Is IRS resolution in Mesa AZ just a sales pitch?

IRS resolution in Mesa AZ 85204

The answer is no. It is a reality. But to make sure, let’s define resolution. Some clients think that if they pay us a fee the whole tax matter will magically go away. There is no magical disappearing trick with IRS taxes. IRS Resolution in Mesa AZ involves one of the following:

A monthly payment plan until the taxes are fully paid or the statute of limitations runs out.

A non-collectible tax status which means that you do not have to pay on the taxes owe as long as you meet certain conditions. Interest and penalties continue to accrue on the taxes owed.

An offer in compromise, if accepted this option will allow you to pay less than you owe on all of the past taxes, including interest and penalties. This is a relatively rare occurrence despite the fact that you have heard many commercials on TV and radio making it sound as if you will get one as certain as weeds grow in your yard. Any company that uses this “carrot” to get you to pay them a large fee up front will more than likely be scamming you out of your money and just make your IRS situation worse. This type of “sales pitch” is a reality and you should avoid it. These companies are usually out of state and also out of your reach when they don’t perform. Although we have seen more law firms locally use this tactic and getting away with it.

A discharge of the tax liability for individual income taxes under the Chapter 7 rules of the bankruptcy code will allow you to avoid paying the tax liability under certain conditions. Payroll taxes are never dischargeable with bankruptcy.

If you are uncertain as to the best IRS resolution in Mesa AZ option, contact me for a consultation to see which option is best for you. Each option has a pro and a con to it—something good and something not so good. However, one of the options is better than the others and you need to know that before pursuing a resolution of your tax debt.

Scott Allen E. A.

Tax Debt Advisors, Inc

Successful IRS Resolution in Mesa AZ

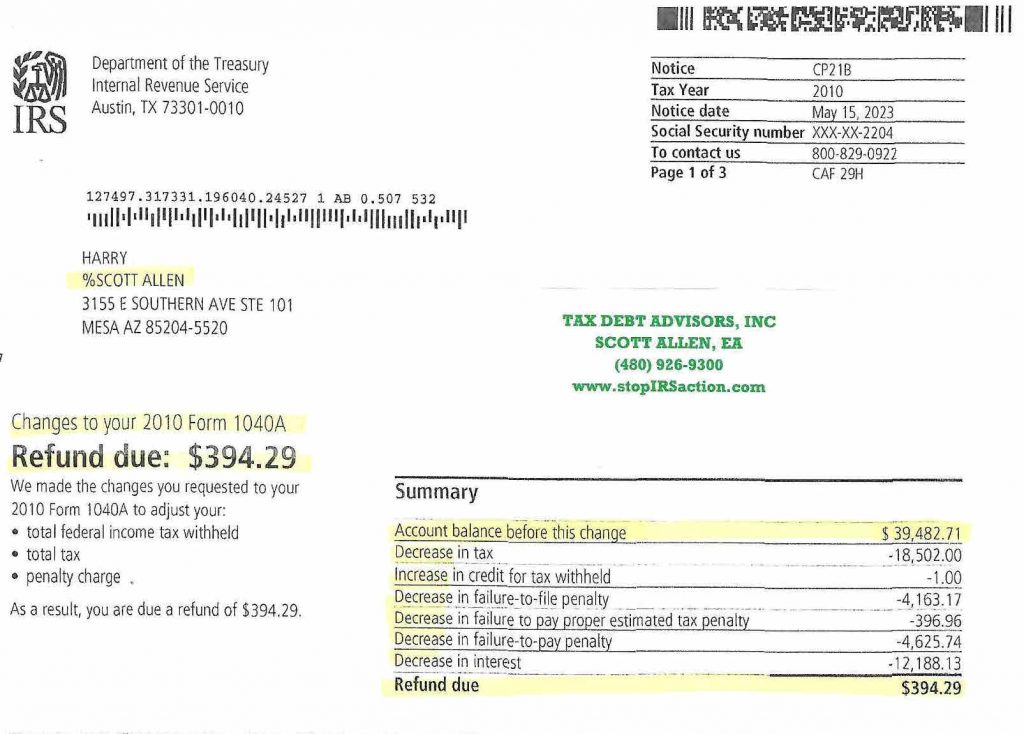

Harry enjoyed a nice IRS resolution in Mesa AZ by Scott Allen EA. His IRS debt was reduced by over 100%. Instead of him owing the IRS $39,482 the IRS actually owed him money! Imagine that! Hard to believe isn’t it? Well if you look at the IRS CP21B letter below you can believe it. Everyone’s IRS case is unique and different but its important to be thorough in you research in making sure you are getting the best possible outcome.