Can my Mesa AZ IRS wage garnishment be stopped?

Scott Allen EA’s company Tax Debt Advisors Inc has stopped IRS wage garnishments since 1977. If you have received that dreaded notice from your HR department that the IRS is going to keep up to 70% of your next paycheck call and talk with Scott Allen EA today.

The IRS does have the right to legally garnish your paycheck if you are not in compliance with them. Being out of compliance can mean you have back tax returns to file and/or owe the IRS on back taxes already filed. Even though the IRS does have the legal right to seize other assets as well such as your cars or home they typically do not.

Don’t let the IRS take anymore of your paycheck then they have to. Call Scott Allen EA for a free consultation to meet with him on what needs to be done to stop your Mesa AZ IRS wage garnishment. Once he has all the information required to stop the IRS garnishment Scott will get it release within 24 hrs.

Part of getting the release of your IRS wage garnishment in Mesa AZ is to enter into one of their settlement options. There are 5 different options available to you. You will be reviewed on the pros and cons of each option. Dont wait until your options and finances are limited by the IRS. Call Scott today at 480-926-9300 or visit his website at www.releaseIRSlevy.com.

Mesa AZ IRS Wage Garnishment Prevented in 2019

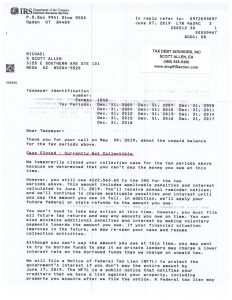

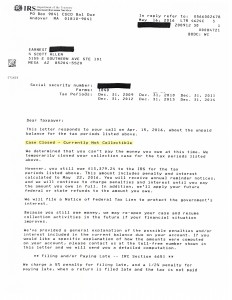

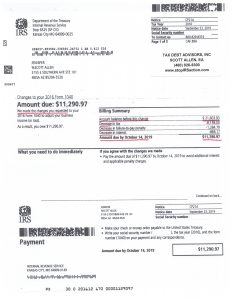

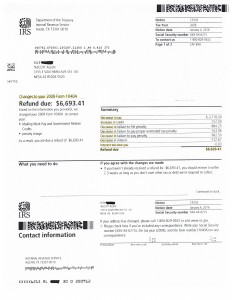

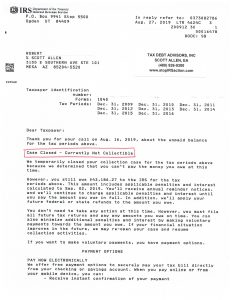

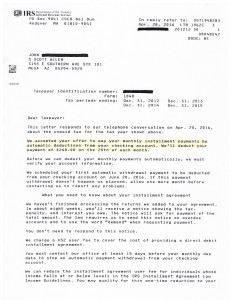

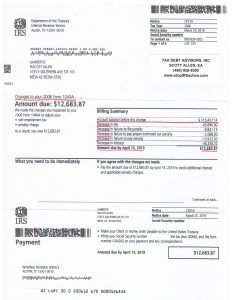

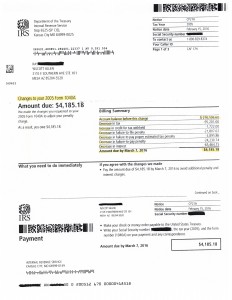

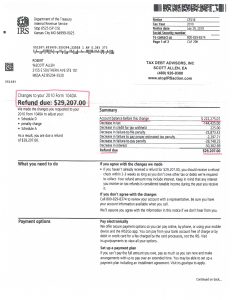

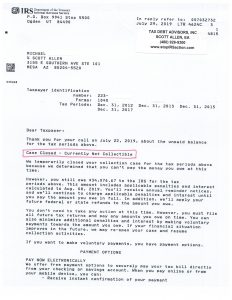

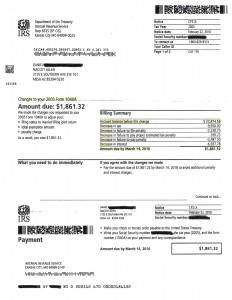

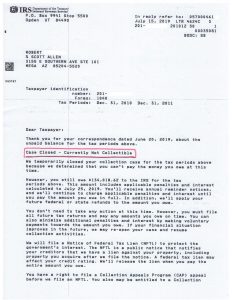

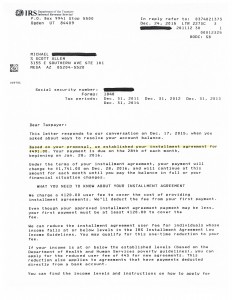

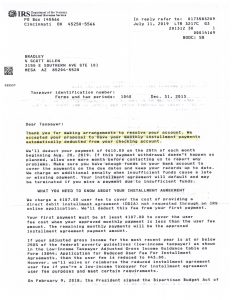

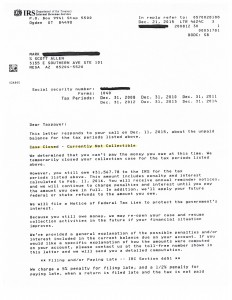

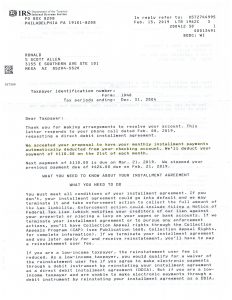

The best tactic someone can engage in when dealing with a Mesa AZ IRS wage garnishment is to be proactive with it. Contact the IRS before it happens. Let me give you an example: Michael had not filed tax returns in 14 years and owed the IRS over $200,000 in back taxes. Someone might think this is an ideal case for the IRS to “throw the hammer” and garnish wages or levy bank accounts. If Michael was reactive this would be the case. But, because he hired competent honest representation he was able to protect his wages and negotiate a favorable agreement with them on his large IRS debt. View the IRS approval agreement below.

Mike is in a “Case Closed – Currently not Collectible status“. As long as he remains in compliance with his future tax liabilities he does not have to pay a dime on his back taxes. This is a great relief for a struggling taxpayer. If you would like to discuss your case or see what options are available to you with your IRS debt or unfiled tax returns call and speak with Scott Allen EA today. He can be reached at 480-926-9300.