Helping People with Tax Problems: An IRS Fresh Start Program in Gilbert, AZ

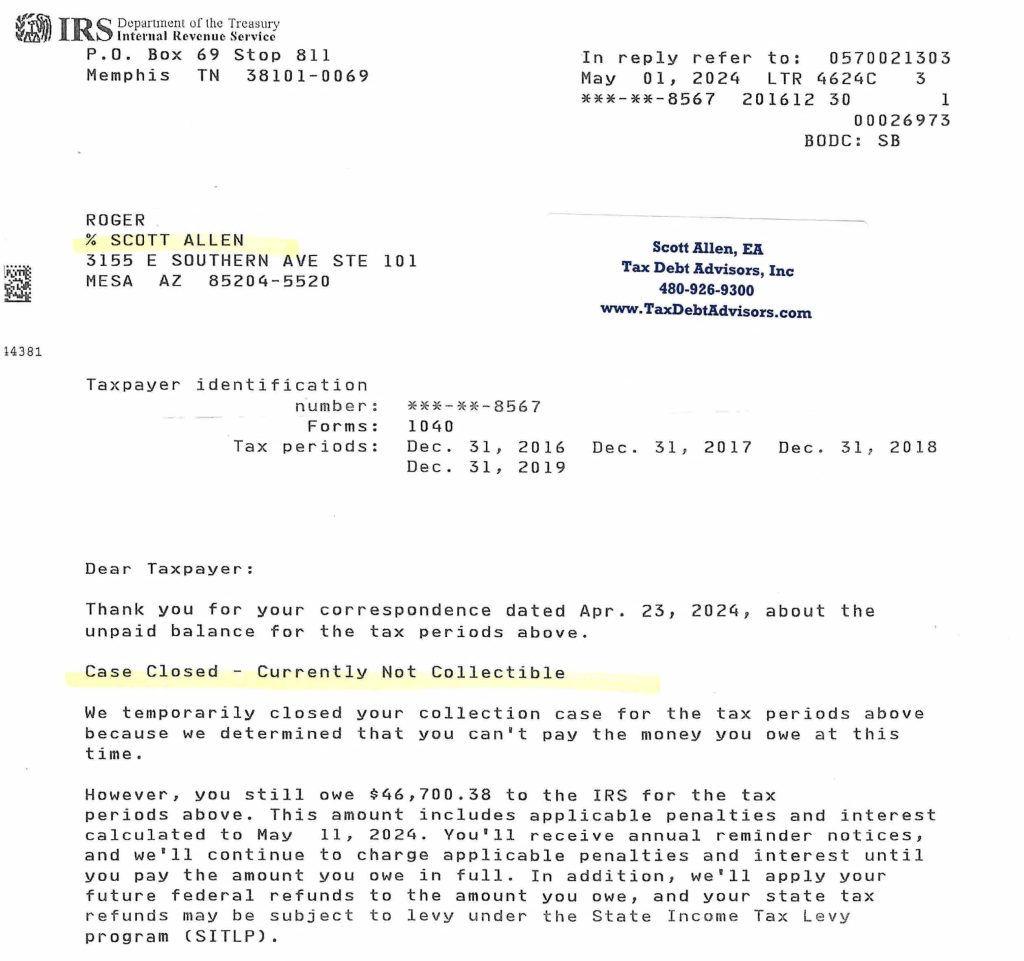

Hello, I’m Scott Allen EA, the owner of Tax Debt Advisors Inc. Our family business has over 40 years of experience in helping individuals and businesses resolve their IRS tax problems, I have seen firsthand the stress and anxiety that tax issues can cause. Today, I want to share a success story about a client of mine, Roger from Gilbert, AZ, who faced significant back taxes owed from 2016-2019. Through our expertise, we were able to negotiate his IRS debt into a Currently Non-Collectible (CNC) status. I’ll explain what CNC status is, how taxpayers can qualify for it, and why local, personalized tax assistance is critical, especially when compared to out-of-state tax resolution companies. CNC status is one of a handle of ways to settle an IRS debt with the IRS’s Fresh Start Program.

Understanding Currently Non-Collectible Status

What is Currently Non-Collectible Status?

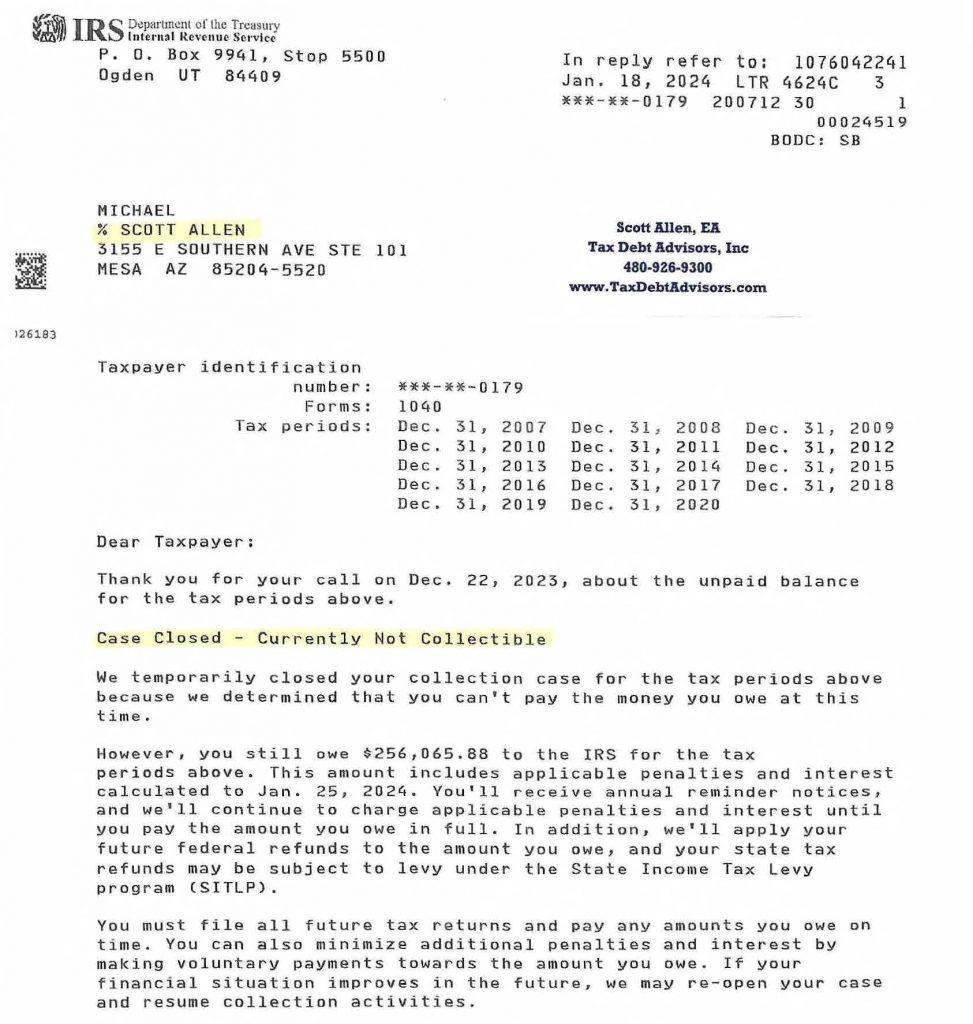

Currently Non-Collectible (CNC) status is a temporary status that the IRS grants to taxpayers who are unable to pay their tax debt due to financial hardship. When a taxpayer is placed in CNC status, the IRS suspends all collection activities, including levies and garnishments. This does not mean the debt is forgiven; instead, it acknowledges that the taxpayer cannot pay at this time without causing significant financial distress.

Qualifying for CNC Status

To qualify for CNC status, a taxpayer must demonstrate financial hardship. This involves showing that paying the tax debt would leave them unable to meet basic living expenses. The IRS considers various factors, including:

- Income: All sources of income are considered, including wages, business income, social security benefits, and pensions.

- Expenses: Necessary living expenses such as housing, utilities, food, transportation, and medical costs are evaluated.

- Assets: The IRS will review the taxpayer’s assets to determine if any could be liquidated to pay the debt.

- Equity in Assets: The IRS also considers the equity in a taxpayer’s assets. If the taxpayer has substantial equity in assets, they may be required to liquidate some of those assets to pay the tax debt.

The Story of Roger from Gilbert, AZ

Roger came to Tax Debt Advisors Inc. with a significant tax debt from the years 2016 to 2019. He was overwhelmed and unsure of how to manage his situation. Here is how we helped him:

Initial Consultation and Financial Analysis

Our process began with a thorough consultation to understand Roger’s financial situation. We reviewed his income, expenses, assets, and liabilities. It was clear that Roger was struggling to make ends meet, and paying off his tax debt in full was not feasible without severe financial consequences.

Negotiating with the IRS

With a detailed understanding of Roger’s financial hardship, we contacted the IRS on his behalf. We provided all the necessary documentation to demonstrate that Roger’s financial situation qualified him for CNC status. This included:

- Income Statements: Pay stubs, social security statements, and any other income documentation.

- Expense Documentation: Receipts and bills for all necessary living expenses.

- Asset Information: Details about any assets Roger owned, including their current value and any outstanding debts associated with them.

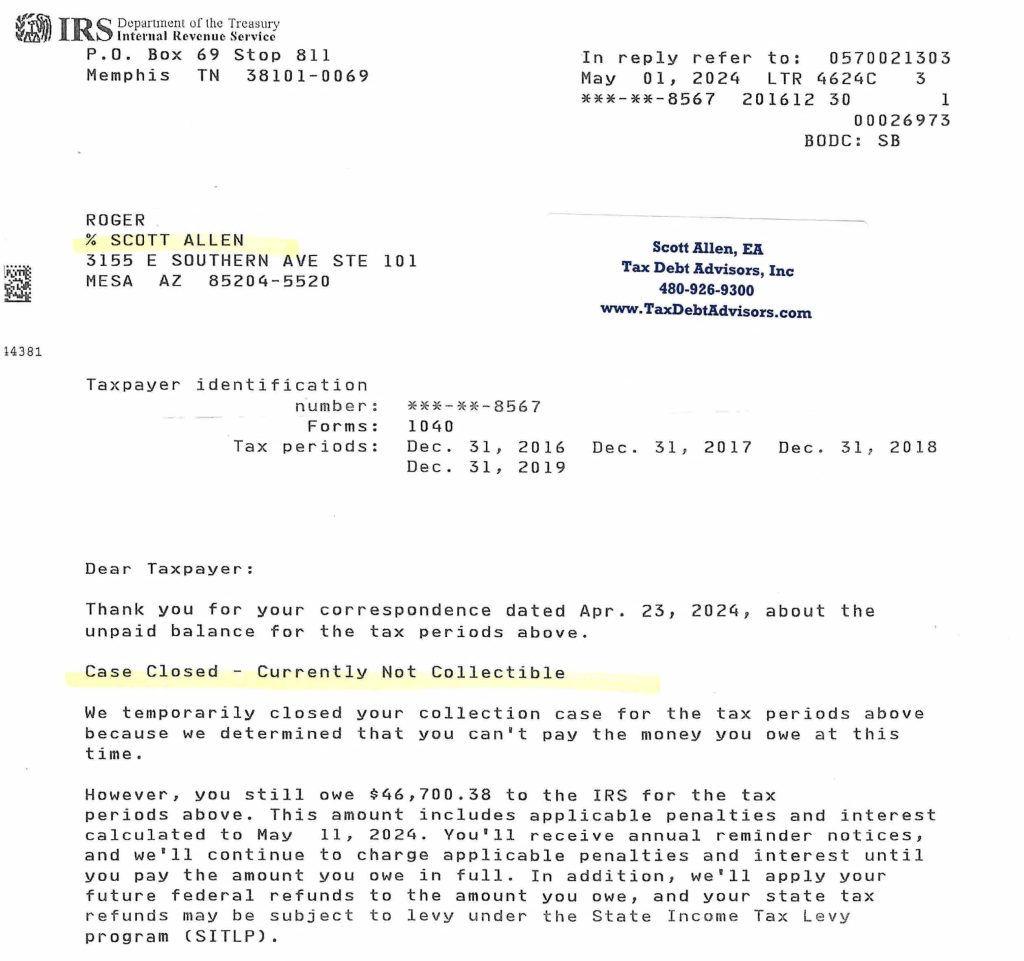

Achieving CNC Status

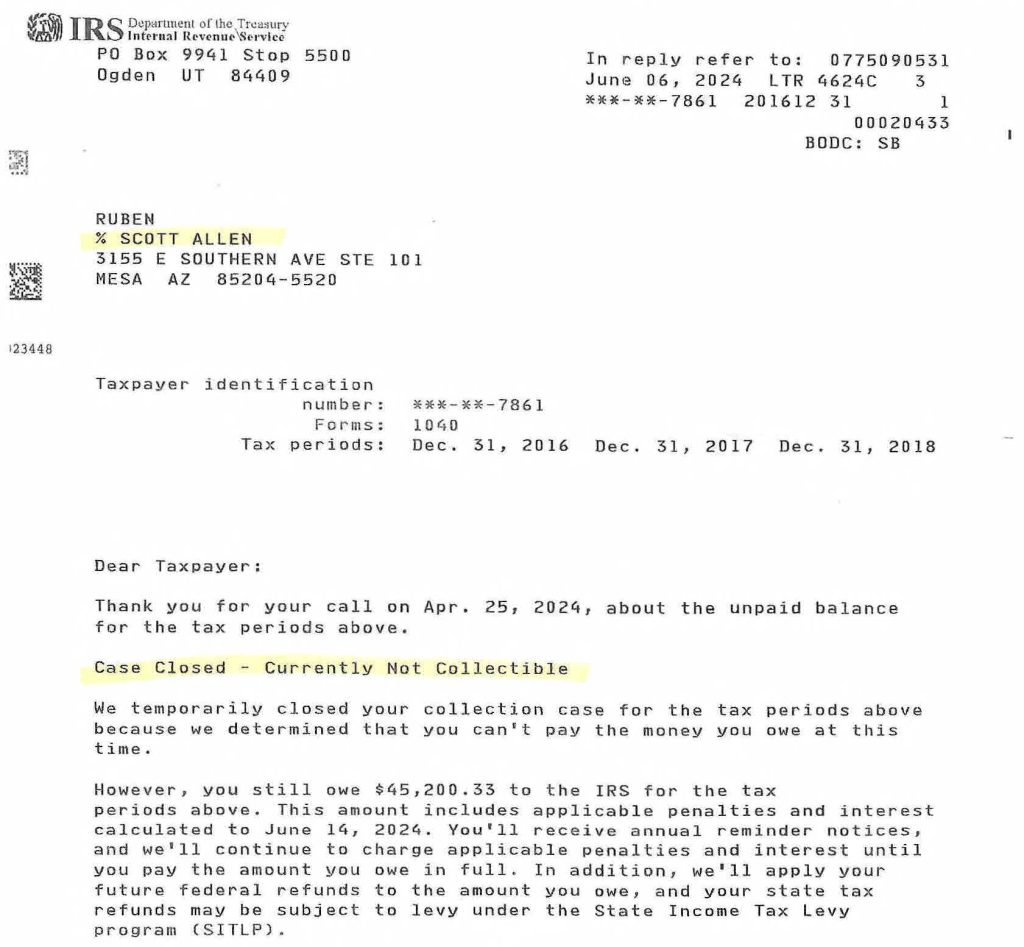

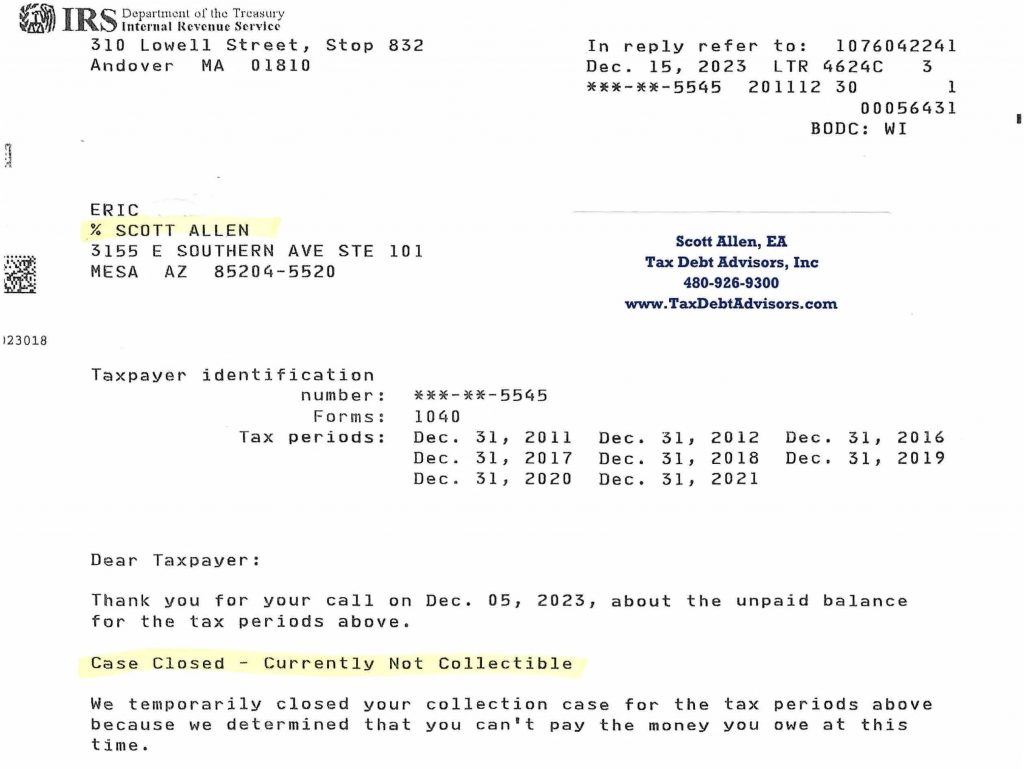

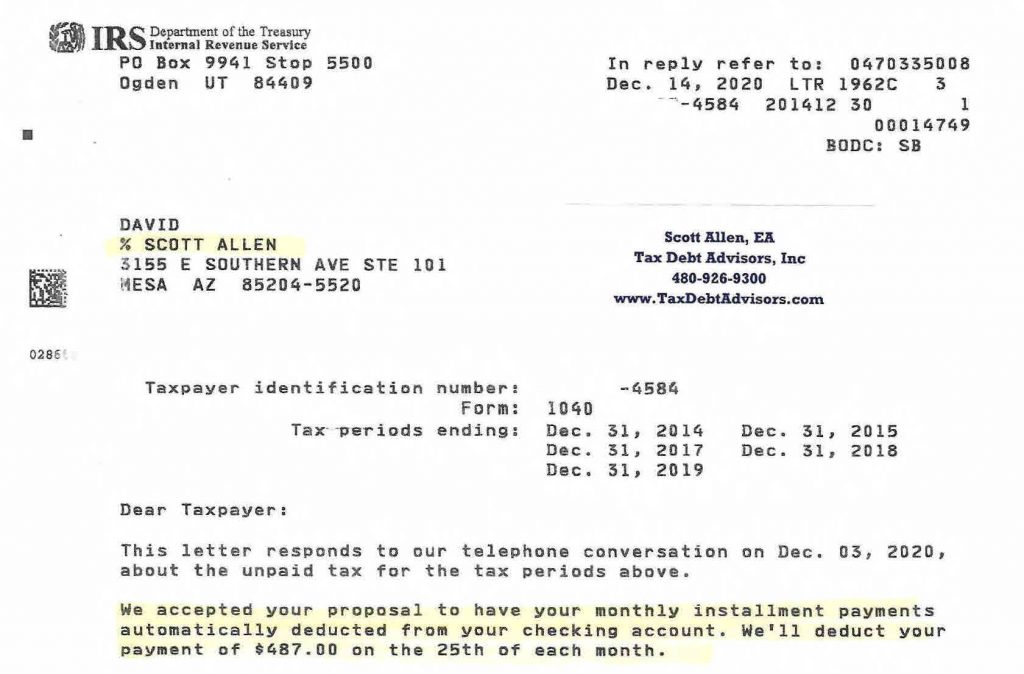

After reviewing the documentation, the IRS agreed that Roger’s financial situation warranted CNC status. This was a significant relief for Roger, as it meant that the IRS would not pursue any collection actions, allowing him to focus on meeting his basic living expenses without the constant fear of IRS levies or garnishments. See Roger’s letter of approval below. He does not have to pay a dime towards his $46,000 IRS debt.

IRS Fresh Start Program Gilbert AZ

The IRS Fresh Start Program

One of the tools we utilized in Roger’s case is part of the broader IRS Fresh Start Program. This initiative was designed to help struggling taxpayers get back on their feet by providing more flexible options for resolving tax debts.

Key Features of the IRS Fresh Start Program

- Increased Thresholds for Tax Liens: The program raised the minimum amount owed before the IRS would file a lien, helping taxpayers avoid additional financial strain.

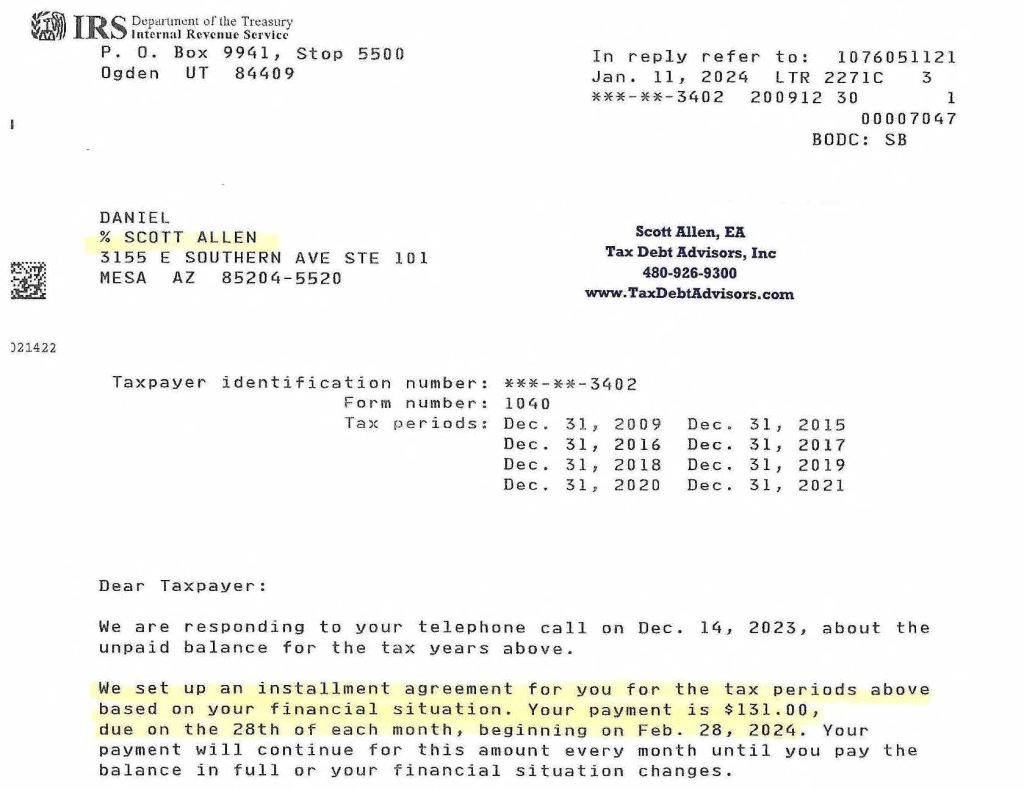

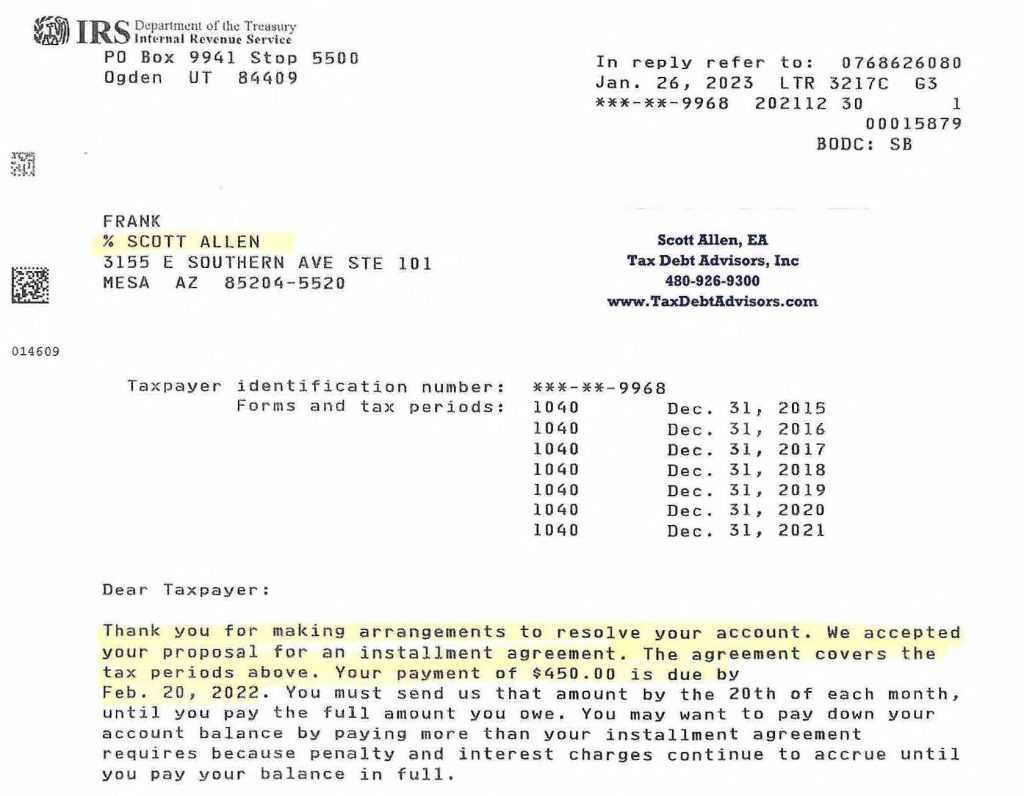

- Expanded Installment Agreements: More taxpayers are now eligible for streamlined installment agreements, making it easier to pay off tax debts over time.

- Offer in Compromise (OIC): This allows eligible taxpayers to settle their tax debt for less than the full amount owed if they can demonstrate an inability to pay.

- CNC Status: As discussed, this suspends collection activities for those facing significant financial hardship.

IRS Fresh Start Program in Gilbert, AZ

For residents of Gilbert, AZ, and the surrounding areas, the IRS Fresh Start Program offers a lifeline to those struggling with tax debt. However, navigating the complexities of this program requires expertise and experience. At Tax Debt Advisors Inc., we specialize in leveraging the Fresh Start Program to help our clients achieve the best possible outcomes.

The Pitfalls of Out-of-State Tax Resolution Companies

When dealing with tax problems, it’s crucial to be cautious about whom you trust. Many out-of-state tax resolution companies advertise aggressively, promising quick fixes and guaranteed results. However, these companies often provide misleading information about the IRS Fresh Start Program in Gilbert AZ and other tax resolution options.

Why Choose Local Expertise?

- Personalized Service: As a local firm, we offer face-to-face consultations and personalized service tailored to your specific needs. We understand the unique financial landscape of Gilbert, AZ, and the surrounding areas.

- Experience and Knowledge: With decades of experience, we have an in-depth understanding of IRS procedures and the intricacies of the tax code. This allows us to provide accurate and effective solutions.

- Accountability: Local firms are more accountable to their clients. Our reputation in the community is built on trust and successful outcomes. We are here to support you every step of the way, unlike out-of-state companies that may disappear after collecting their fees.

Beware of False Promises

Out-of-state companies often make promises that sound too good to be true, such as:

- Guaranteed Results: No reputable tax professional can guarantee specific outcomes, as every case is unique.

- Quick Resolutions: Resolving tax issues takes time and careful negotiation with the IRS. Be wary of promises for instant results.

- One-Size-Fits-All Solutions: Effective tax resolution requires a customized approach based on your financial situation. Avoid companies that offer generic solutions without understanding your specific needs.

How Tax Debt Advisors Inc. Can Help

At Tax Debt Advisors Inc., near Gilbert AZ we are committed to helping our clients navigate the complexities of tax debt resolution with confidence and peace of mind. Our services include:

Comprehensive Tax Debt Analysis

We start with a thorough analysis of your tax debt and financial situation. This includes reviewing all relevant documents, understanding your financial constraints, and identifying the best resolution strategies.

Personalized Resolution Plans

Based on our analysis, we develop a personalized plan tailored to your specific needs. Whether it’s negotiating CNC status, setting up an installment agreement, or exploring an Offer in Compromise, we ensure that you understand all your options and the potential outcomes.

Expert Negotiation with the IRS

Our extensive experience in dealing with the IRS enables us to effectively negotiate on your behalf. We present your case in the best possible light, backed by comprehensive documentation and a clear demonstration of your financial hardship.

Ongoing Support and Guidance

Tax debt resolution is not a one-time event but an ongoing process. We provide continuous support to ensure that you remain in compliance with IRS requirements and avoid future tax problems. Our goal is to help you achieve long-term financial stability.

Facing tax problems can be overwhelming, but you don’t have to go through it alone. At Tax Debt Advisors Inc., we are dedicated to helping you find the best solutions for your tax debt issues. Our success story with Roger from Gilbert, AZ, is just one example of how we can help you achieve financial relief through the IRS Fresh Start Program in Gilbert AZ and other resolution options.

If you’re struggling with tax debt, especially if you’re considering the IRS Fresh Start Program in Gilbert, AZ, contact Scott Allen EA today for a consultation. Let us put our expertise to work for you and help you regain control of your financial future.