TAX NEGOTIATION PHOENIX

FAMILY OWNED TAX DEBT SETTLEMENT BUSINESS SINCE 1977!

TAX NEGOTIATION PHOENIX

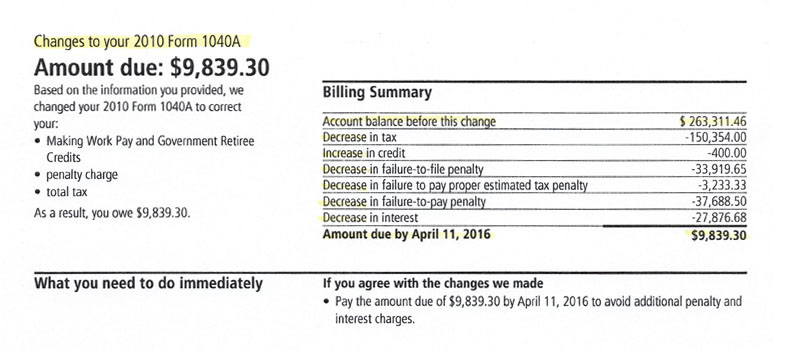

Does This Notice Look Familiar?

Are you searching for “Tax Negotation Phoenix“, while looking for tax experts to help you overcome your tax problems with the IRS? If so, Scott Allen, an Enrolled Agent with Tax Debt Advisors Inc can help! For more information read below or if you have additional questions about our IRS Tax Negotiation Services, give us a call today at 480-926-9300.

Tax Debt Advisors has been helping residents of Phoenix, Arizona negotiate and settle their tax problems with the IRS since 1977. With over 108,000 tax debts solved over the past 41 years, Tax Debt Advisors has the knowledge and experience necessary to help you solve your tax problems no matter what issue you have with the IRS. We will do our absolute best to help you avoid seizures, liens, levies, and wage garnishment.

Were You Flagged By The IRS?

When you get flagged by the IRS for errors on your tax returns or back taxes, it can put you in a difficult position. Preparing for an IRS audit requires intimate knowledge of tax codes and timely response to the IRS with necessary paperwork. Failure to provide what the IRS is requesting can leave you with a hefty bill that can threaten your finances.

How Do I Negotiate My Settlement?

When facing audit notices or tax penalties, rather than trying to negotiate with IRS yourself. you should consult Tax Debt Advisors for your tax negotiation needs. After performing an in-depth analysis of your financial situation, our experienced tax experts will negotiate a manageable settlement on your behalf.

WHAT DO I NEED TO DO TO PREPARE FOR NEGOTIATION?

After you receive the IRS negotiation letters, our tax experts will get to work by evaluating your individual situation. A thorough assessment of your tax issues will determine your real-life situation in comparison to the IRS’s claims. This is an important part of the process that will help us determine what led to your tax audit/penalties.

IRS Settlement Options

Once the assessment is complete, our tax experts will develop an individualized repayment plan that will reflect your financial obligations in a more feasible manner than the IRS’s repayment plan. Furthermore, by developing an installation plan, it can help relieve some of the tax /problems penalties that have been levied against you because of your owing money to the IRS. Some of these problems/penalties includes seizures, liens, levies, and wage garnishment.

Beginning The Negotiation Process

After you have approved the settlement proposal, our tax experts will file all of the required paperwork to start the negotiation process with the IRS. Throughout each stage of the negotiation, Tax Debt Advisors will provide you with frequent updates. Our tax experts can work on your behalf to reach a better outcome than you trying to deal with IRS tax problems on your own.

AFTER THE SETTLEMENT

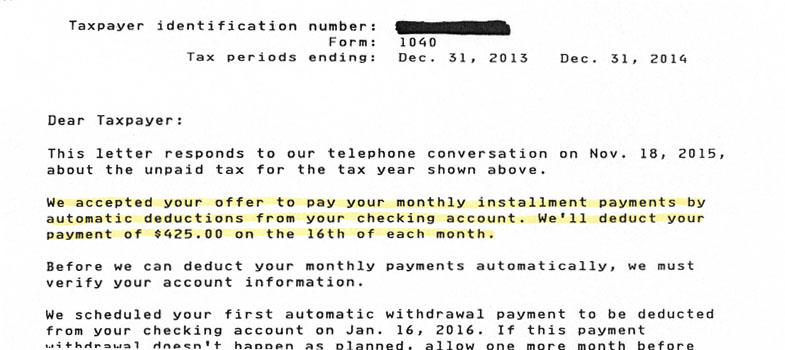

IRS Settlement Negotiation Accepted

Once you have reached a settlement with the IRS, we will help you develop and more long term plan to help improve your financial health while paying your back taxes. We can also help create more long-term tax planning to help prevent tax problems reoccurring in the future.

Tax Resolution in Phoenix or Mesa

At Tax Debt Advisors, our main goal is to help you overcome tax problems and plan for a stable financial future. For more information or questions about our IRS Tax Negotiation Services, give us a call today at 480-926-9300.

3155 East Southern Avenue, Suite 101 Mesa, AZ 85204