Kimberly’s Journey to Settle IRS Debt in Mesa AZ

Kimberly’s Journey to IRS Debt Resolution: A Cautionary Tale of Choosing the Right Tax Advisor to Settle IRS Debt in Mesa AZ

Managing Mesa AZ IRS debts can be overwhelming and daunting for any individual. Kimberly found herself in such a predicament, facing unresolved back tax returns and looming IRS debts. Faced with mounting anxiety and uncertainty, she sought the expertise of Scott Allen, E.A., from Tax Debt Advisors, Inc., situated in Mesa, Arizona. Her experience sheds light on the importance of selecting a reliable tax advisor and avoiding the pitfalls of larger, out-of-state companies promising miraculous debt settlement solutions.

Kimberly’s IRS Debt Challenge

Kimberly’s tax woes were not uncommon. Unfiled tax returns and unsettled IRS debts in Mesa AZ had left her in a state of constant worry. Upon realizing the gravity of her situation, Kimberly embarked on a quest to find a solution that would alleviate her tax burden and offer a viable path to financial stability.

Choosing Scott Allen, E.A., of Tax Debt Advisors, Inc.

Amidst the myriad of options available for resolving IRS debts, Kimberly’s choice to work with Scott Allen, E.A., was pivotal. His local presence and expertise stood out among the larger, out-of-state companies bombarding her with promises of settling IRS debts for pennies on the dollar.

The Role of Scott Allen, E.A., as Kimberly’s IRS Power of Attorney

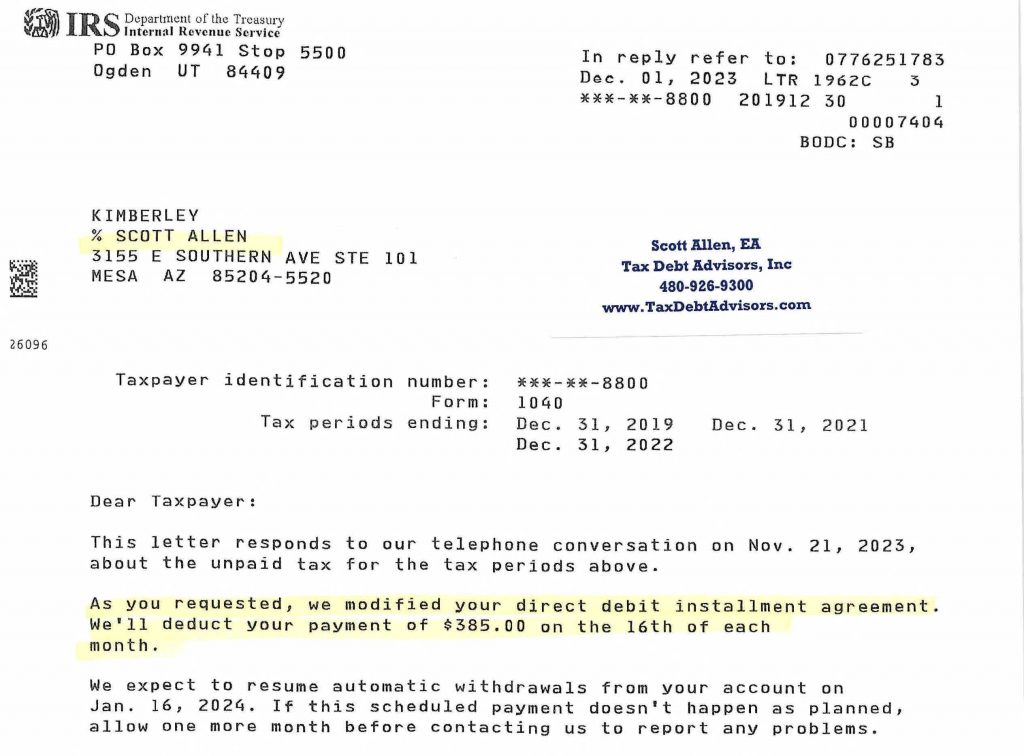

One of the key aspects that set Scott Allen apart was his role as Kimberly’s IRS Power of Attorney (form 2848). This designation allowed him to represent her before the IRS, enabling direct communication and negotiation on her behalf. Scott’s comprehensive understanding of IRS protocols and tax laws empowered him to navigate Kimberly’s case efficiently and effectively.

The Pitfalls of Out-of-State Companies Promising Unrealistic Settlements

Kimberly’s cautionary tale serves as a warning against entrusting IRS debt resolution to larger, out-of-state companies making extravagant promises of settling debts for negligible amounts. Many such companies often advertise misleadingly, claiming they can magically resolve IRS debts for pennies on the dollar. These promises, however, often fall short or lead to even more complicated and protracted situations.

Scott Allen’s Approach: Honesty, Expertise, and Realistic Solutions

Scott Allen, E.A., took a methodical and realistic approach to Kimberly’s case. Instead of making lofty promises, he offered a transparent and structured plan. His expertise and local presence allowed him to understand Kimberly’s specific circumstances and devise a tailored strategy to resolve her IRS debts.

Settlement of IRS Debt: A Low $385 Monthly Payment Plan

Scott’s diligent efforts culminated in a favorable resolution for Kimberly. By negotiating directly with the IRS, he managed to secure a settlement that significantly eased Kimberly’s financial burden. The outcome—a manageable $385 monthly payment plan—highlighted the efficacy of a well-thought-out approach led by a knowledgeable and dedicated tax advisor.

Warning to Taxpayers: Beware of Unrealistic Claims by Out-of-State Companies

Kimberly’s experience serves as a stark reminder for taxpayers to exercise caution when considering services from large, out-of-state companies claiming they can settle IRS debts in Mesa AZ unrealistically. Choosing a local, qualified tax advisor like Scott Allen, E.A., provided Kimberly with personalized attention, expertise, and a realistic resolution plan that aligned with her financial situation.

Conclusion: Choosing Wisely for IRS Debt Resolution

Resolving IRS debts requires a strategic and informed approach. Kimberly’s success story with Scott Allen, E.A., emphasizes the importance of selecting a trustworthy and knowledgeable tax advisor. Opting for local expertise over flashy, out-of-state promises can make a world of difference in achieving a feasible and sustainable resolution to IRS debt challenges.

In conclusion, Kimberly’s journey to resolving her IRS debts underscores the significance of making informed decisions when selecting a tax advisor. Scott Allen, E.A., exemplified the qualities of a reliable professional, steering Kimberly toward a manageable solution without succumbing to unrealistic promises. Taxpayers navigating similar challenges should heed this cautionary tale and seek qualified local professionals for their IRS debt resolution needs.

For individuals like Kimberly, finding the right tax advisor can be a game-changer in their quest for financial stability and peace of mind amidst IRS debt concerns. It’s crucial to approach this task with care, diligence, and an understanding of the pitfalls to avoid when selecting a tax advisor.

Remember, the road to IRS debt resolution may be challenging, but with the right guidance from a qualified professional like Scott Allen, E.A., it’s possible to achieve a favorable outcome that aligns with your financial situation and sets you on the path to a brighter financial future. Call Scott today at 480-926-9300.