Scottsdale AZ IRS Tax Attorney or Scott Allen EA for Filing Past Due Tax Returns

Scott Allen EA for Filing Past Due Tax Returns

In the realm of taxation, the complexities and intricacies of past due tax returns can be a source of immense stress for any taxpayer. It’s in this challenging scenario that individuals often find themselves pondering the crucial decision of who to entrust with the task – a Scottsdale AZ IRS tax attorney or Scott Allen EA. Delving into the options, it becomes evident that Scott Allen EA presents a compelling case for being the preferred choice. This blog explores the reasons why a taxpayer should opt for the services of Scott Allen EA over a Scottsdale AZ IRS tax attorney when it comes to filing past due tax returns.

Expertise and Specialization

Scott Allen EA is not just an ordinary tax professional. As an Enrolled Agent (EA), he possesses a unique specialization in taxation matters. Enrolled Agents are federally authorized tax practitioners empowered by the U.S. Department of the Treasury to represent taxpayers before the IRS. This specialization provides Scott Allen EA with an in-depth understanding of tax laws, regulations, and procedures. On the other hand, while Scottsdale IRS tax attorneys possess a general legal background, they might not be as deeply versed in the nuances of tax laws as an EA like Scott Allen.

Focused Approach

When faced with past due tax returns, time is of the essence. Scott Allen EA is well-versed in swiftly assessing a taxpayer’s situation and strategizing the best course of action. His specialized expertise allows him to focus specifically on tax-related matters, ensuring that his approach is streamlined and efficient. In contrast, a Scottsdale IRS tax attorney might have a broader range of legal responsibilities, which could potentially divert their focus away from the intricacies of tax return filing.

Personalized Attention

One of the key advantages of opting for Scott Allen EA is the personalized attention he provides to each client. As an independent tax practitioner, he can dedicate ample time to understanding the unique financial situation of the taxpayer, ensuring that no detail is overlooked during the past due tax return filing process. This level of personalized attention might be harder to come by when working with a Scottsdale AZ IRS tax attorney, who could be juggling multiple cases simultaneously.

Cost-Efficiency

Cost considerations are always at the forefront of any taxpayer’s mind. Scott Allen EA’s services are often more cost-effective compared to those of Scottsdale AZ IRS tax attorneys. This is primarily due to the focused nature of his practice and his ability to offer specialized services without the overhead costs associated with larger law firms.

Direct Communication

Open and direct communication is pivotal when dealing with sensitive financial matters like past due tax returns. Scott Allen EA prides himself on maintaining clear and transparent communication with his clients. Clients can directly engage with him, ensuring that questions are answered promptly and concerns are addressed comprehensively. In contrast, communication with a Scottsdale AZ IRS tax attorney might go through intermediaries, leading to potential delays and misinterpretations.

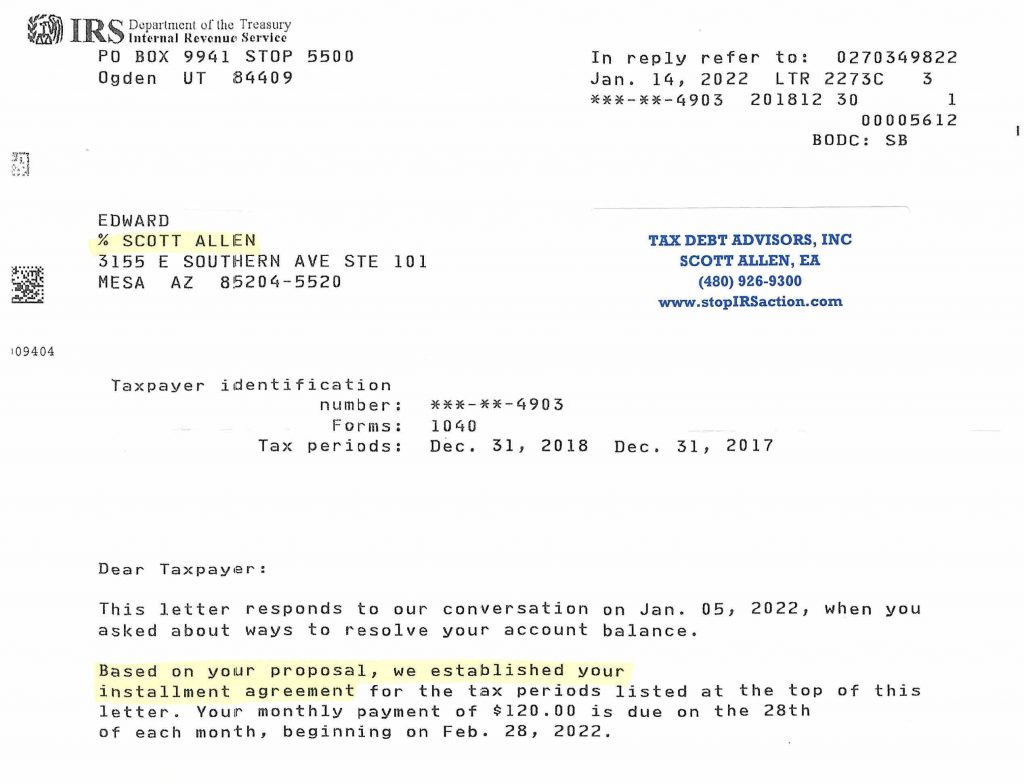

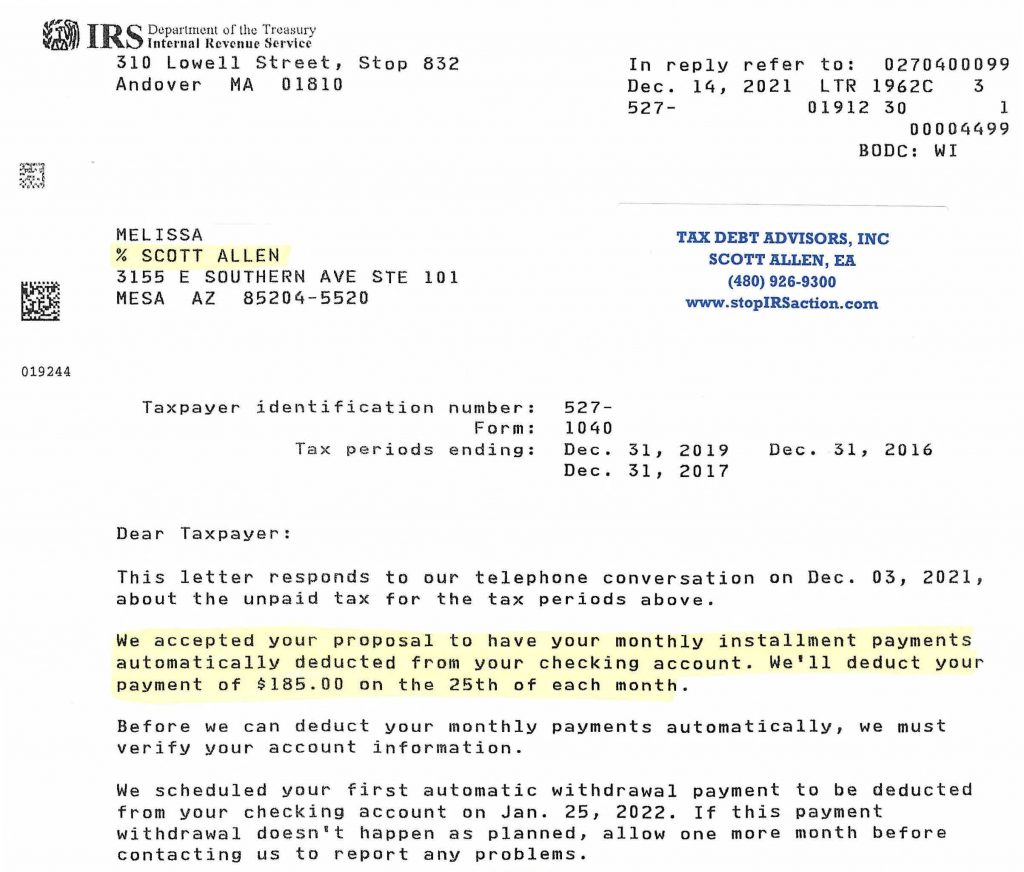

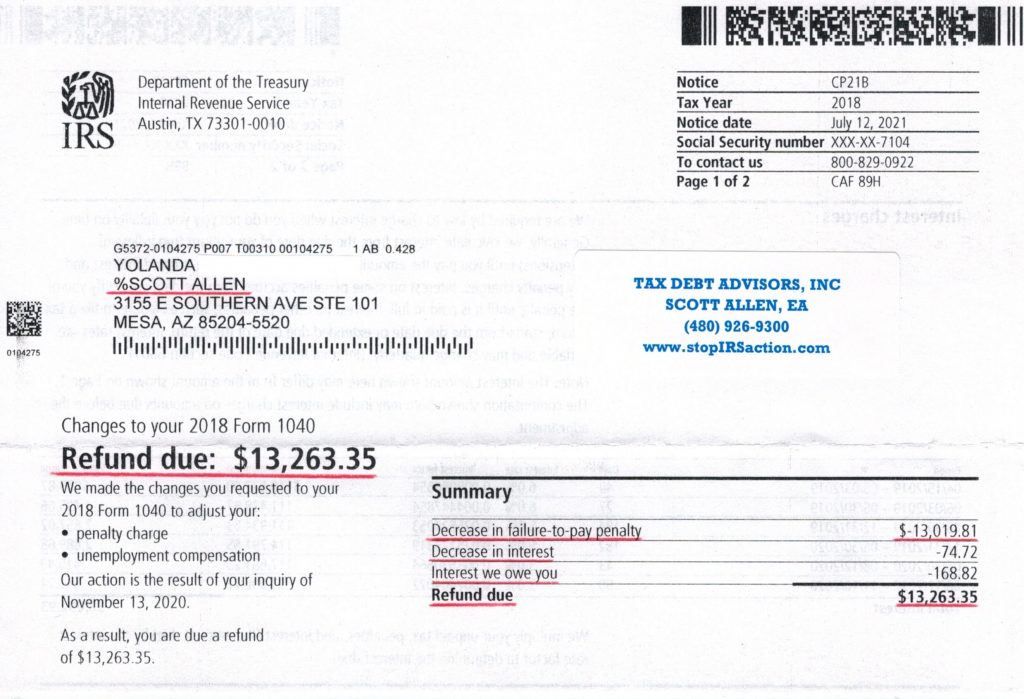

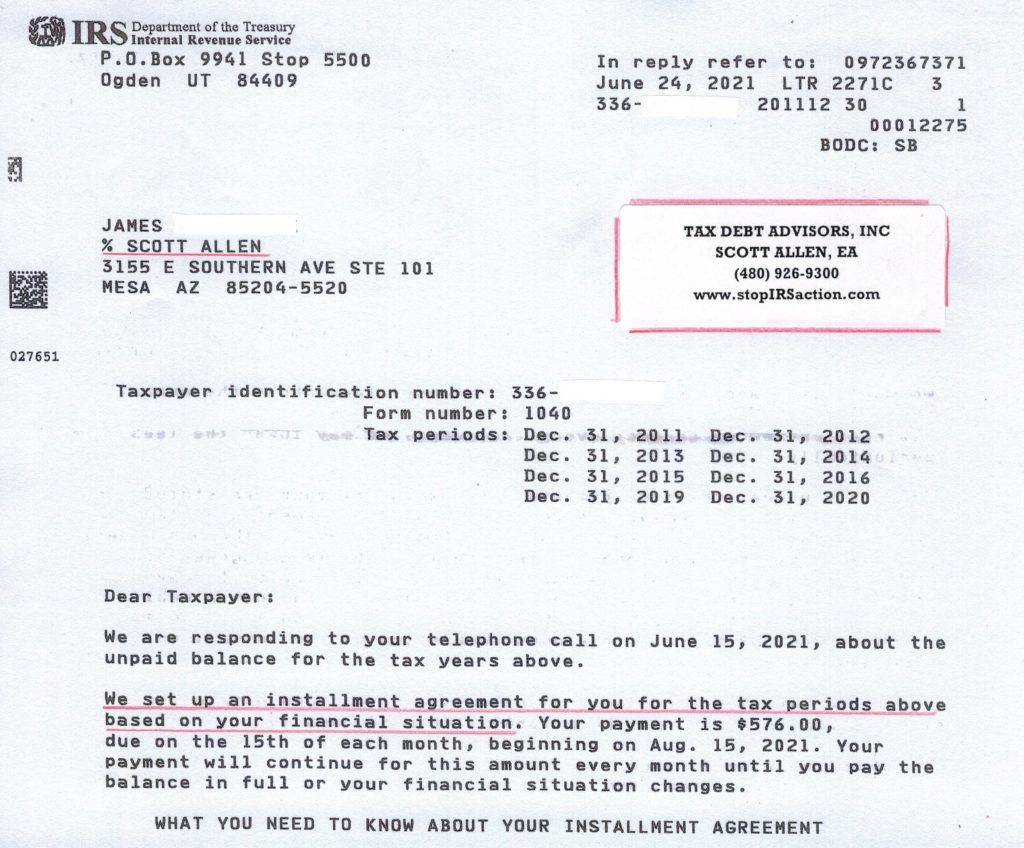

Proven Track Record

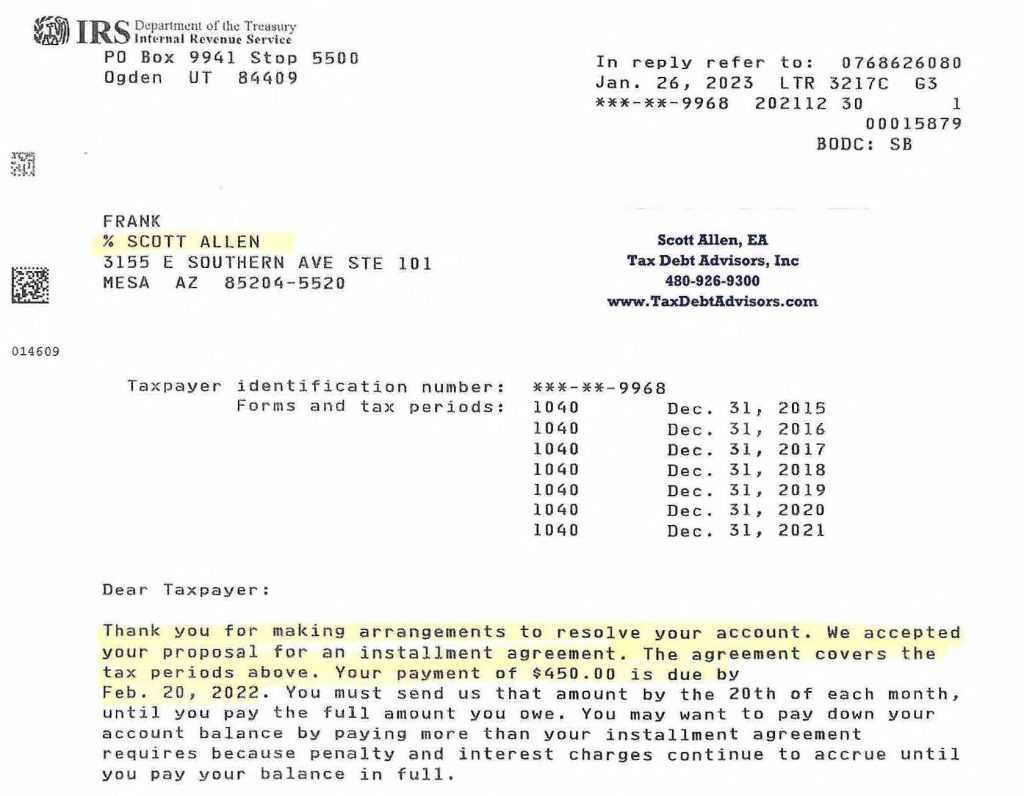

Scott Allen EA boasts a proven track record of successfully assisting clients in resolving past due tax return issues. His reputation is built on a foundation of trust, professionalism, and positive outcomes. This is an essential factor to consider when comparing his services to those of a Scottsdale IRS tax attorney, whose track record might not be as explicitly tailored to taxation matters. Below is a great example of how Scott Allen EA represented Frank in his large tax liability. He was able to negotiate all seven years of back taxes owed into one low monthly payment plan of $450 per month. Again, before making the costly decision thinking your tax debt requires a Scottsdale AZ IRS tax attorney meet with Scott Allen EA. He can represent you just like he did for his client Frank.

The decision to choose between Scott Allen EA and a Scottsdale AZ IRS tax attorney for filing past due tax returns ultimately rests upon careful consideration of expertise, specialization, efficiency, cost-efficiency, communication, and track record. While both options offer valuable services, the tailored expertise and personal attention that Scott Allen EA brings to the table make him a compelling choice for taxpayers seeking to navigate the complex landscape of past due tax returns. By entrusting Scott Allen EA with the task, taxpayers can breathe easier, knowing they have a dedicated Enrolled Agent on their side, working tirelessly to ensure their financial matters are resolved effectively and efficiently. Contact Scott Allen EA of Tax Debt Advisors, Inc today. You will not regret that choice.