Scott released my Gilbert AZ IRS wage garnishment

Do you have a Gilbert AZ IRS wage garnishment?

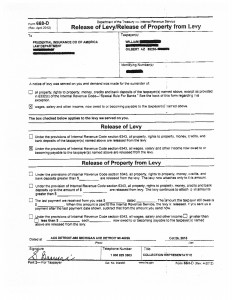

If so, you might want to utilize the services of Tax Debt Advisors, Inc. In this particular case (see below) they were able to help their client William out. He came in to meet with Scott Allen EA last week. The IRS sent a Gilbert AZ IRS wage garnishment to his employer six weeks prior, taking over $1,200 of his pay check every two weeks. Within 36 hours of giving Scott Power of Attorney he was able to get a full release of that garnishment on his wages.

If you don’t this can happen to you, think again. When the IRS feels that the taxpayers is no longer responsive they will resort to Gilbert AZ IRS wage garnishment action. They hope for this to be a wake up call to get the taxpayer back in compliance with them.

What does it mean to be in compliance?

There are two major steps to getting yourself back in good standing or compliance with the IRS. First, you have to be current with all your tax filing obligations. If you have any back tax returns that need to be prepared Scott Allen EA will assist you in that preparation process. Second, in order for the IRS to consider you compliant you have to be current with you withholdings if you are an employee or making estimated tax payments if you are self employed. The IRS is more concerned that you are paying your current and future taxes on time more so then paying your back taxes.

Once you are in compliance with the IRS by accomplishing those two steps now they will have open ears for a settlement or negotiation. There are several different options to resolve an IRS debt and Tax Debt Advisors will evaluate each option with you to determine the best outcome possible.

If you would like to speak with Scott Allen EA of Tax Debt Advisors he can be reached at 480-926-9300. He does not charge any fee for an initial consultation to discuss your case. His tax practice specializes in filing back tax returns and settling IRS debts.

August 2018 Case Update:

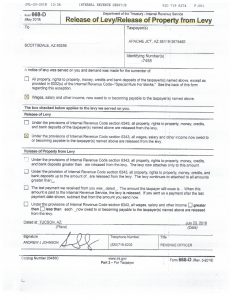

Check out the Gilbert AZ IRS wage garnishment release for a client of Tax Debt Advisors. This particular client had a handful of tax returns that needed to be filed. They were already prepared; just not turned in. In summary, we filed all the tax returns with the IRS agent assigned to the case and negotiated a payment plan agreement to settle the debt. The IRS tax levy that was issued was released within just a couple of days and well before the client was due to be paid by him employer. This scenario and similar ones happen on a daily basis. Put that experience to work for you. View the levy release below.

If you are in fear of receiving a Gilbert AZ IRS wage garnishment get in contact with Scott Allen EA of Tax Debt Advisors today. He will work for you as quickly as possible to get you the best possible result the law allows. If you need tax returns prepared he is licensed in all 50 states to handle that for you. Scott Allen EA can be reached at 480-926-9300 or stopIRSaction.com