Tax Debt Advisors resolves IRS Wage Garnishments in Scottsdale Arizona

Stop IRS Wage Garnishments

Even though taxpayers have not filed all their returns or are aware that they owe the IRS, there they are shocked when their employer notifies them that their wages are being garnished by the IRS. Clients ask us how much the IRS can take from their pay. The amount varies depending on a number of factors but whether it is 60% or 80% isn’t that too much? Not being able to pay your rent or car payment can be overwhelming when you know that you are going to miss that payment unless you take quick action.

Scott Allen E.A. of Tax Debt Advisors has the expertise to get your IRS wage garnishments in Scottsdale Arizona released as quickly as the law allows. Depending on your circumstances, there can be returns to file and financial information to be disclosed before a release will be granted. Call Tax Debt Advisors today for a free initial consultation at 480-926-9300.

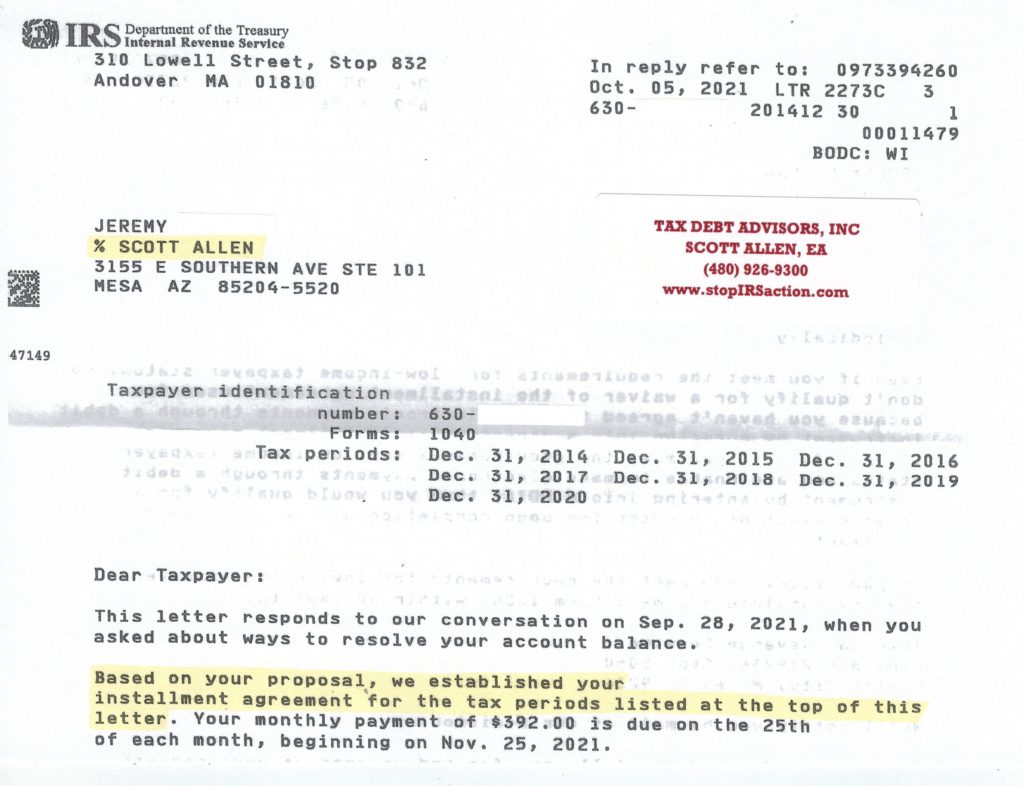

See an example below of what Tax Debt Advisors was able to do for their client Jeremy to stop IRS wage garnishments in Scottsdale Arizona. Its always best to reach out to the IRS before they reach out to you. When they do it will not be a friendly reminder warning. It usually comes in the form of an intent to levy or garnishment letter.

0