Tax Debt Advisors, Inc. Will Release Your Phoenix AZ IRS Wage Garnishment today

Release Phoenix AZ IRS Wage Garnishment

An IRS wage garnishment in Phoenix AZ is not released until certain conditions have been met. First, all tax returns need to be filed. Secondly, the taxpayer must enter into one of several settlement options. Once these two conditions have been met, your Phoenix AZ IRS wage garnishment will be released. Scott Allen E.A. of Tax Debt Advisors, Inc. has the expertise to represent you for a quick release. Tax Debt Advisors, Inc. has represented employees at many companies including Salt River Project, Southwest Airlines, Vanguard Health Systems, and John C. Lincoln Heath Network. Call for a free initial consultation at 480-926-9300. You will be glad you did!

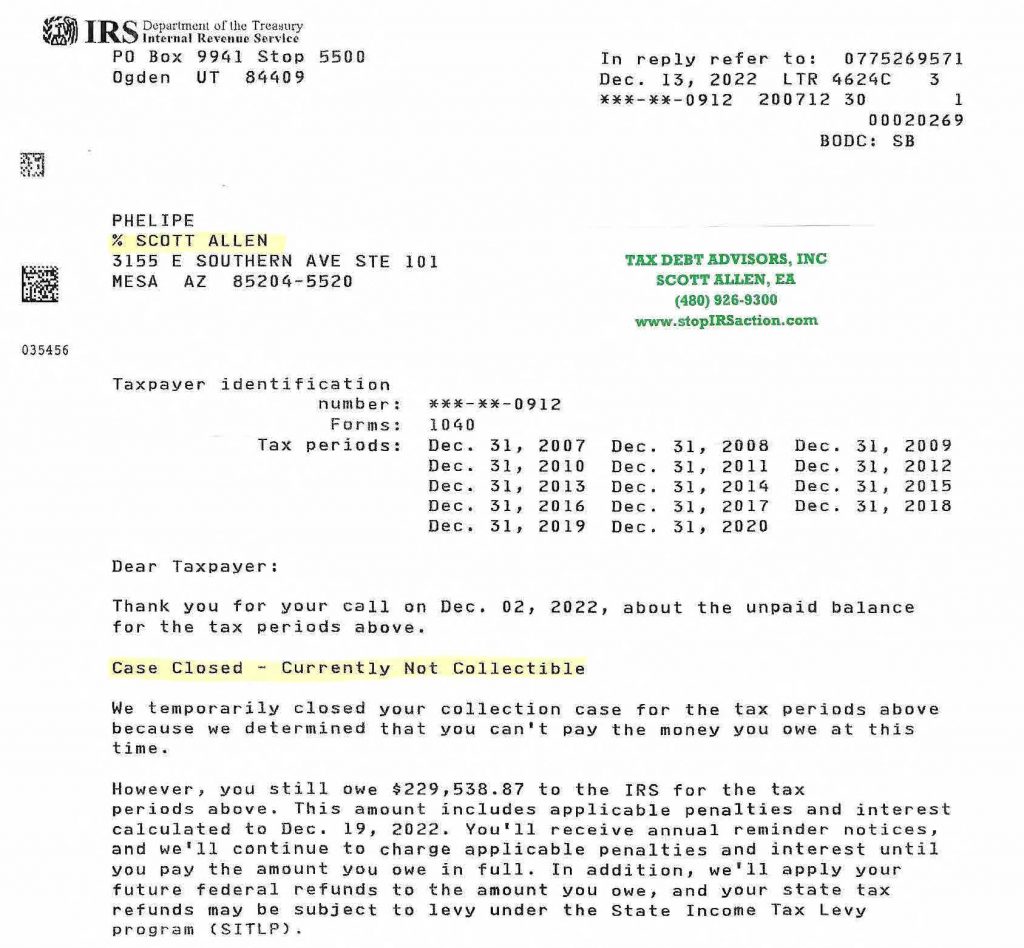

Phelipe Got his Phoenix AZ IRS Wage Garnishment released

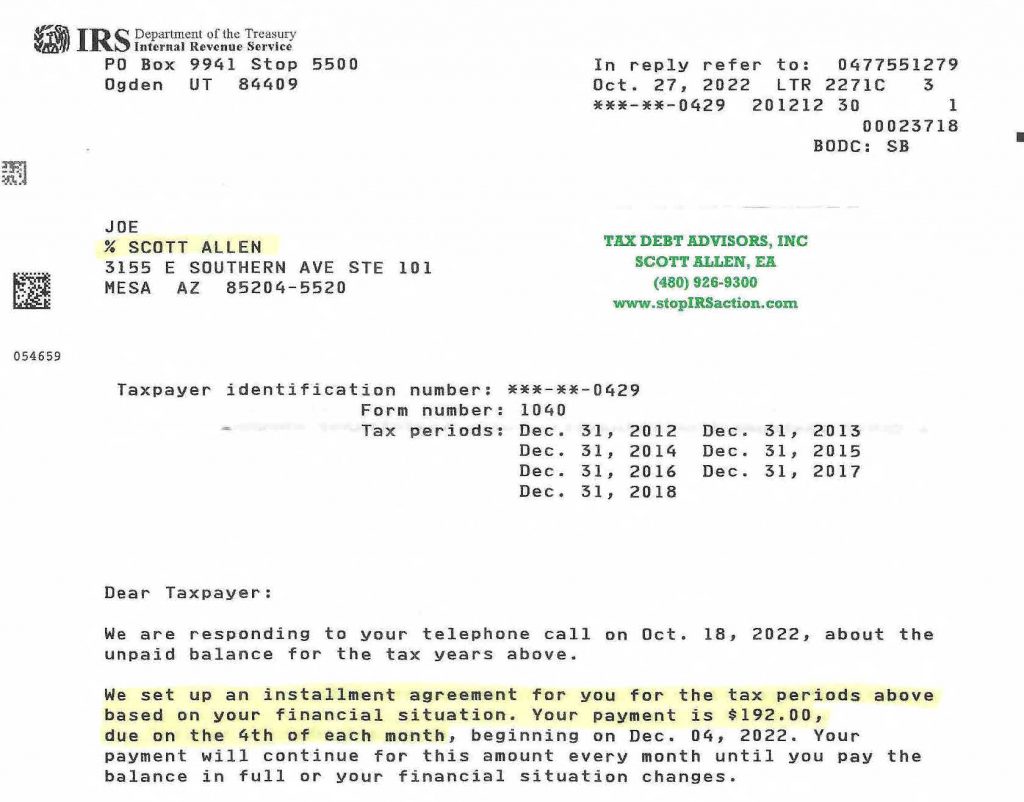

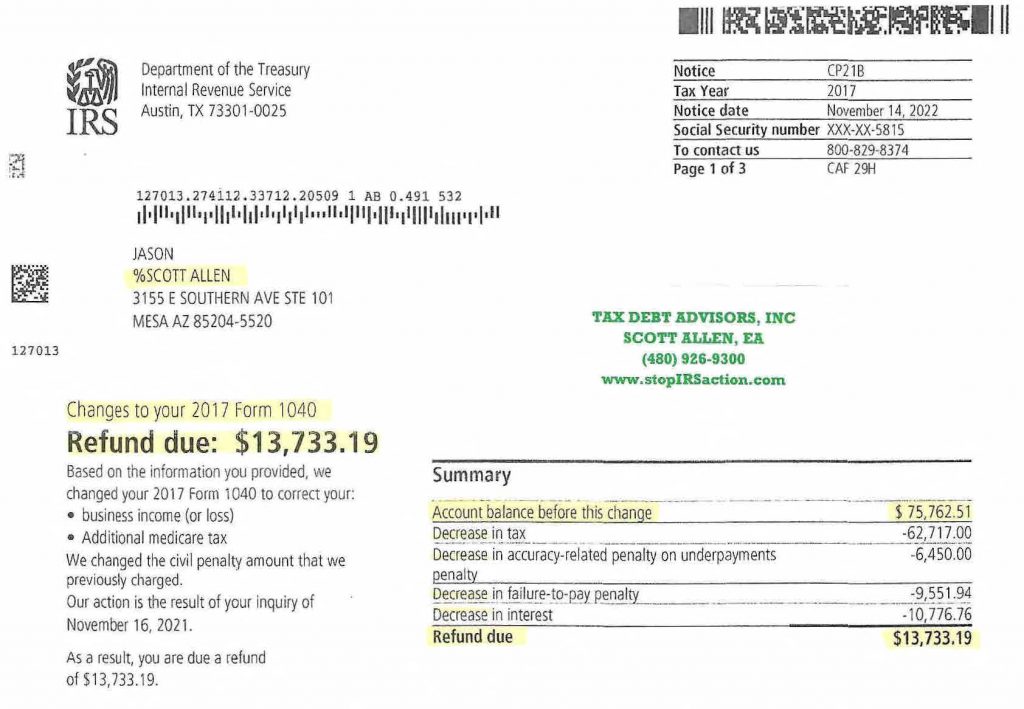

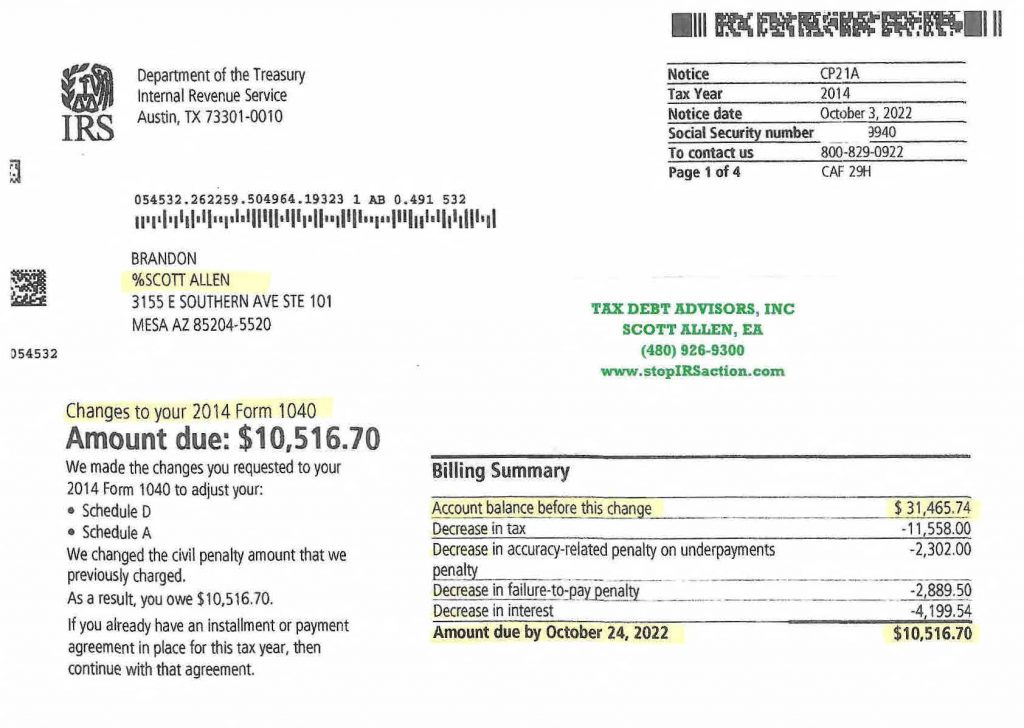

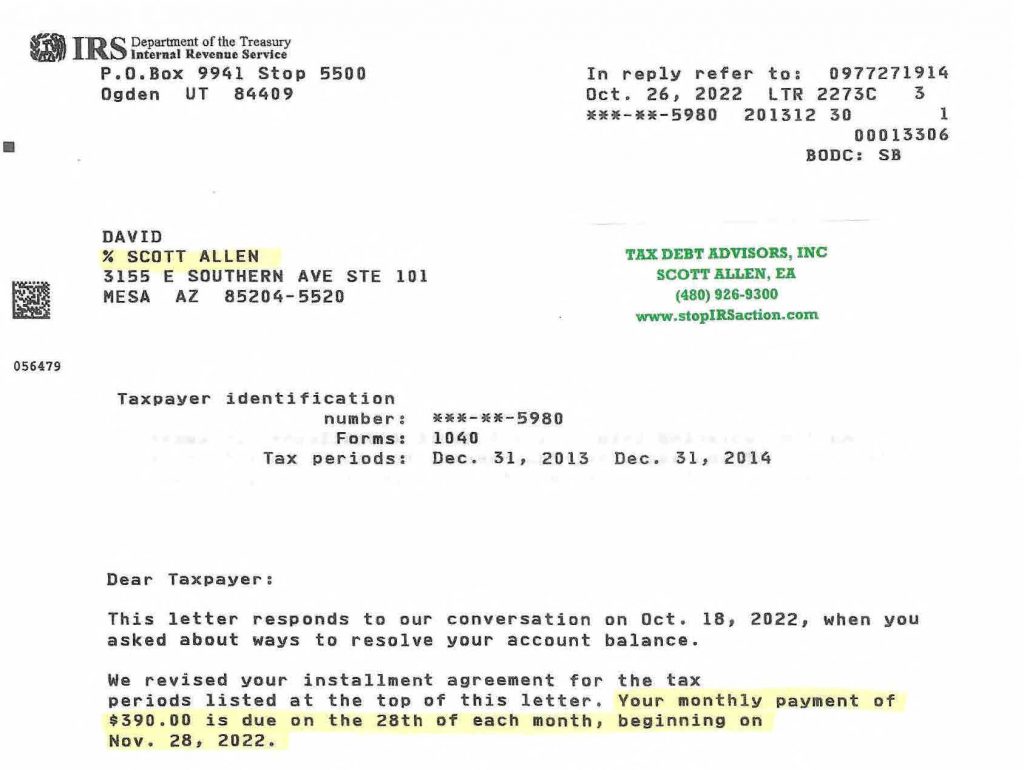

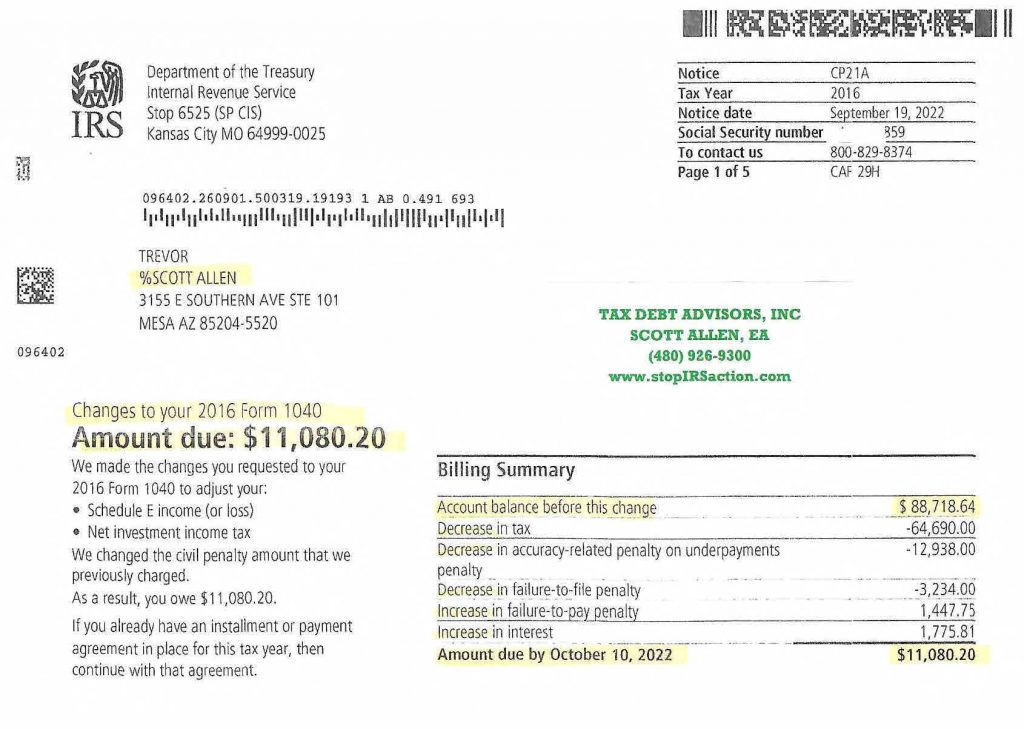

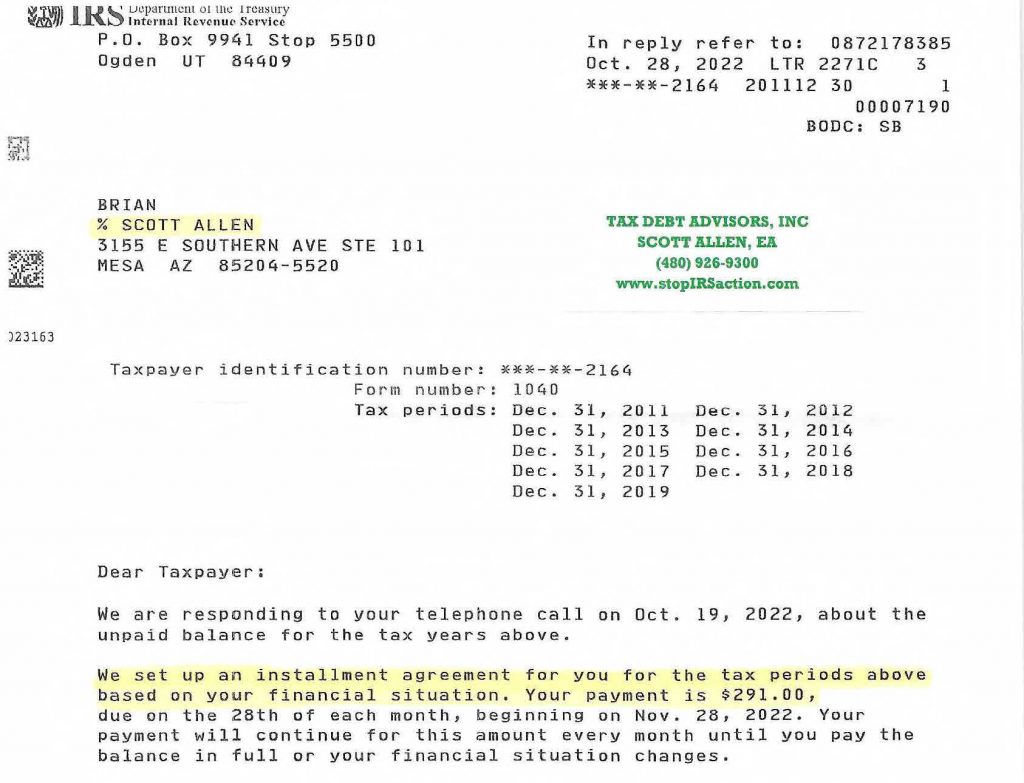

You might be wondering how Scott Allen EA released Phelipe’s Phoenix AZ IRS wage garnishment. If you look at the notice below you will see that Phelipe owed for fourteen different tax years and over $229,000 in back taxed owed. Phelipe didn’t believe that the IRS would do anything to release or lower his wage garnishment. He figured he was stuck. But that was all before he met with Scott Allen EA at Tax Debt Advisors, Inc.

After a thorough investigation into his IRS account Scott Allen EA knew that he could immediately negotiate a settlement with the IRS and stop the wage garnishment before his next pay period. When he took a look at all of his current finances (income, expenses, debts, and assets) he knew he was a lock for a currently non collectible status. A currently non collectible status is one of the best settlement options the IRS has available. This means that Phelipe does not have to make any monthly payments or lump sum settlement payments on any of his back taxes owed. The catch? He has to file and full pay his future tax returns on time to keep the settlement in place. If he does not, the IRS will default it and a new arrangement has to be negotiated again. Per statute of limitations the IRS only has ten years to collect a tax debt from when the tax returns were filed. Many of these tax years are just a couple years away from “falling off” too.

This is a huge relief for Phelipe as you can imagine. With the agreement approved, the IRS released the Phoenix AZ IRS wage garnishment right away. It was faxed to his employer within hours (not days or weeks). Time is precious if you are under an IRS levy or garnishment. Act immediately and call Scott Allen EA for proper representation. You will be glad you did.