Mesa AZ IRS Fresh Start Program: Hope for Taxpayers

Navigating the Mesa AZ IRS Fresh Start Program: A Beacon of Hope for Taxpayers

Tax season can be a stressful period for many, but for those who have fallen behind on their tax filings or owe back taxes, the stress can be overwhelming. The IRS Fresh Start Program in Mesa AZ offers a lifeline for taxpayers providing them with a pathway to resolve their tax issues. One family-owned business, Tax Debt Advisors, Inc., has been at the forefront of helping Mesa residents navigate this program, achieving remarkable success in settling over 114,000 IRS debts since its inception in 1977.

Understanding the IRS Fresh Start Program

The IRS Fresh Start Program, initiated in 2011, aims to make it easier for individuals and small businesses to pay back taxes and avoid tax liens. The program has evolved over the years, enhancing options for taxpayers to manage their debt, including extended installment agreements, expanded eligibility for Offers in Compromise (OIC), and leniency for taxpayers experiencing financial hardship.

For taxpayers in Mesa, Arizona, understanding the nuances of this program is crucial. The Fresh Start Program offers several key components:

- Installment Agreements: Taxpayers can spread their tax debt over a period of up to six years, making manageable monthly payments.

- Offer in Compromise: This allows taxpayers to settle their tax debt for less than the full amount owed, based on their ability to pay.

- Tax Liens: The program increased the threshold for when the IRS would file a tax lien, helping taxpayers avoid the negative impacts on their credit scores.

Tax Debt Advisors, Inc.: A Legacy of Service

Tax Debt Advisors, Inc., a family-owned business based in Mesa, Arizona, has been a pillar of support for taxpayers since 1977. Their deep-rooted commitment to the community is reflected in their impressive track record of settling over 114,000 IRS debts. The company, known for its personal touch and dedication, understands that each client’s situation is unique and requires a tailored approach. Scott Allen EA will represent you from start to finish as your IRS Power of Attorney

A Recent Success Story: Peter’s Journey

One of the many success stories from Tax Debt Advisors, Inc. involves a client named Peter. Peter, a Mesa resident, found himself overwhelmed with his tax debt and unsure of how to proceed. Facing the potential for severe financial repercussions, he turned to Tax Debt Advisors, Inc. for help.

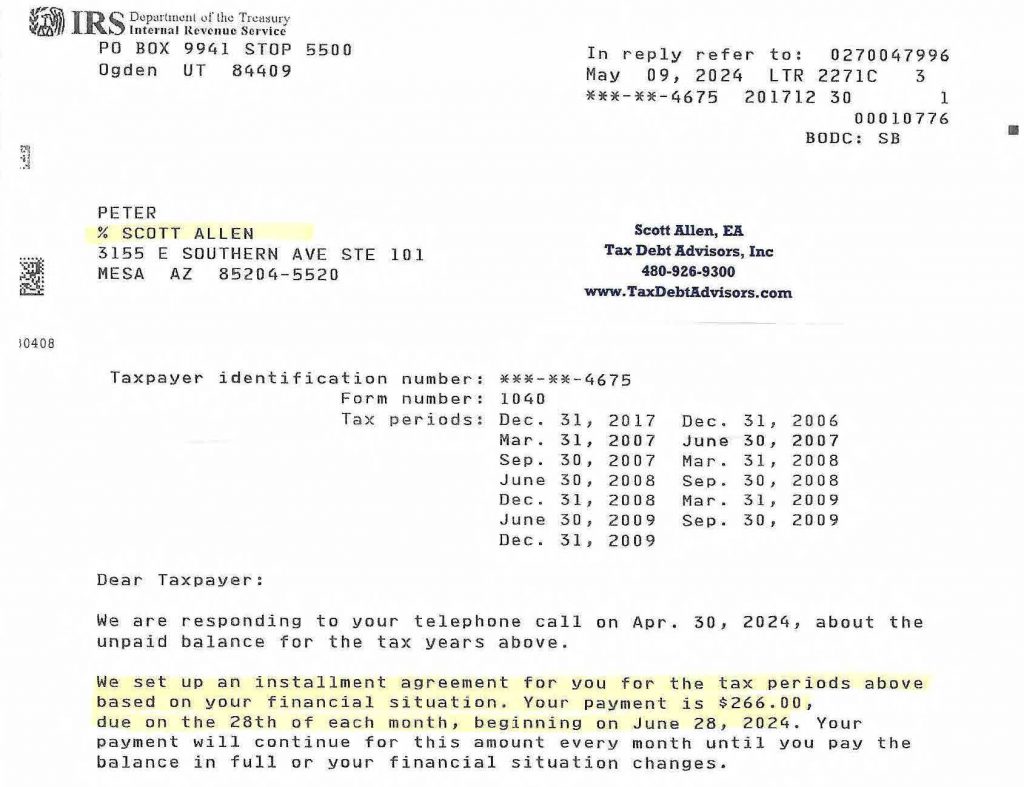

Representing Peter as his power of attorney, Tax Debt Advisors, Inc. negotiated with the IRS on his behalf. Their expertise and strategic approach culminated in securing a low monthly payment plan of $266 for Peter. This agreement not only alleviated Peter’s immediate financial burden but also provided him with a clear path to resolving his tax issues. See his Mesa AZ Fresh Start Program settlement below.

Steps to Enroll in the IRS Fresh Start Program

Taxpayers in Mesa looking to enroll in the IRS Fresh Start Program can benefit from the guidance and support of Tax Debt Advisors, Inc. The process typically involves the following steps:

- Assessing Eligibility: The first step is to determine eligibility for the program. Tax Debt Advisors, Inc. conducts a thorough evaluation of the taxpayer’s financial situation to identify the best available options.

- Filing Outstanding Returns: All tax returns must be up-to-date. Tax Debt Advisors, Inc. assists clients in filing any outstanding returns, ensuring compliance with IRS requirements.

- Negotiating with the IRS: With power of attorney, Tax Debt Advisors, Inc. handles all communications with the IRS, negotiating terms that are in the best interest of the client.

- Implementing the Agreement: Once an agreement is reached, Tax Debt Advisors, Inc. ensures that all necessary paperwork is completed and submitted, and they provide ongoing support to help clients stay on track with their payment plans.

The Benefits of Professional Representation

Navigating the IRS Fresh Start Program can be complex and intimidating. Having a knowledgeable and experienced advocate like Tax Debt Advisors, Inc. can make a significant difference. Their services offer several benefits:

- Expertise: With over four decades of experience, Tax Debt Advisors, Inc. possesses an in-depth understanding of IRS processes and regulations.

- Negotiation Skills: Their team is skilled in negotiating favorable terms, leveraging their experience to achieve the best possible outcomes for their clients.

- Peace of Mind: Clients can focus on their daily lives, knowing that their tax issues are being handled by professionals.

- Personalized Service: As a family-owned business, Tax Debt Advisors, Inc. prides itself on offering personalized service and treating each client as a part of their extended family.

Common Challenges and How Tax Debt Advisors, Inc. Overcomes Them

While the IRS Fresh Start Program in Mesa AZ provides significant relief, there are common challenges that taxpayers may face. Tax Debt Advisors, Inc. is well-equipped to handle these obstacles:

- Complex Financial Situations: Taxpayers with complex financial situations may struggle to demonstrate their inability to pay. Tax Debt Advisors, Inc. meticulously prepares financial documentation to present a clear and accurate picture to the IRS.

- Communication Barriers: Direct communication with the IRS can be daunting. Tax Debt Advisors, Inc. acts as a buffer, ensuring that all correspondence is professional and effective.

- Maintaining Compliance: Keeping up with IRS requirements during the repayment period is crucial. Tax Debt Advisors, Inc. provides ongoing support to help clients maintain compliance and avoid additional penalties.

Why Mesa Residents Choose Tax Debt Advisors, Inc.

Mesa residents have a trusted ally in Tax Debt Advisors, Inc. The firm’s long-standing presence in the community and commitment to client success have earned them a stellar reputation. Here are a few reasons why Mesa taxpayers continue to choose Tax Debt Advisors, Inc.:

- Proven Track Record: Over 114,000 settled IRS debts speak volumes about their capability and reliability.

- Family Values: As a family-owned business, they emphasize trust, integrity, and personalized service.

- Local Expertise: Being based in Mesa, they have a unique understanding of the local community and its specific needs.

- Comprehensive Services: From filing delinquent returns to negotiating payment plans, they offer a full spectrum of services to address every aspect of tax debt resolution.

Peter’s Experience: A Testimonial of Success

Peter’s case is a testament to the effectiveness of Tax Debt Advisors, Inc. His journey from uncertainty to relief highlights the crucial role that professional representation can play. Peter’s low $266 monthly payment plan not only brought immediate financial relief but also set him on a path to becoming debt-free.

Peter’s testimonial underscores the importance of seeking professional help when dealing with tax debt. His success story is one of many, reflecting the dedication and expertise that Tax Debt Advisors, Inc. brings to every client’s situation.

The IRS Fresh Start Program offers a valuable opportunity for Mesa taxpayers to regain control of their financial futures. However, the complexities involved necessitate expert guidance. Tax Debt Advisors, Inc., with its rich history and proven success, stands out as a beacon of hope for those struggling with tax debt.

For over four decades, Tax Debt Advisors, Inc. has been helping Mesa residents navigate their way out of tax debt, providing personalized, professional, and effective solutions. Whether it’s through low monthly payment plans or negotiated settlements, their commitment to client success is unwavering. As Peter’s story illustrates, the right support can make all the difference, turning a daunting tax debt situation into a manageable and hopeful journey.

Tax Debt Advisors, Inc. continues to build on its legacy, offering Mesa taxpayers the expertise and personalized care they need to successfully utilize the IRS Fresh Start Program and achieve financial peace of mind.