Call Scott Allen E.A. to file your IRS Audit Reconsideration in Scottsdale Arizona

IRS Audit Reconsideration in Scottsdale Arizona

If you have been audited and afterwards come across information that will substantiate your deductions, you are allowed to request an IRS audit reconsideration in Scottsdale Arizona. This procedure also applies to audits that were not attended and the IRS disallowed all deductions. An audit reconsideration can take considerable time for the IRS to review the paper work that must accompany the request.

If you have an IRS matter that you feel qualifies for an IRS audit reconsideration in Scottsdale Arizona, call Scott Allen for a free consultation. He has the expertise to file and get your tax liability reduced or eliminated through this program. Contact Scott Allen E.A. at 480-926-9300 to schedule your appointment. Scott will only take your case if it will benefit you.

Recent case:

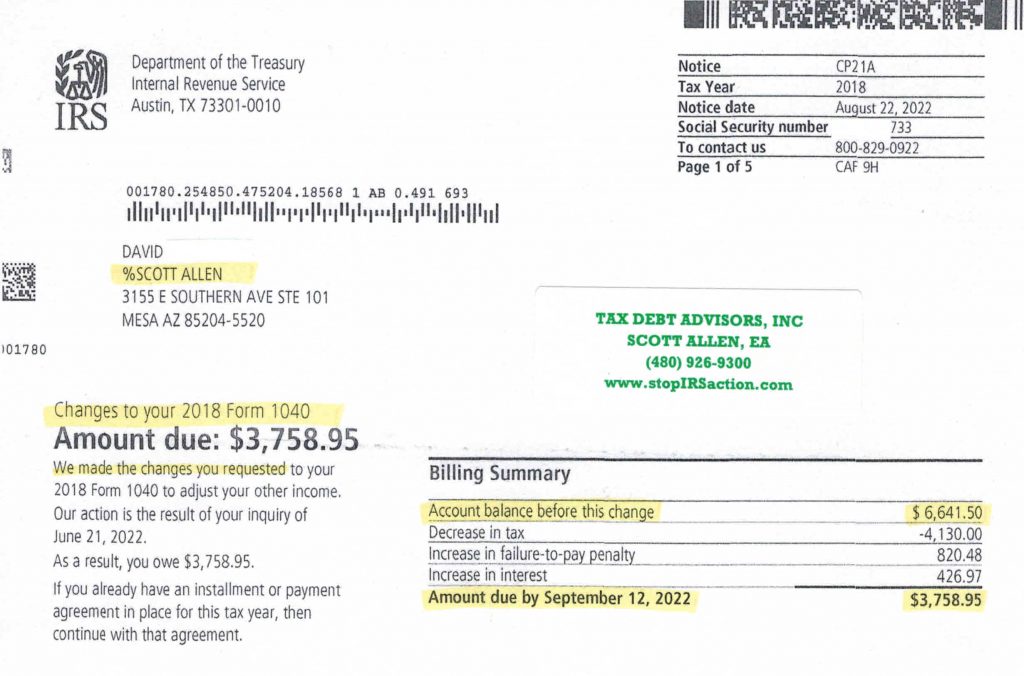

Scott Allen EA was able to assist David with his IRS audit reconsideration in Scottsdale Arizona. The IRS made an assessment against his 2018 tax return. This assessment resulted in an account balance due of $6,641.50. David had put this off and didn’t schedule an appointment to meet with Scott until 2022. After a careful review of his account and investigating the IRS records and also the taxpayers records Scott Allen EA knew he could save David some money and get the account balance reduced. He was exactly right. If you view the IRS adjustment letter below you can see that the account balance was reduced by $2,882.55. Never believe it is too late to resolve problems with the IRS. Some things are subject to a statute of limitations but many things are not. Always consult with an Enrolled Agent (E.A) if you are experiencing IRS problems.