Prevent IRS Levy Mesa AZ

Don’t let the IRS cause you to lose sleep any longer.

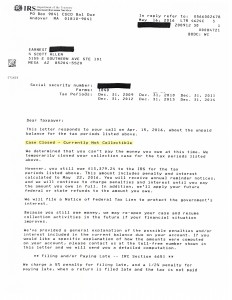

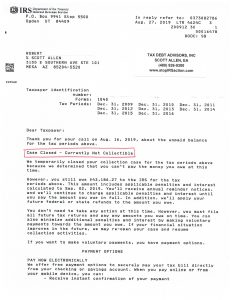

Prevent IRS Levy Mesa AZ by getting your IRS debt into a settlement. Earnest was behind on his tax filings and the IRS was threatening to levy his modest wages if he did not get into compliance. Earnest met with Scott Allen EA, hired him to be his Power of Attorney and to work they went. Over the next few months, the Mesa AZ back tax returns were prepared and a settlement was negotiated. Earnest is now in a currently non collectible status for his entire IRS debt. He does not have to make any payments at all: as long as he files and full pays any future tax obligations. Just like him you too can prevent IRS levy Mesa AZ. View his IRS settlement letter below.

How can you prevent IRS levy Mesa AZ?

To understand more go to PreventIRSLevy.com. If you are worried about your next paycheck getting levied by the IRS contact Scott Allen EA of Tax Debt Advisors today. Get him working your case today!

Prevent IRS Levy Mesa AZ in 2019

Do not let yourself be a victim of an IRS levy. Be proactive with your IRS issues. The best way to be proactive is with Scott Allen EA as your IRS Power of Attorney. He will help you get the best possible result allowable by law. Check out some recent work accomplished by him for his client Jennifer.

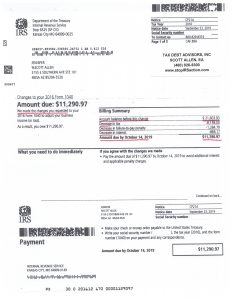

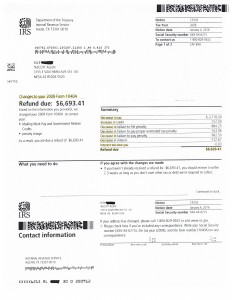

Scott Allen EA was able to reduce Jennifer’s 2016 IRS debt from $21,000 down to about $11,000. This is just another example of quality work done by a local tax professional. Not every taxpayer qualifies for the same options or programs so it is important to evaluate your financial income, assets, and expenses to see what you will qualify for.

Scott Allen EA is owner of Tax Debt Advisors Inc located in Mesa AZ