Queen Creek AZ IRS Settlement Help

Stacie’s Second Chance: How Family Business Tax Debt Advisors Helped Her get an IRS Settlement in Queen Creek, AZ

Do you live in Queen Creek, Arizona, and owe back taxes to the IRS? The situation can feel overwhelming, but you’re not alone. Many individuals and families struggle with tax debt, and the IRS offers various solutions to help taxpayers get back on track. Here at Family Business Tax Debt Advisors, Inc., we understand the complexities of IRS tax settlements and are dedicated to helping our clients in Queen Creek and surrounding areas find the best possible resolution.

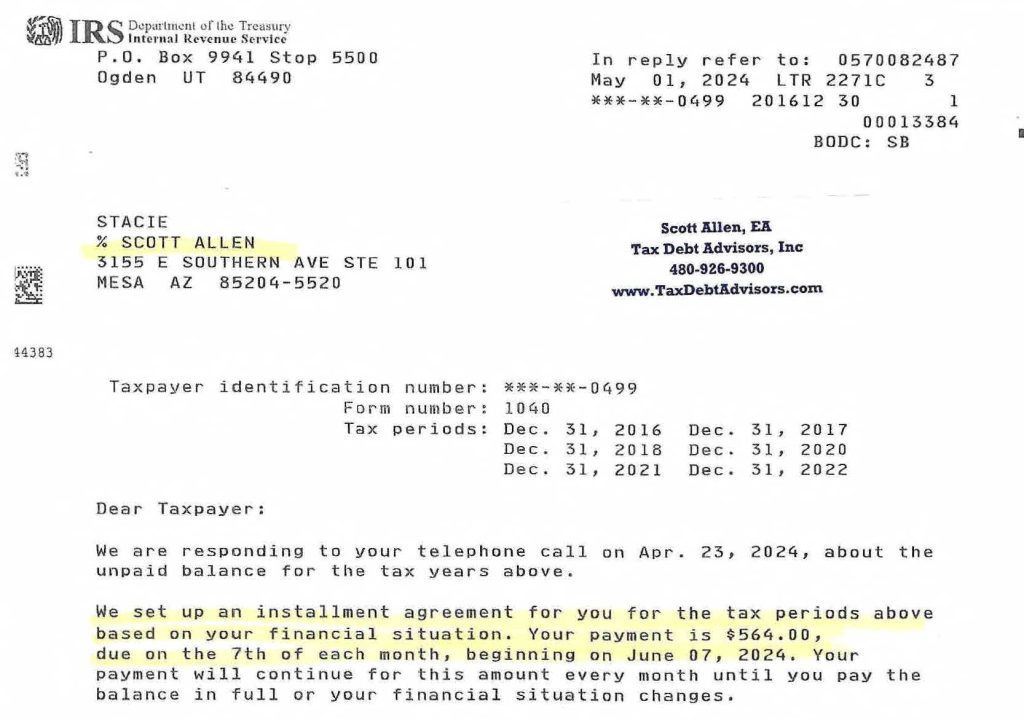

This blog post details a recent success story where we assisted Stacie, a resident of Queen Creek, AZ, in resolving her tax debt with the IRS. Stacie came to us with a significant tax burden, owing back taxes for tax years 2016 through 2022. This meant she had several years of unfiled tax returns and a hefty amount of accumulated penalties and interest.

Stacie’s case was assigned to a local IRS revenue officer in Arizona. Revenue officers are IRS representatives responsible for collecting outstanding taxes. Often, the initial contact with a revenue officer can be stressful, but it’s crucial to remember they are there to find a solution.

Understanding the Problem: Back Taxes and Penalties

Stacie’s situation was typical of many taxpayers who fall behind on filing tax returns. Life happens, and sometimes tax filing gets pushed aside. However, neglecting to file tax returns leads to serious consequences. The IRS imposes failure-to-file penalties that accrue monthly until the return is filed. Additionally, interest on unpaid taxes continues to accumulate, further increasing the overall tax debt.

The Path to Resolution: Filing Back Tax Returns and Negotiating a Settlement

At Family Business Tax Debt Advisors, Inc., we take a comprehensive approach to resolving tax debt. Our first step was to gather all of Stacie’s financial information for the relevant tax years. With this information, we meticulously prepared and filed Stacie’s delinquent tax returns. This process ensured the IRS had an accurate picture of her income and tax liability for each year.

Once the back tax returns were filed, we negotiated with the assigned IRS revenue officer on Stacie’s behalf. Our goal was to secure a manageable and affordable installment agreement for Stacie. We emphasized the financial hardship Stacie was facing and worked diligently to demonstrate her willingness to comply with a payment plan.

Positive Outcome: A Favorable Settlement for Stacie

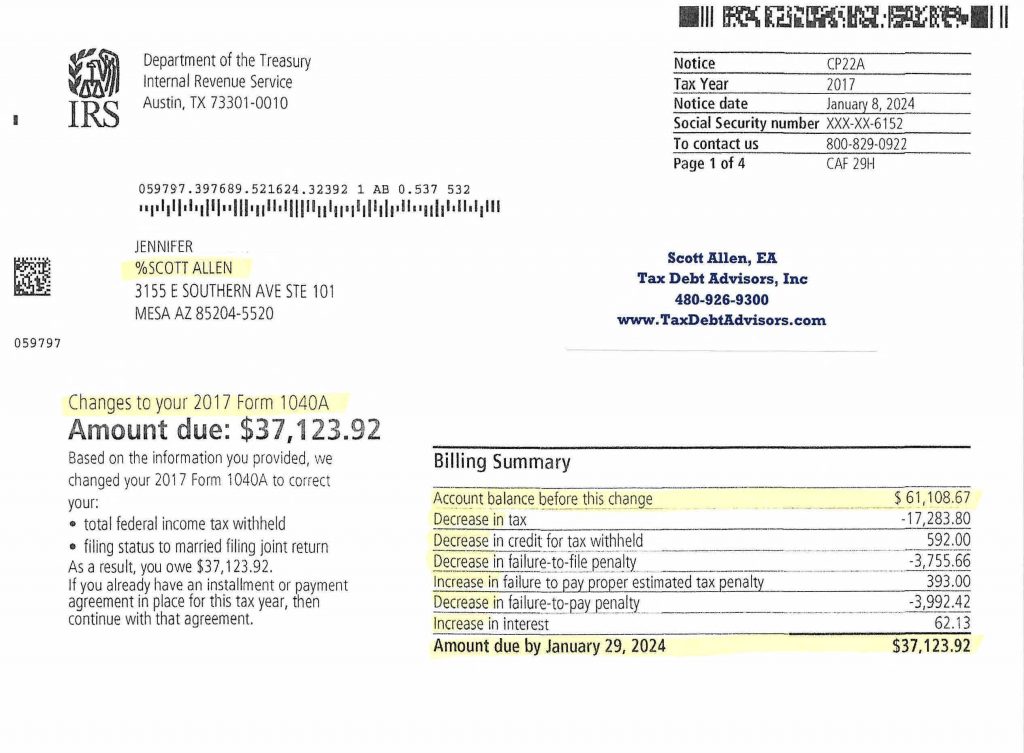

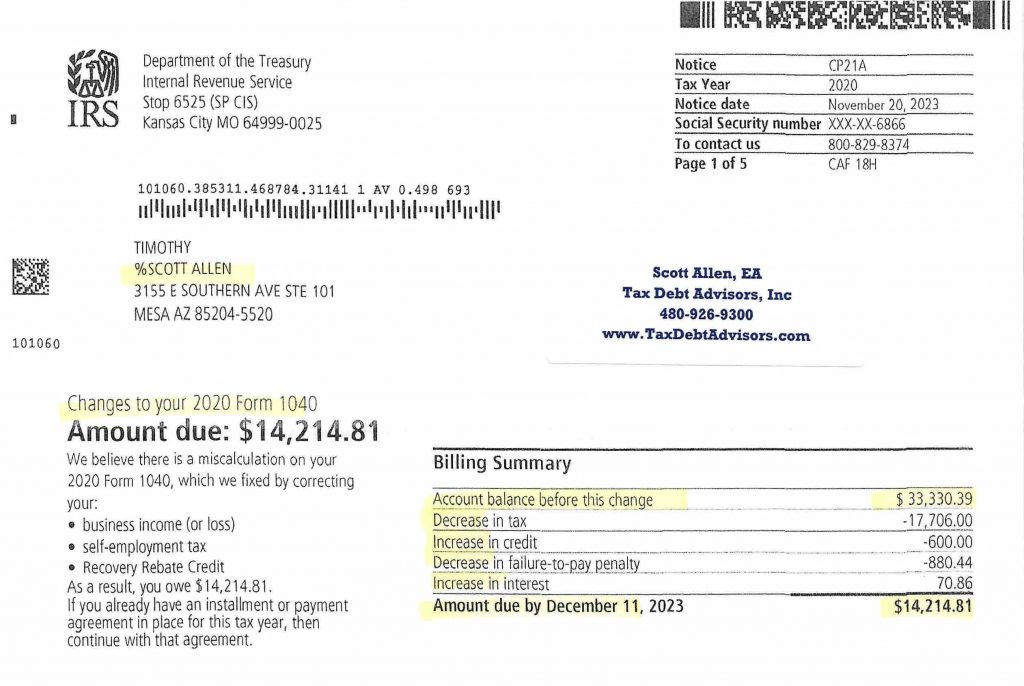

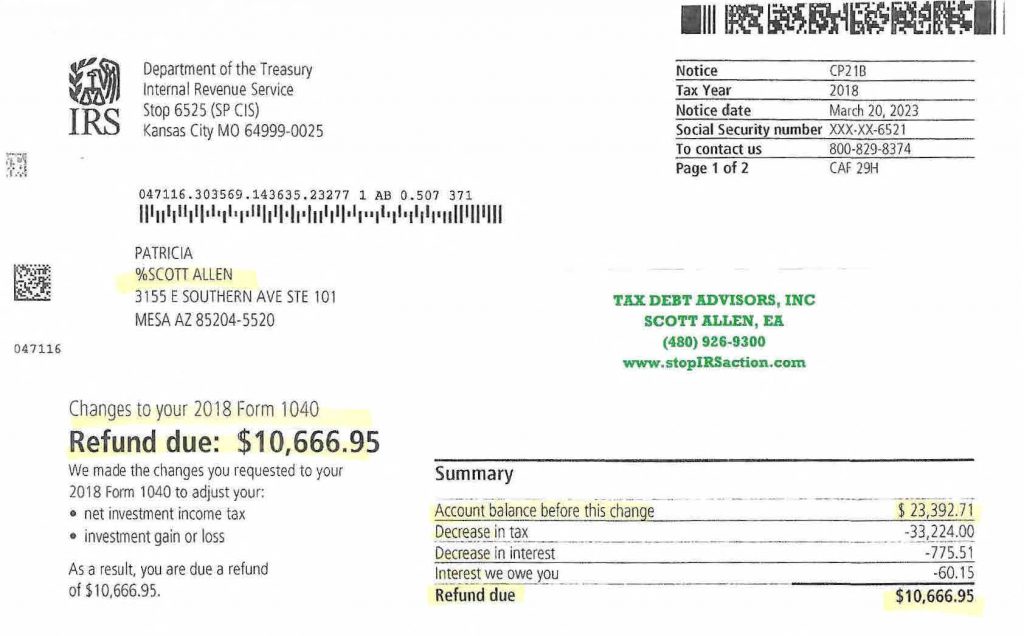

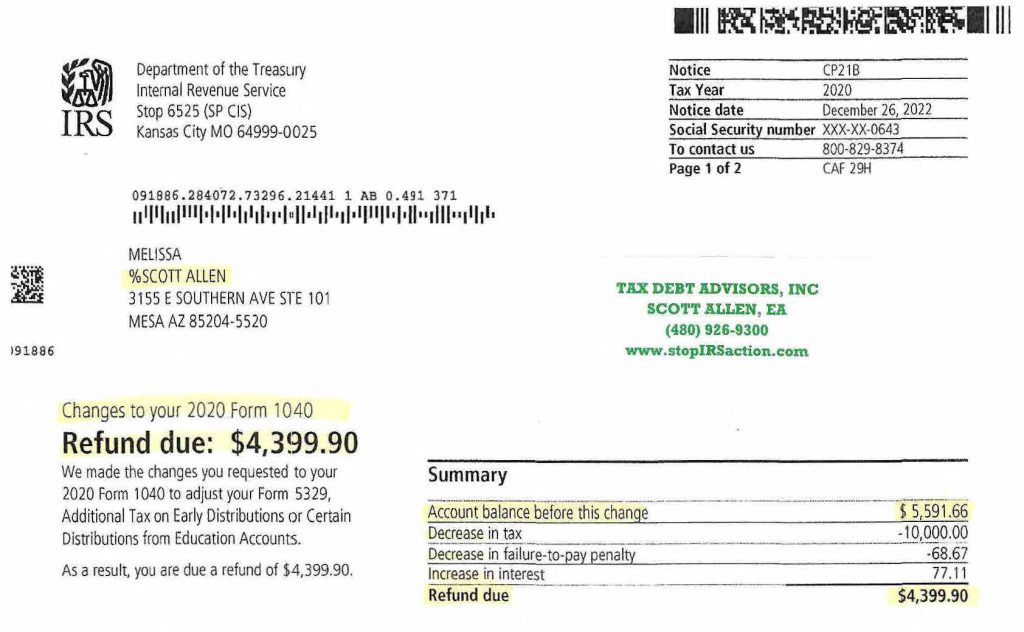

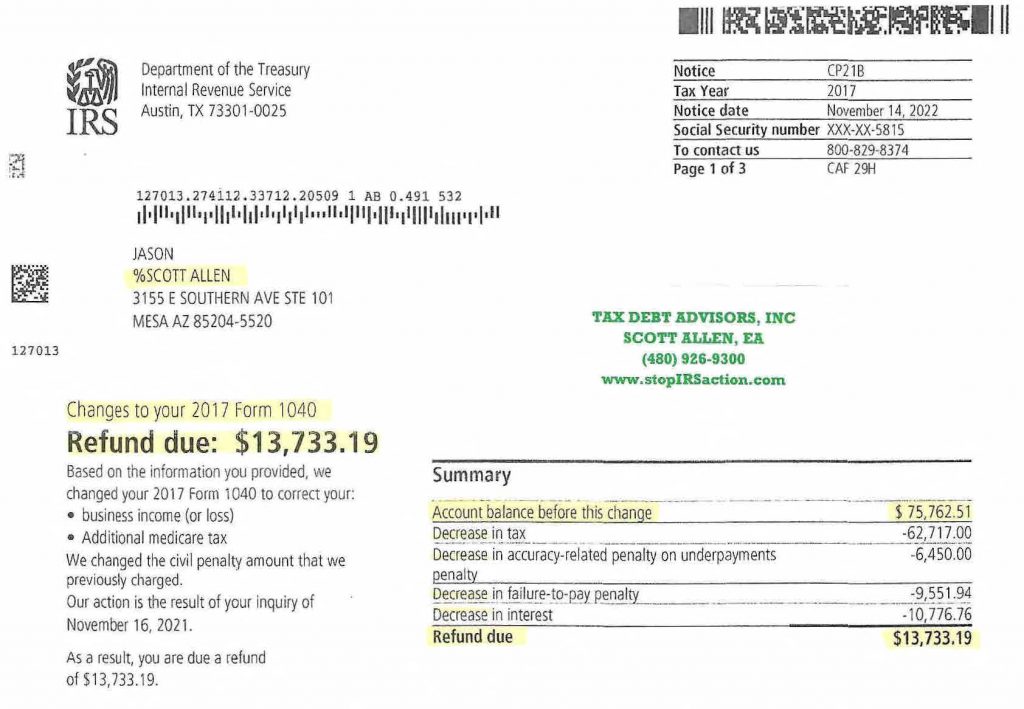

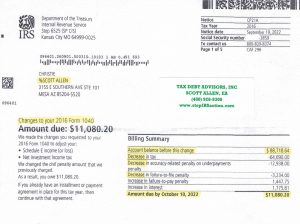

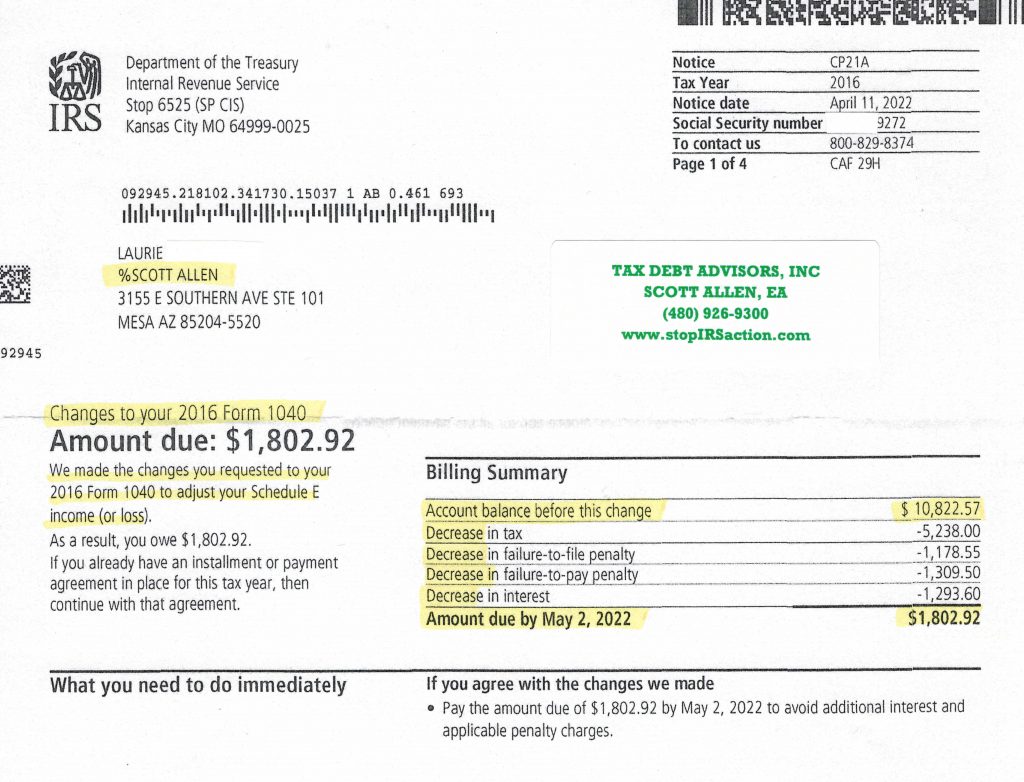

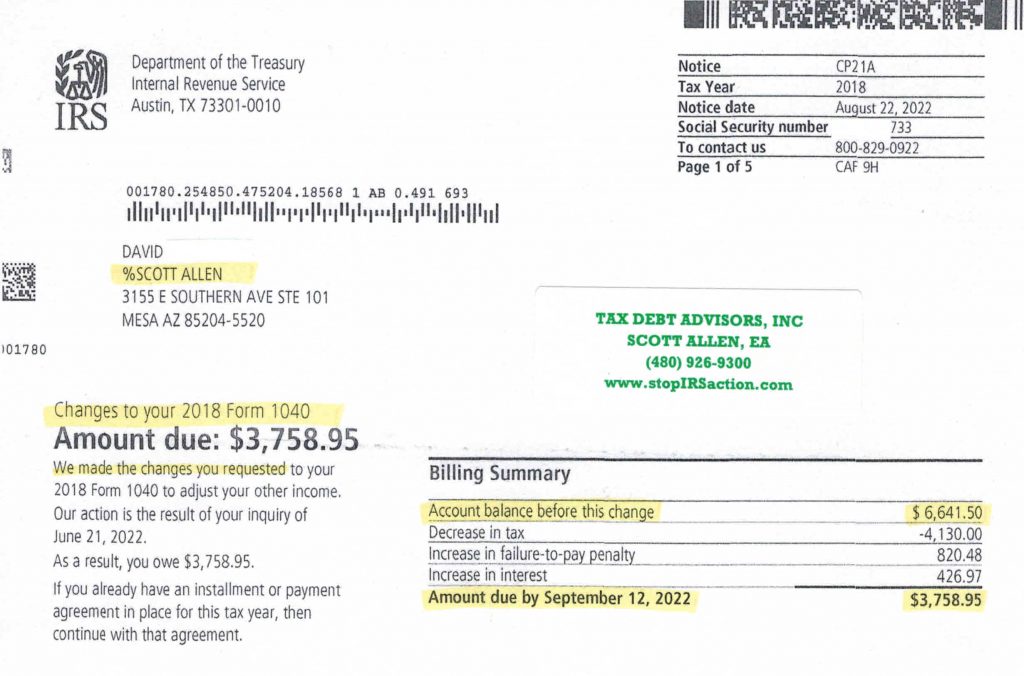

Our negotiations with the IRS revenue officer were successful. We were able to secure a favorable settlement for Stacie, resulting in a reduced tax debt and a manageable monthly payment plan of $564. This significant reduction in her monthly obligation provided Stacie with much-needed financial relief. Below is her Queen Creek AZ IRS Settlement negotiated by Scott Allen EA in her behalf.

We Can Help You Too!

Stacie’s story is a testament to the power of seeking professional help with IRS tax debt. If you live in Queen Creek, AZ, or the surrounding areas and are facing a similar situation needing IRS settlement help, family business Tax Debt Advisors, Inc. can help. We have a proven track record of successfully resolving tax debt issues for our clients and can guide you through the entire process.

Here’s what we can do for you:

- Review your tax situation: We’ll analyze your tax filings and identify any errors or missed deductions that could reduce your tax liability.

- File delinquent tax returns: We’ll take care of preparing and filing your back tax returns on your behalf.

- Negotiate with the IRS: We’ll advocate for you with the IRS and fight for the most favorable settlement possible.

- Help you stay compliant: We’ll ensure you understand your tax obligations and guide you to avoid future tax problems.

Don’t wait any longer! The longer you wait to address your tax debt, the more it will grow. Contact the family business Tax Debt Advisors, Inc. today for a free consultation. We’re here to help you find a solution to your Queen Creek AZ IRS Settlement and get back on solid financial ground.

Additional Resources:

- Internal Revenue Service (IRS): https://www.irs.gov/filing

- Family Business Tax Debt Advisors, Inc.: https://taxdebtadvisors.com/

Disclaimer:

The information contained in this blog post is for general informational purposes only and does not constitute legal or tax advice. Please consult with a qualified tax professional for personalized advice regarding your specific tax situation.