Tax Attorney Cost

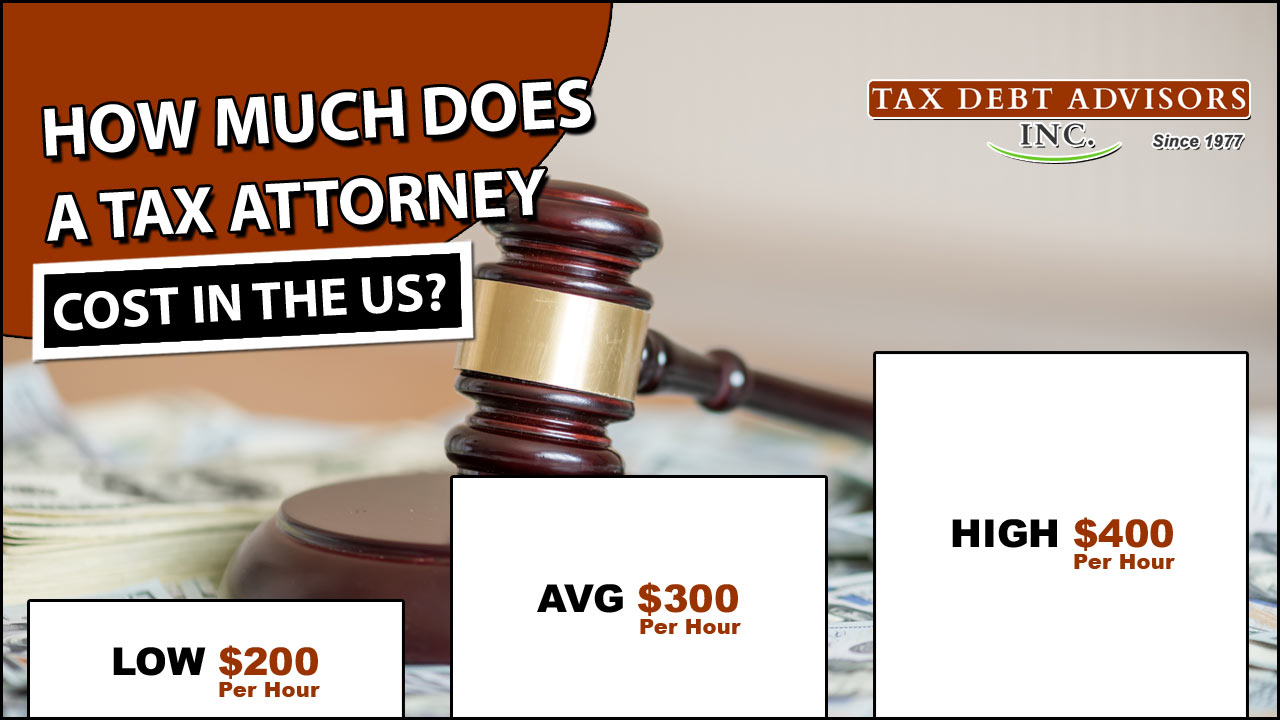

How Much Does a Tax Attorney Cost?

On average, a tax attorney costs about $300 per hour with average tax lawyer fees ranging from $200 to $400 in the US for 2019. However, hiring an experienced tax attorney that works in a large firm can cost you upwards of $1,000 per hour.

Average Tax Lawyer Fees

According to Cross Law Group, “Tax attorneys generally charge either an hourly rate or a flat fee for their services. Hourly Rate: The majority of tax attorneys charge by the hour. Every attorney will charge a different hourly rate, but most rates are between $200 to $400 per hour.“

Hiring a tax attorney for installment agreements with cost an average of $1,250 with average prices ranging from $750 to $1,500. Offers in Compromise cost an average of $5,000 with average fees ranging from $3,500 to $6,500. For a simple IRS audit you can expect to pay a tax lawyer anywhere from $2,000 to $3,500 while a complex audit can cost $5,000 or more. Penalty Abatement costs an average of $1,750 with average fees ranging from $1,000 to $2,500. IRS Appeals with cost anywhere from $5,000 to $7,500 and Tax Court Litigation will cost upwards of $10,000 or more. *Disclaimer – These our not the actual cost of our Tax Debt Advisory services. Contact Tax Debt Advisors to get an actual quote for the IRS help you need.

Do I Need a Tax Attorney?

Believe it or not, you actually don’t have need a tax attorney to settle IRS debt. Instead why not hire a Tax Debt Advisor who can do the same thing as a tax lawyer, and who has been helping customers dealing with tax issues since 1977. Scott Allen E.A. from Tax Debt Advisors has helped over 108,000 people settle their problems with the IRS and can help guide you through any tax situation you may be dealing with. Avoid paying the high cost of hiring a tax attorney when you don’t need one and save money by hiring a tax debt advisor today!

Settle Debt With Tax Debt Advisors

Need help with wiping out your old tax debt? Tax Debt Advisors has helped resolve over 108,000 debts. Receive a tax debt consultation today by giving Scott a call today at 480-926-9300. Tax Debt Advisors can help negotiate an offer in compromise on your behalf to finally settle your tax debt.

We can also help with:

- IRS Tax Debt

- IRS Tax Problems

- IRS Help

- Offers-in-Compromise

- Filing Back Taxes

- Bankruptcy Filing

- IRS Wage Garnishment

- Tax Debt Settlement

- IRS Tax Audits

- Property tax issues

- Offers-in-Compromise

- Business Tax Issues

- Installment Agreements

- IRS Liens & Tax Levies

- Tax Audit Defense

- Income Tax Preparation