Mesa AZ Notice of Federal Tax lien?

Can Scott Allen EA help with a Mesa AZ Notice of Federal Tax Lien?

Yes, Scott Allen EA can help you with a Mesa AZ notice of federal tax lien. He is an enrolled agent (EA) with over 15 years of experience in tax resolution. His firm Tax Debt Advisors, Inc has been solving tax problems for over 45 years. He has helped thousands of clients resolve their tax problems, including IRS tax liens.

If you have received a Mesa AZ notice of federal tax lien, it is important to act quickly. A tax lien is a public record that shows that the IRS has a claim against your property. This can make it difficult to get a loan, buy a house, or even get a job.

Scott Allen EA can help you understand your tax lien and develop a plan to resolve it. He can negotiate with the IRS on your behalf to reduce your debt or let you know your options in getting the lien removed. He can also help you file back tax returns and get on an installment plan to pay off your debt.

If you are facing a Mesa AZ notice of federal tax lien from the IRS, contact Scott Allen EA today for a free consultation. He will help you understand your options and develop a plan to resolve your specific tax problem.

Here are some of the services that Scott Allen EA can provide to help you with a notice of federal tax lien:

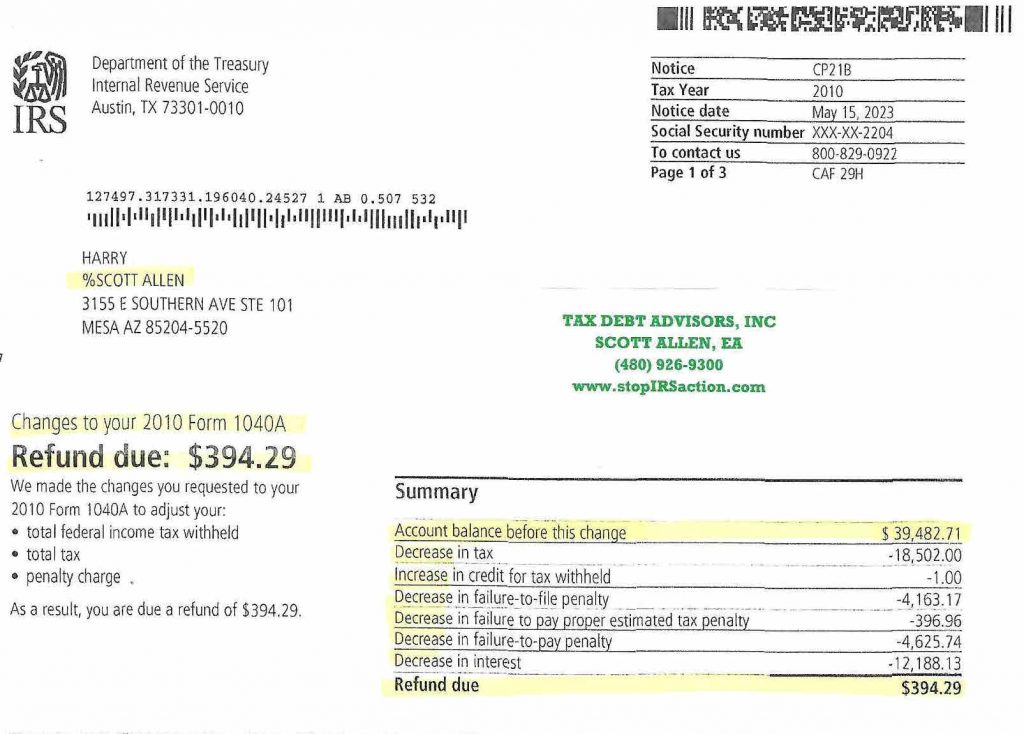

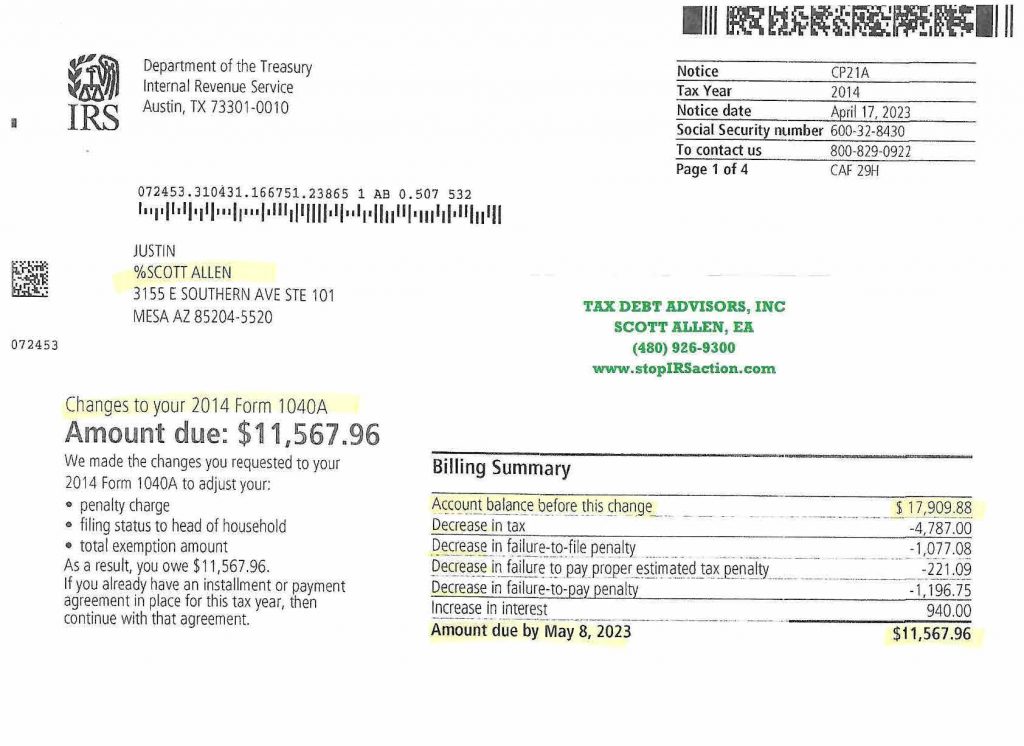

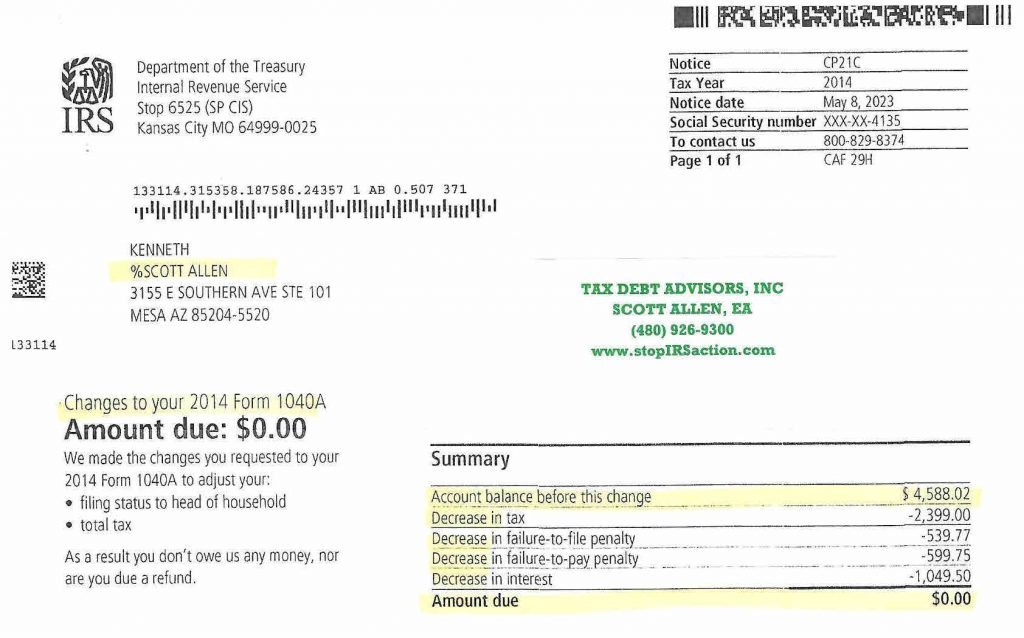

- Negotiate with the IRS: Scott Allen EA can negotiate with the IRS on your behalf to reduce your debt or get the lien removed if you qualify. He has a long history of success in negotiating with the IRS and has helped thousands of clients resolve their tax problems.

- File back tax returns: If you have not filed your tax returns in a while, Scott Allen EA can help you file them. Scott’s average client that comes in has not filed in 4-7 years. This is important because the IRS will not be able to negotiate your debt if you have not filed all your tax returns.

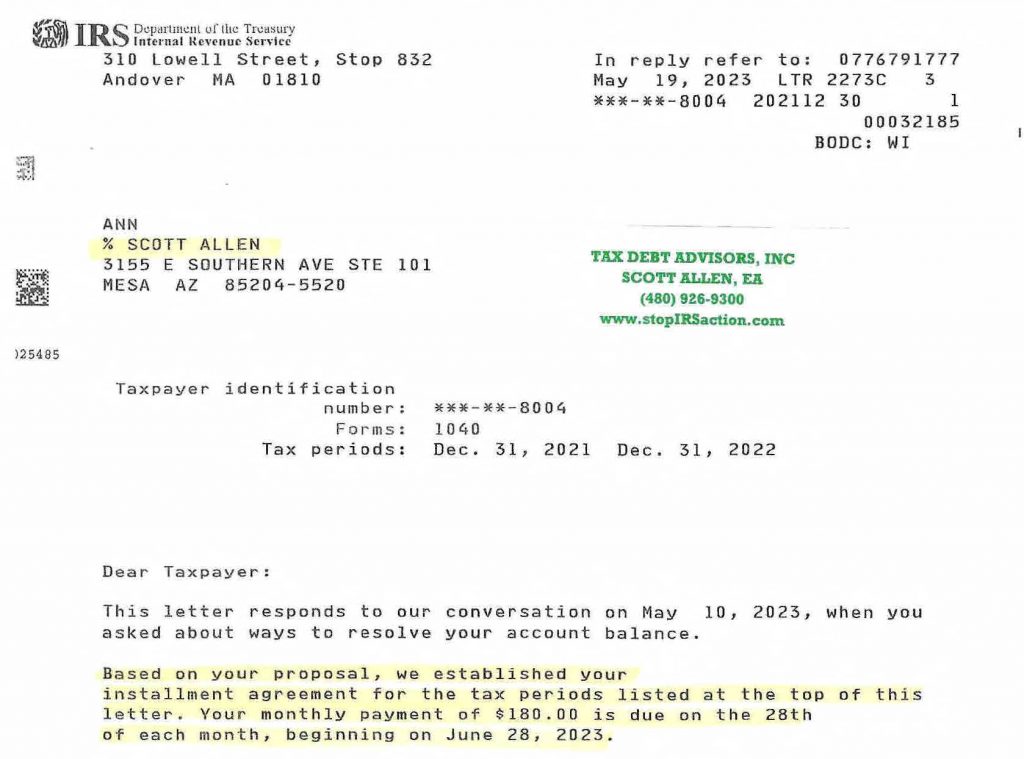

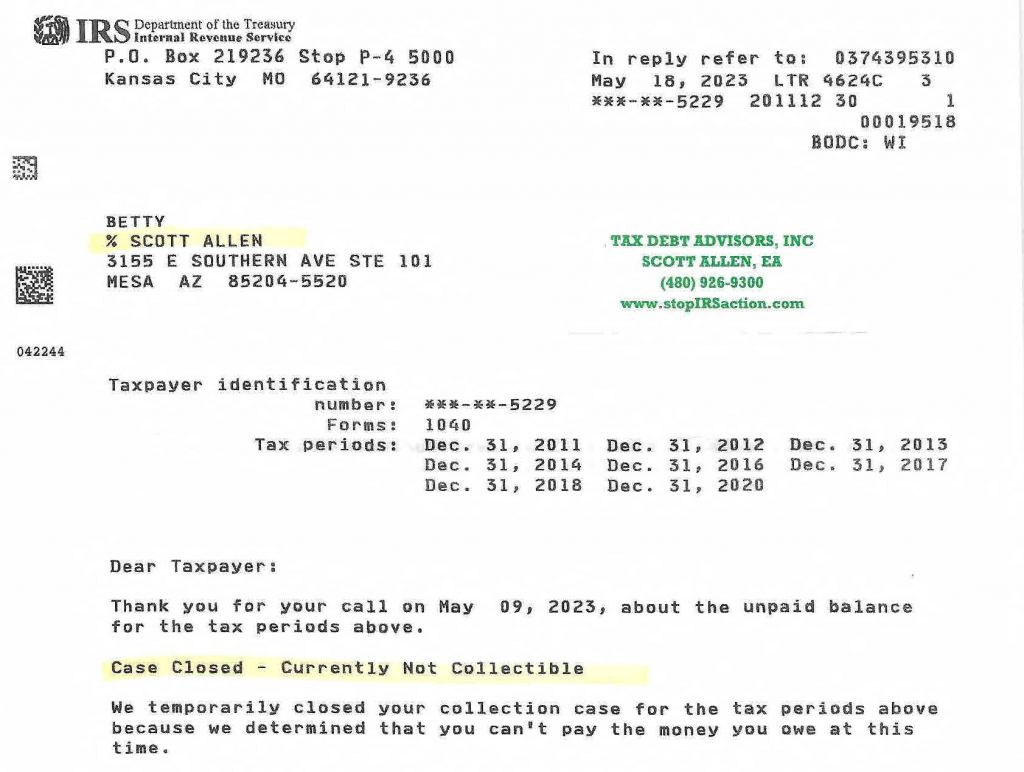

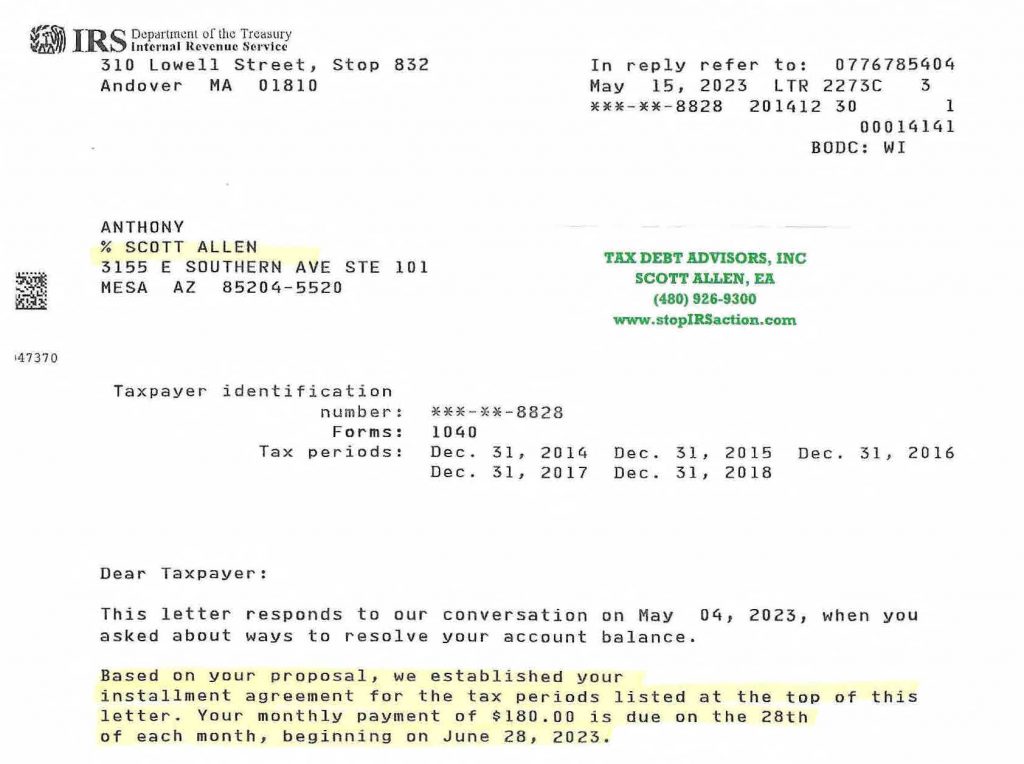

- Get on an installment plan: If you cannot afford to pay off your tax debt in full, Scott Allen EA can help you get on an installment plan. This will allow you to pay off your debt over time.

If you are facing a Mesa AZ notice of federal tax lien, contact Scott Allen EA today for a free consultation. He will help you understand your options and develop a plan to resolve your tax problem.

Scott Allen EA was able to help his client Ann out with negotiating an installment plan for her IRS back taxes owed. This is just one of thousands of examples of successful settlement negotiations that Scott has done. With this agreement the IRS will NOT file a Mesa AZ notice of federal tax lien on Ann.