Scott Allen E.A. of Arizona will help you qualify for an IRS Currently Not Collectible Status

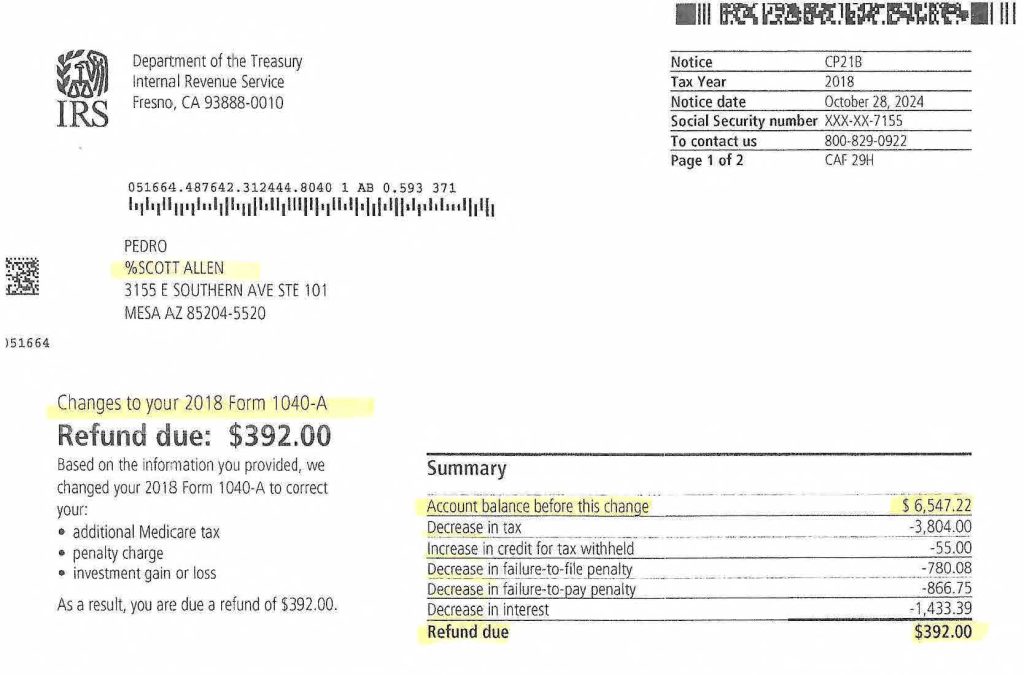

The IRS is reluctant to put a taxpayer who owes back taxes on a non-collectible status (CNC). One of the main factors the IRS takes into consideration is the “hardship” that making payments on past tax debt will inflict on the taxpayer. This is where having a professional represent you is critical. Scott Allen E.A. has qualified many taxpayers for a CNC status in Arizona. He is aware of all the deductions against income that will show the IRS your inability to make a monthly payment.

Remember that interest and penalties will continue to accrue or add to the tax balance due. Scott Allen E.A. will find out when your tax liability will go away due to the passage of the statute of limitations. The IRS calls this the “Collection Statute Extension Date.” The IRS will likely file a tax lien. However, if you are able to get to the date the liability is released, the tax lien will also expire. Call Scott Allen E.A. at 480-926-9300 to schedule a free consultation. He will make that day a great day for you!