Do I Need a Gilbert AZ Tax Attorney if I get an IRS Notice of Deficiency?

Gilbert AZ Tax Attorney for back taxes?

Before we begin let me just say that today can be a great day for you!

First, this is not a legal matter and does not need the attention of a Gilbert AZ Tax Attorney. The IRS Notice of Deficiency is also known as a “90 day letter.” You will have to either file a corrected return and if that return is not assessed within 90 days, a petition with the tax court needs to be filed. The tax court will refer your petition to the local Appeals Office. It may take several weeks before the Appeals Office will contact you or your IRS representative (hopefully Scott Allen, E.A.) and either accept the return that was filed or request documentation of certain items on the return. In most cases the returns are accepted as filed.

This process can be a little tricky and is one you should use an IRS professional such as Scott Allen E.A. Scott will prepare the return and file the U.S. Tax Court Petition. He will also take over when the Appeals Officer calls to approve the return as filed or provide documentation that may be requested. Scott Allen E.A. is available for a free consultation at 480-926-9300.

If you live and or work in the Gilbert Arizona area, don’t make a mistake or delay the process. Scott is usually available to meet with you within 24-48 hours on most cases. In meeting with me you will be able to compare the difference in my services verses the services of a Gilbert AZ Tax Attorney.

Recent success story without needing a Gilbert AZ Tax Attorney

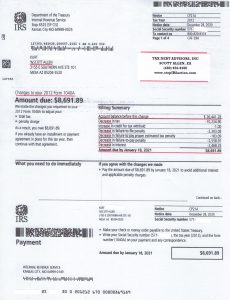

Kurt met with Scott because the IRS was sending him outrageous bills in the mail for back taxes owed for 2012. However, he never filed a 2012 return so how could he owe them over $26,000? Scott Allen EA was about to investigate the matter and discovered that the IRS filed an SFR return in his behalf and a protest tax return needed to be filed for it immediately. Scott Allen E.A. did exactly that! By filing a corrected tax return Kurt’s tax bill was reduced by $18,000. Don’t settle or be afraid to challenge the IRS as they are not always right. Know your rights and speak with Scott today.

Thank you for taking the time to read my blog. www.IRShelpblog.com