Hiring Scott Allen EA for Filing Past Due Tax Returns over a Tempe, AZ IRS Tax Attorney

Making Informed Choices: Hiring Scott Allen EA for Filing Past Due Tax Returns instead of a Tempe, AZ IRS Tax Attorney

In the bustling city of Tempe, Arizona, taxpayers facing the daunting task of filing past due tax returns often find themselves at a crossroads. They must decide whether to enlist the services of a Tempe IRS tax attorney or opt for the expertise of a seasoned professional like Scott Allen EA. This blog delves into the compelling reasons why a taxpayer should consider the latter option, highlighting the benefits and advantages that Scott Allen EA brings to the table.

1. Tailored Expertise and Focus on Tax Matters: While Tempe AZ IRS tax attorneys are adept at handling a wide array of legal issues, their expertise is more generalized. In contrast, Scott Allen EA specializes exclusively in taxation matters. With years of experience focused on tax regulations, deductions, and credits, Scott possesses an in-depth understanding of the intricacies of tax law. This specialization ensures that taxpayers receive tailored advice and guidance specifically targeted towards their tax concerns.

2. Efficient and Cost-Effective Approach: Hiring an IRS tax attorney can often be an expensive endeavor due to the nature of legal proceedings and representation. Scott Allen EA, on the other hand, offers a more cost-effective solution without compromising on quality. His efficient approach streamlines the process of filing past due tax returns, minimizing unnecessary expenses and ensuring that clients receive optimal value for their investment.

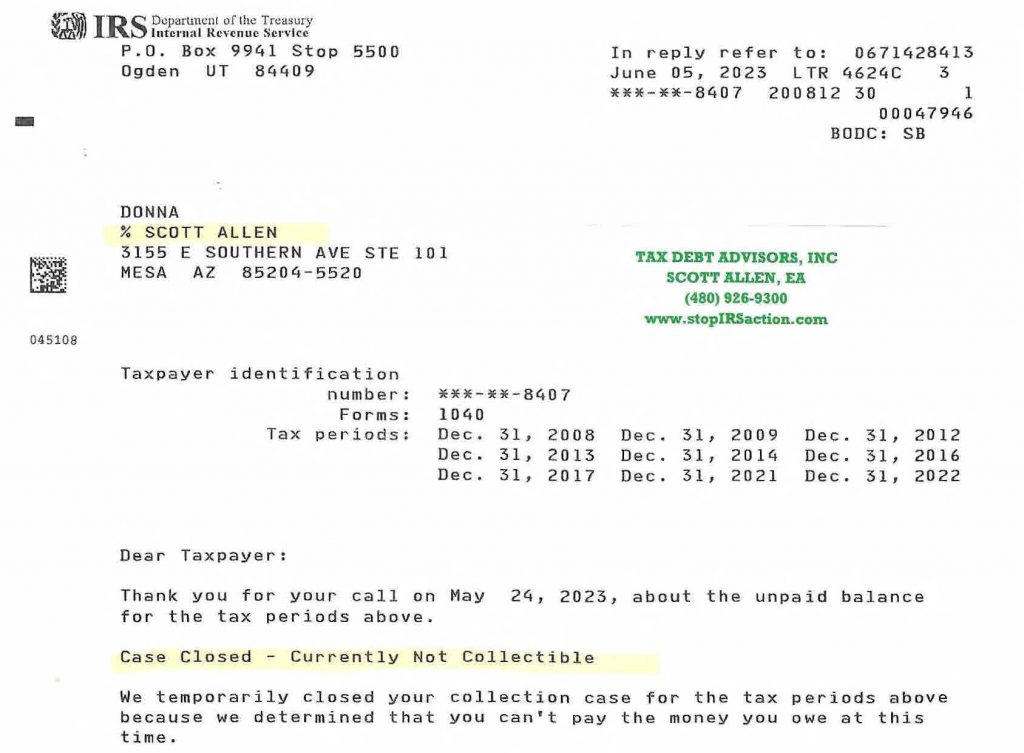

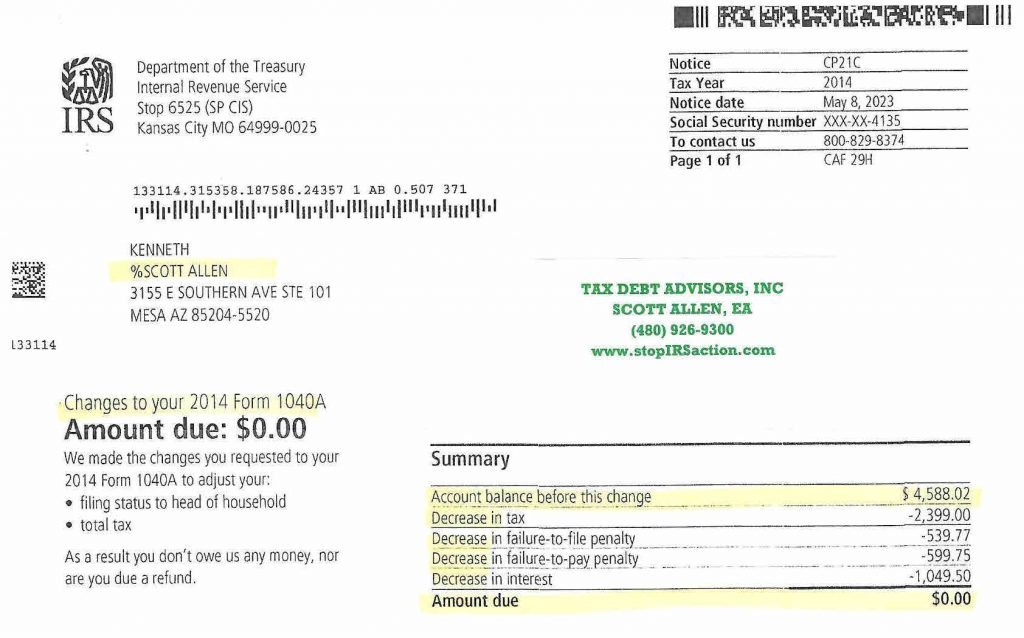

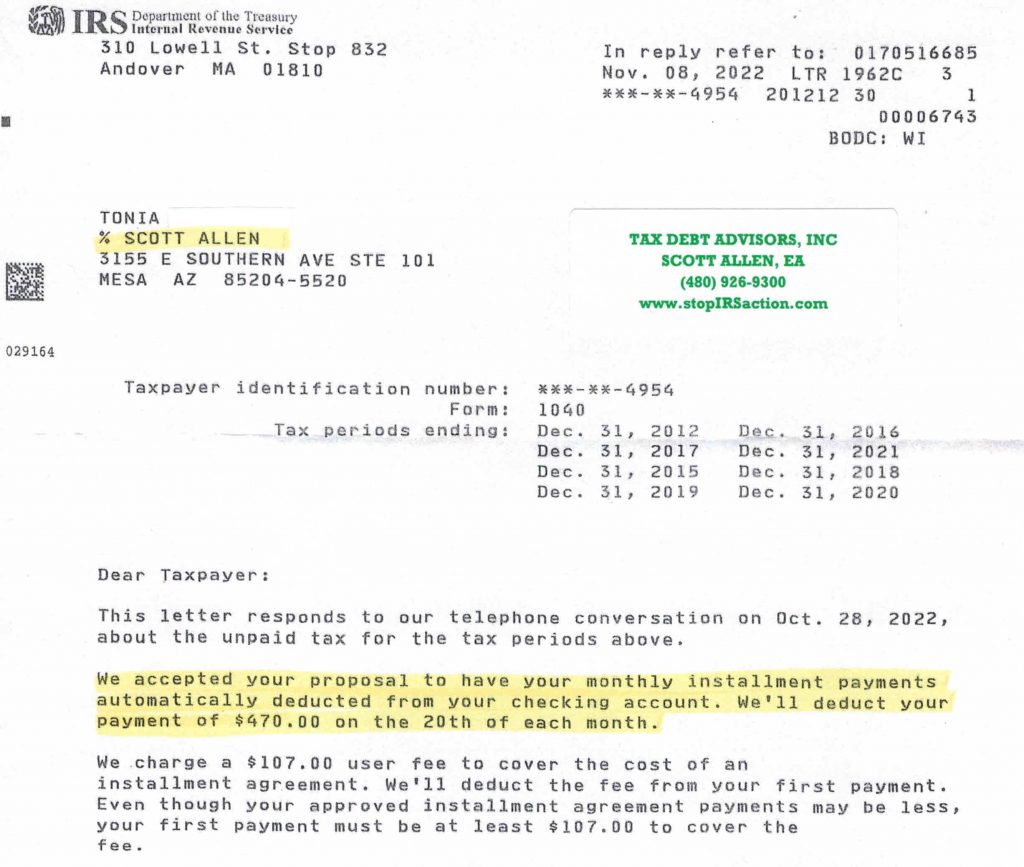

3. Proven Track Record of Success: Scott Allen EA boasts a track record of successful outcomes in helping clients navigate past due tax return situations. His history of resolving complex tax matters demonstrates his ability to comprehend intricate tax scenarios and develop effective strategies for resolution. This success record builds a strong case for entrusting one’s tax concerns to Scott’s capable hands. He can show your thousands of examples to successful cases he has handled. Below is just one example of how he helped his client Michael with some past due taxes. The IRS had him originally owing $18,631 and it was reduced to $7,809. No Tempe, AZ IRS Tax Attorney was needed for this case. Just responsive and orderly action taken by Scott Allen EA that understood Michael’s rights as a taxpayer.

4. Personalized Attention and Accessibility: One of the significant advantages of hiring Scott Allen EA is the personalized attention he provides to each client. Unlike larger law firms, where clients might get lost in the shuffle, Scott ensures that his clients’ needs are heard and addressed. This level of accessibility fosters a sense of trust and confidence, assuring taxpayers that their tax concerns are being handled with utmost care.

5. Up-to-Date Knowledge and Adaptability: Tax laws are subject to frequent changes and updates. Scott Allen EA remains committed to staying abreast of the latest developments in tax regulations. This commitment to ongoing education and awareness ensures that his clients receive advice based on the most current information. This knowledge, coupled with his adaptability, allows him to devise strategies that align with the ever-evolving tax landscape.

6. Focus on Minimizing Tax Liability: While an Tempe AZ IRS tax attorney may primarily focus on legal representation, Scott Allen EA prioritizes minimizing tax liabilities. His expertise lies in identifying deductions, credits, and potential areas for tax savings. By collaborating with him, taxpayers can not only address their past due tax returns but also gain insights into opportunities to reduce their overall tax burden.

7. Streamlined Process and Timely Resolution: Time is of the essence when dealing with past due tax returns. Scott Allen EA understands this urgency and follows a streamlined process to ensure timely resolution. His systematic approach minimizes delays and ensures that taxpayers regain compliance promptly, avoiding potential penalties and legal complications.

When faced with the decision of whether to hire a Tempe IRS tax attorney or enlist the services of Scott Allen EA for filing past due tax returns, the latter offers a compelling array of advantages. From specialized expertise and cost-effective solutions to a proven track record of success and personalized attention, Scott Allen EA’s approach is tailored to address the unique tax concerns of each individual taxpayer. By making an informed choice to collaborate with Scott Allen EA, taxpayers can navigate the complexities of past due tax returns with confidence and peace of mind. Scott is the owner and operator of Tax Debt Advisors, Inc. It has been a family business since 1977.