Enrolled Agent vs Phoenix AZ IRS Tax Attorney

When is a Phoenix AZ IRS tax attorney necessary and when isn’t it?

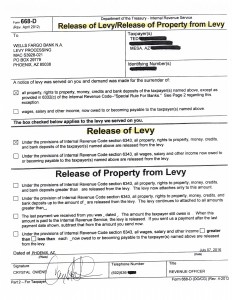

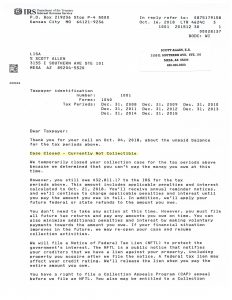

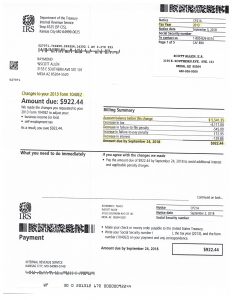

If you are facing an IRS bank levy or wage garnishment an Enrolled Agent can help you the same way a Phoenix AZ IRS tax attorney can. Scott Allen EA, president of Tax Debt Advisors, Inc, has facilitated in the release of 1,000’s of IRS bank levies or wage garnishments. When a taxpayer is in non-compliance with their taxes, as a last result the IRS will enforce all available collection tactics. Scott Allen as an Enrolled Agent here in the Phoenix area represents Ted as his IRS Power of Attorney to contact the IRS, stop and release the bank levy, and work through a schedule to get him back in compliance. Ted and his wife were behind on six years of back tax returns. This was the biggest step in getting them back in compliance and keeping their bank accounts from future levies. All of those six tax returns were prepared over the next three weeks. For your viewing is a copy of the release of levy notice. Scott Allen EA did this for Ted and he can do it for you too if you are under a current bank or wage levy.

Tax Debt Advisors, Inc business niche is sticking with tax preparation and IRS problem services. Those services include but not limited to:

- Yearly tax preparation

- IRS Power of Attorney Representation

- Back tax return investigation and filing

- IRS Offer in Compromise

- Installment arrangements/payment plans

- IRS currently non collectible status

- IRS appeals

- Release IRS levy and garnishment

- IRS audit representation

- IRS audit reconsideration

- State of Arizona tax debt resolution

To schedule a free evaluation consultation with Scott Allen EA call 480-926-9300. To learn more on is website go to www.TaxDebtAdvisors.com. This is an important decision that requires the opinion of a highly skilled Enrolled Agent. Scott Allen EA can be that choice for you.

October 2018 Case Update:

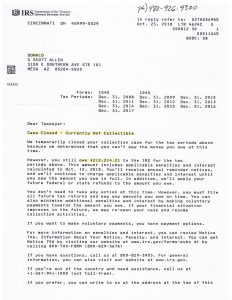

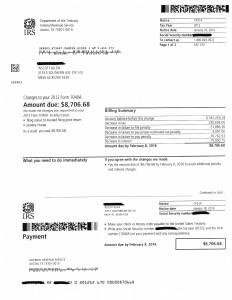

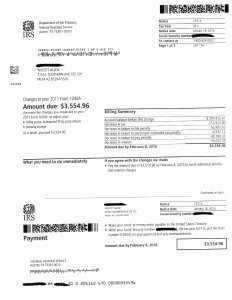

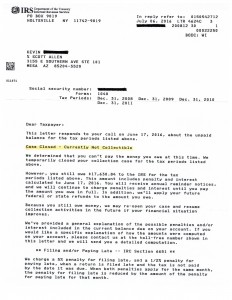

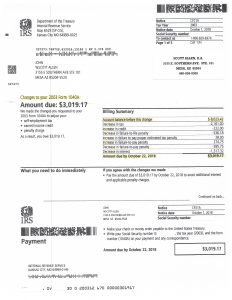

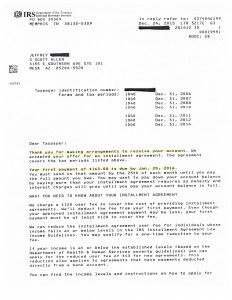

Don thought he needed to make an appointment with a Phoenix AZ IRS tax attorney for his IRS debt. In fact, he did meet with one before discussing his situation with Scott Allen, Enrolled Agent. Scott gave him the confidence that he could file his back tax returns and negotiate a settlement that would suit his financial situation. Don was very happy with the end result and was glad he hired an experienced Enrolled Agent to handle his IRS problem. A copy of his IRS settlement is attached. Don settled his entire IRS $212,000 IRS debt into a currently non collectible status.

Before (or after) you consult with a Phoenix AZ IRS tax attorney regarding your IRS matter it is suggested you also schedule a consultation appointment with Scott Allen, Enrolled Agent to see what options he recommends for you.