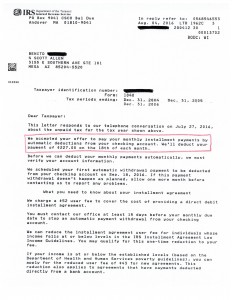

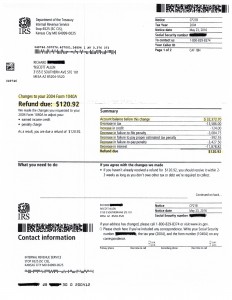

Mr. Morris came in about two years ago to meet with Scott Allen EA. He was behind on a couple years of tax returns. He was in a rut with a tax debt from a previous business gone bad. Due to not being able to pay the payroll taxes the debt was transferred to him personally as civil penalties. In addition to the civil penalty debt there were also two years of 1040 tax debt. Upon a detailed evaluation of his tax matter it was determined that Mr. Morris qualified for a Mesa IRS Offer in Compromise. Before submitting the Offer he first had to get him into compliance with his tax filings. It took over a year to complete and get it approved but it was approved. The worst thing you can do is submit an offer in compromise if it does not have a chance to get accepted. Meet with Scott Allen EA of Tax Debt Advisors to determine if you are a viable candidate to settle your IRS debt in a lump sum agreement. He will meet with you for a free initial consultation.