What Are IRS Audits?

A tax audit is when the IRS chooses to look into your tax return a little more comprehensive and verify that your income and deductions are true. Usually, your tax return is selected for audit when something you entered on your return is not common.

Receiving notice of an IRS audit can be stressful, but taking the right steps can help you manage the process effectively. Here are the first steps you should take if the IRS audits you:

- Read the Notice Carefully:

- The IRS audit notice will outline the scope of the audit, which tax year(s) are being examined, and what specific information is being requested. Understanding the details is crucial for a timely and appropriate response.

- Gather Documentation:

- Collect all relevant documents, such as tax returns, receipts, bank statements, and records that support the items being audited. Make sure your documentation is organized and complete.

- Contact Your Tax Professional:

- If you have a tax advisor or accountant, inform them immediately. They can provide guidance and may represent you during the audit. If you don’t have one, consider hiring a tax professional with experience in IRS audits.

- Respond Promptly:

- Respond to the IRS by the deadline specified in the notice. Timely communication is essential to avoid additional penalties

How Long Do IRS Audits Take?

As mentioned above, most of these audits will be completed within a year. There is a time limit for how long the IRS has to charge you or assess any additional taxes on the return being audited. This statute will expire three years from the due date of the return or the date when it was filed, whichever is later. For example, the statute would expire on April 15, 2026 for a taxpayer filing on April 13, 2023.

The IRS audit should be completed within a year, in most cases. Even though the IRS has three years to audit a return, the IRS likes to close audits well before the statute of limitations comes into play. The IRS does not have a statute of limitations if tax fraud is involved. When there is a large amount of unreported income, the statute is six years. However, the IRS rarely goes into an audit assuming an extended statute.

Types Of IRS Audits

There are three different kinds of IRS audits. These audits can take anywhere from just a few months to a year.

Mail Audits

No matter what kind of audit the IRS chooses to carry out, you will get notification of it through mail. A mail audit is the most straightforward kind of IRS review and doesn’t require you to meet with an auditor personally.

Usually, the IRS petitions for additional documentation to prove different items you reported on your return. For instance, if you claim $5,000 in philanthropic deductions, the IRS might send you a letter calling for evidence of your donations. Typically, submitting adequate evidence will complete the audit in your favor if the IRS is content.

Average time to complete a mail audit: 3-6 months.

Office Audits

An office audit is a face-to-face audit carried in a local IRS office. This type of audit is usually more detailed than a mail audit and typically comprise of questioning by an audit officer about details on your return.

You will be requested to bring particular information to an office audit, like the books and records for your company or your personal financial institutional statements and receipts. You additionally have the right to bring a CPA or attorney to represent you during the audit.

Average time complete an office audit: 3-6 months.

Field Audits

A field audit is the most comprehensive kind of review that the IRS carries out. In such a situation, an IRS agent will carry out the audit at your home or business. Usually, field audits are done when the IRS is double checking more than one deduction. A field audit is typically very detailed and will cover a lot, if not all, issues on the return.

Average time complete a field audit: less than 1 year.

IRS Audit Time Factors

Here are a few factors below that will help you estimate how long your audit may take.

Adjustments Found

If the IRS auditor makes a lot of adjustments to your return, he or she will often look for more. This means the auditor may even look into other tax years, resulting in a longer process overall.

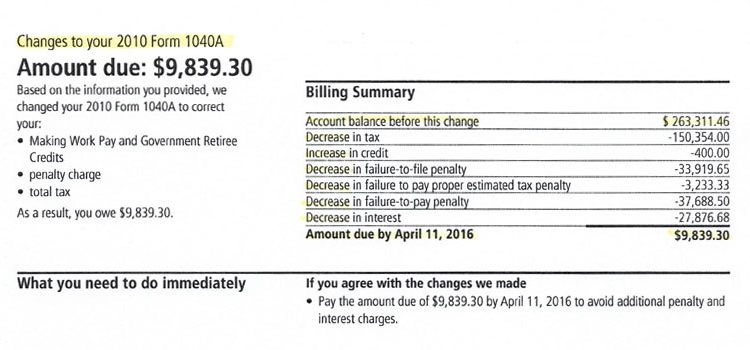

Pursuing Penalties

Oftentimes, the IRS will pursue penalties if they have to make lots of adjustments. This, of course, will extend the timeline of the process. If the IRS pursues fraud, the audit could last several years. The IRS pursues this action in only about 2,000 or 155 million cases each year, on average.

Small Business Ownership

It is undoubtedly harder for the IRS to track small business income. Auditors will have to review bank records, websites, accounts, and client accounting records. This extensive review can take several more months to complete.

Taxpayer Disagrees With Adjustments

You can take your case to IRS appeals if you disagree with the auditor’s findings. Going this route will usually tack on an extra six months to the case.

Tax Settlement in Mesa, Arizona

If you need IRS Debt Help, Tax Debt Settlements or Tax Debt Advising in Phoenix, Mesa or anywhere else, Tax Debt Advisors can help! Give us a call at 480-926-9300 or fill out our contact form for a free consultation.