Idioms to Remember if you need to STOP a Mesa AZ IRS Levy

Scott will stop Mesa AZ IRS Levy

- Ace in the hole—A hidden advantage. “The coach was certain that his new trick play would turn out to be his ace in the hole.” This term comes from the game of stud poker, in which one or more cards are turned face down, or “in the hole,” as bets are placed. The ace is the card with the highest value.

- Act of God—An event beyond human control like an earthquake or a volcanic eruption.

- Albatross around one’s neck—An annoying burden: “That old car is an albatross around my neck.”

- Bite the bullet—To adjust to unpleasant circumstances. “The severe drought is forcing everybody to bit the bullet and use less water.” Before anesthesia, surgeons operating on the wounded gave them a bullet to bite to help withstand the pain.

- Burn the candle at both ends—To do more than one ought to: to overextend oneself: “Working three jobs is burning the candle at both ends.”

- Chip on one’s shoulder—To “have a chip on one’s shoulder” is to invite conflict by being extremely touchy. In the past, a young boy would place a wood chip on his shoulder and dare anyone to knock it off as a way of showing how tough he was.

- Chutzpah—Yiddish term for courage bordering on arrogance.

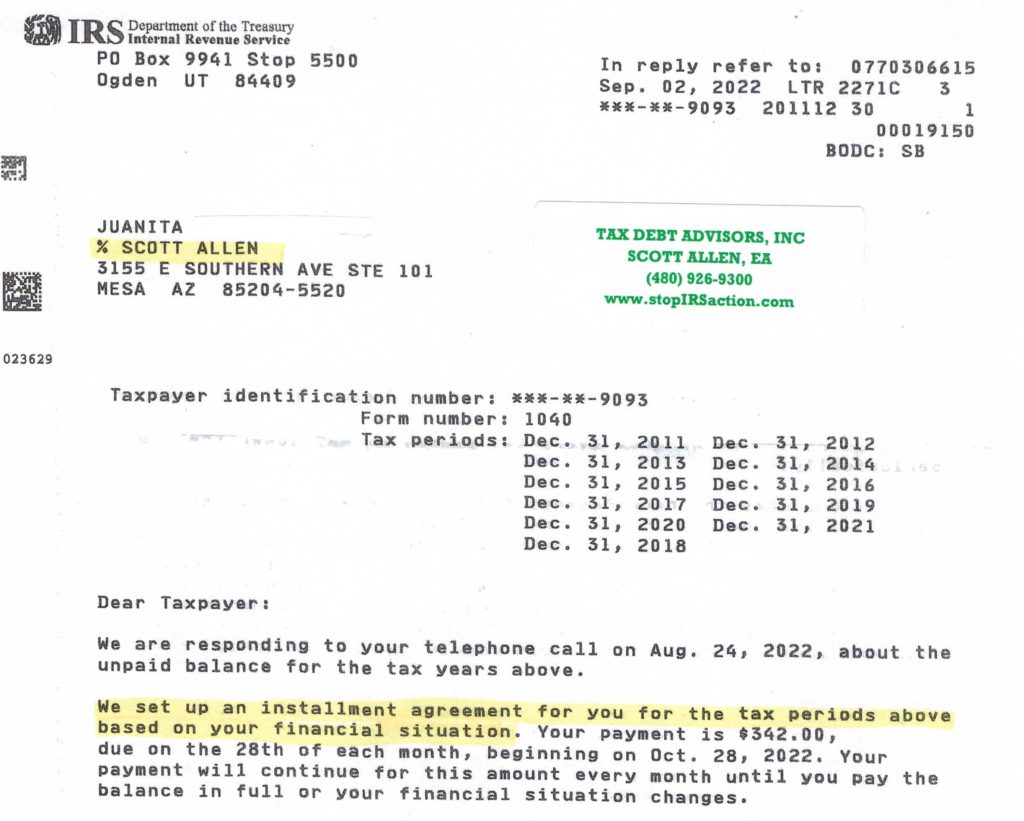

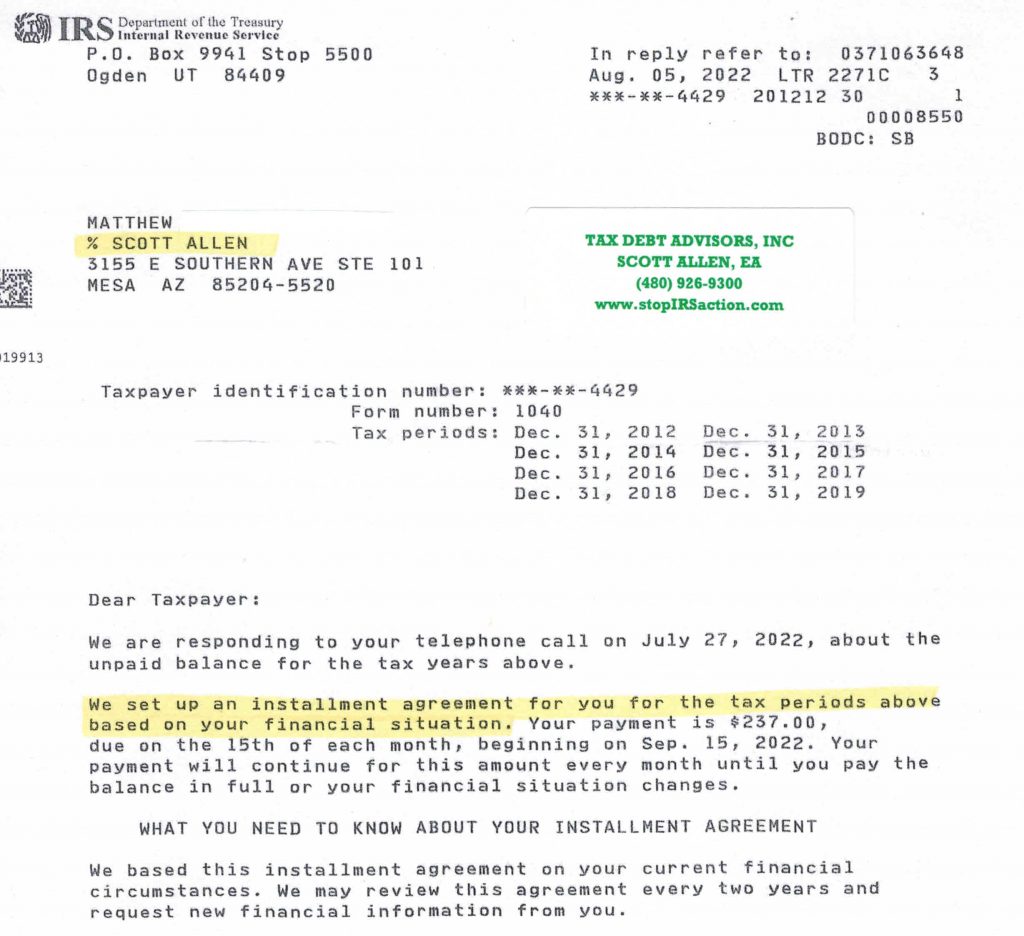

There is more then one way to stop a Mesa AZ IRS levy. It is important to make a plan of attack for your specific circumstances to be sure to stop the IRS levy in Mesa AZ as soon as possible. Many times is can be accomplished within a 24 hour period of first contact with the IRS. On occasions we can get the IRS to give a temporary or partial stop to a Mesa AZ IRS levy with commitments to get accomplished as is needed (i.e. file back tax returns, provide financial information) to make it a permanent stop to the IRS levy in Mesa AZ.