Help You File Back Tax Returns and Settle Your Mesa AZ IRS Debts

How We Can Help You File Back Tax Returns and Settle Your Mesa AZ IRS Debts

Taxation is an essential aspect of every citizen’s financial responsibility. Filing tax returns and paying taxes on time is not only a legal obligation but also a crucial element in maintaining good financial health. However, life’s complexities can sometimes lead individuals to miss filing their tax returns or fail to meet their tax obligations, resulting in tax debt. When you find yourself in such a situation, it’s essential to seek professional assistance to get your finances back on track.

Tax Debt Advisors, Inc., located in Mesa, Arizona, is a firm specializing in helping individuals and businesses resolve their tax debt issues, including filing back tax returns and settling IRS debts. In this comprehensive blog, we will explore the services offered by Tax Debt Advisors and discuss the various options available to you when dealing with tax debt.

-

Understanding the Importance of Filing Back Tax Returns

Filing your tax returns is not something to be taken lightly. It is an essential responsibility that allows the government to determine your tax liability accurately. Failing to file your tax returns can lead to severe consequences, including:

a. Penalties and Interest: The IRS imposes penalties and interest on the unpaid taxes, making your tax debt grow significantly over time.

b. Legal Consequences: Not filing tax returns is a violation of the law and can lead to criminal charges and legal actions.

c. Loss of Refunds: If you’re entitled to a tax refund, not filing your returns means you won’t receive the money you’re owed.

d. Damage to Your Financial Health: Unresolved tax debt can negatively impact your credit report and financial stability.

-

The Role of Tax Debt Advisors, Inc.

Tax Debt Advisors, Inc. in Mesa AZ is a professional tax resolution firm dedicated to helping individuals and businesses address their tax issues efficiently. Their team of experts in tax law and finance work with clients to:

a. Assess the Situation: Tax Debt Advisors begins by evaluating your financial circumstances, including outstanding tax debt and unfiled tax returns.

b. File Back Tax Returns: If you have unfiled tax returns, Tax Debt Advisors will assist you in gathering the necessary documents and completing the returns for each year you missed.

c. Negotiate with the IRS: Once your returns are filed, the firm will communicate with the IRS on your behalf. They can help you negotiate a manageable payment plan or explore other tax resolution options.

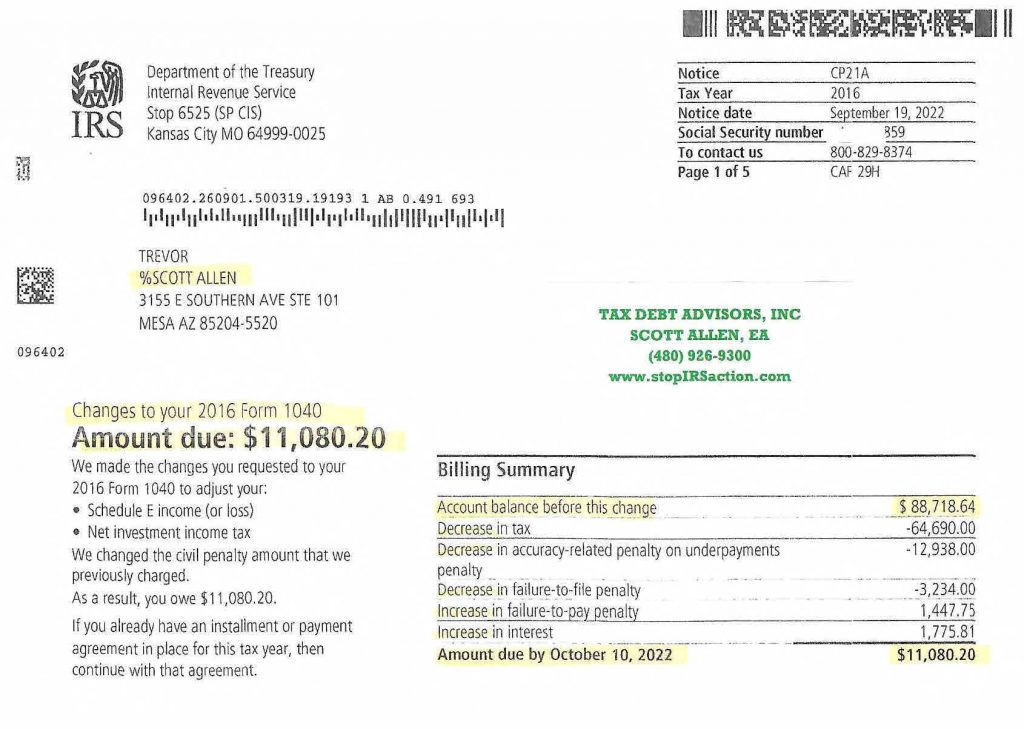

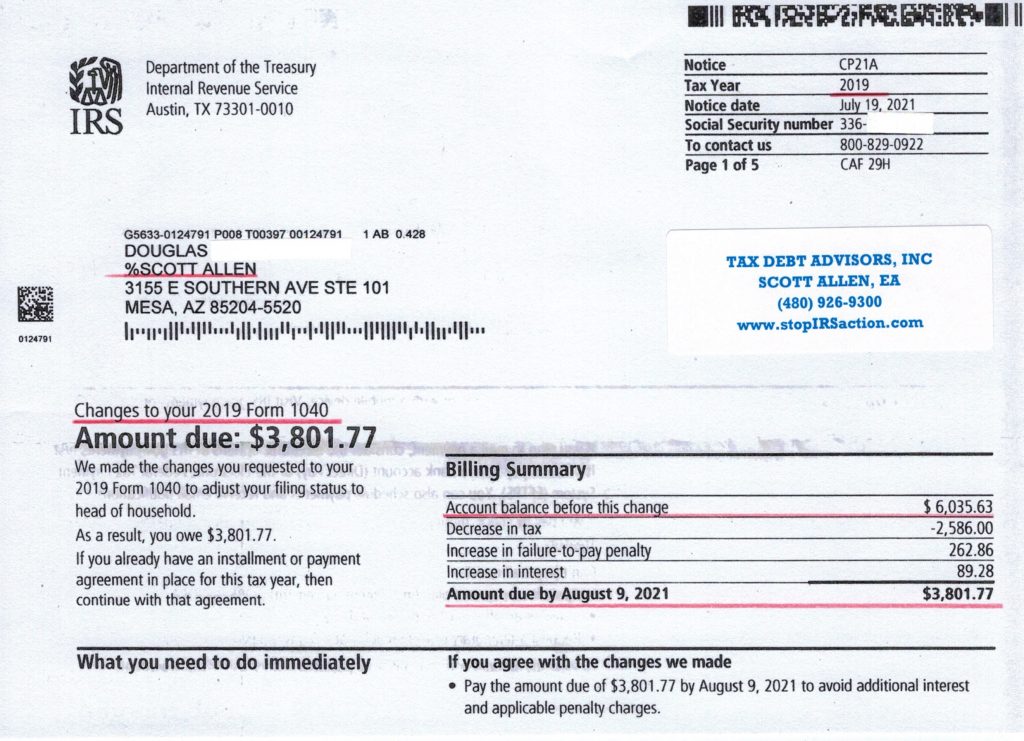

d. Minimize Penalties and Interest: Tax Debt Advisors can work with the IRS to reduce or eliminate penalties and interest on your tax debt (if you qualify), potentially saving you a significant amount of money.

-

Options for Dealing with IRS Tax Debt

Tax Debt Advisors, Inc. offers several options to help you deal with your Mesa AZ tax debt, depending on your unique situation and financial capabilities. Let’s explore these options:

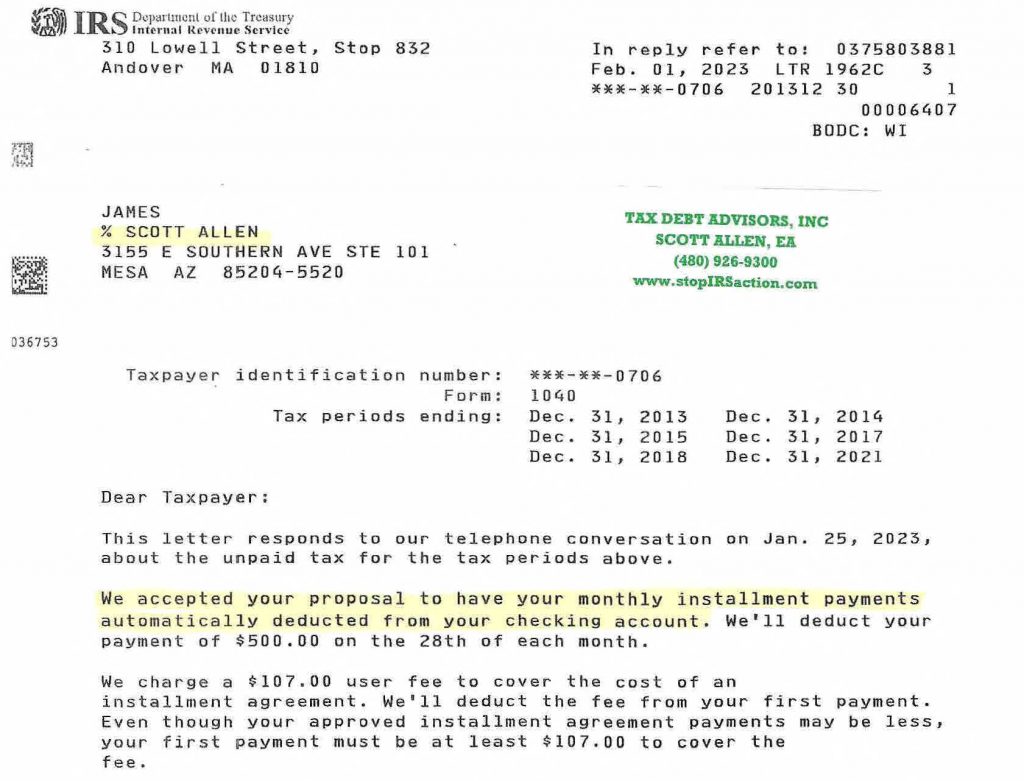

a. Installment Agreements: An installment agreement allows you to pay your tax debt over time in smaller, more manageable monthly installments. Tax Debt Advisors can help you negotiate the terms of the agreement with the IRS.

b. Offer in Compromise (OIC): An OIC is a settlement agreement that allows you to pay the IRS a reduced amount to clear your tax debt. Tax Debt Advisors can assist you in preparing and submitting an OIC that has the best chance of being accepted.

c. Innocent Spouse Relief: If you filed a joint return with your spouse, and they failed to report their income or underreported their income, you may qualify for innocent spouse relief. Tax Debt Advisors can help you navigate this process.

d. Penalty Abatement: Tax Debt Advisors can work with the IRS to reduce or eliminate penalties and interest on your tax debt if you can demonstrate reasonable cause for your failure to pay or file on time.

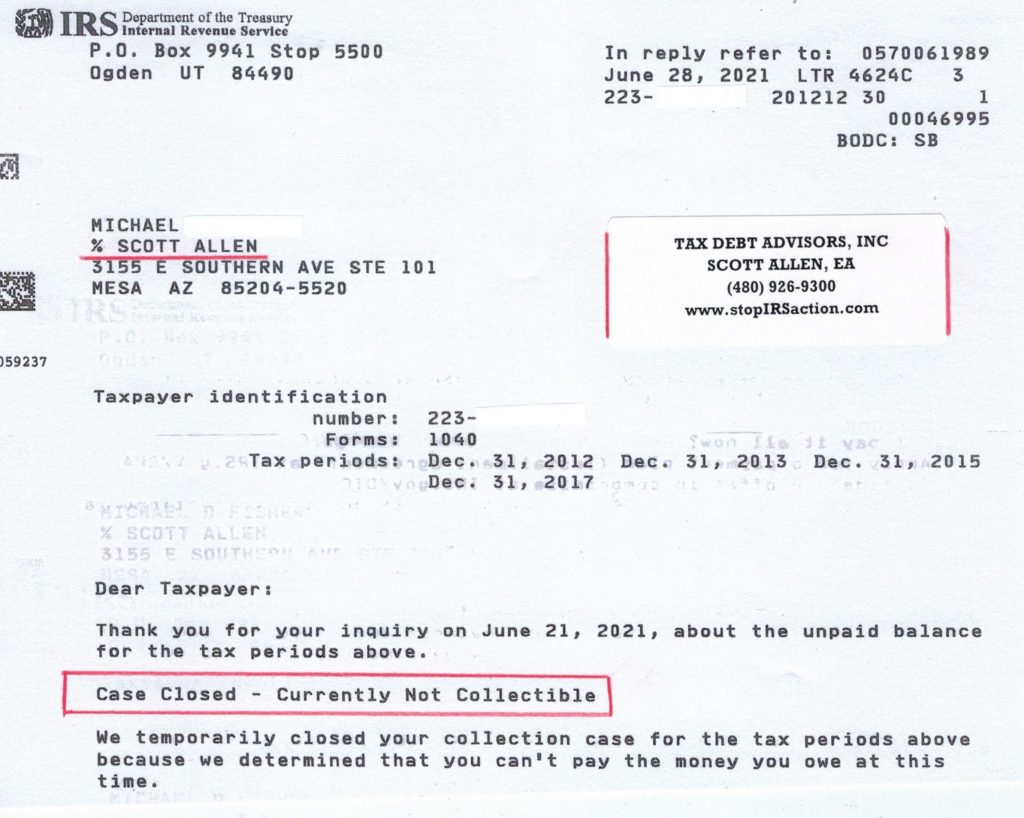

e. Currently Not Collectible (CNC) Status: If you are facing financial hardship and cannot afford to pay your tax debt at the moment, Tax Debt Advisors can help you apply for CNC status, temporarily suspending IRS collection efforts until your financial situation improves.

f. Bankruptcy: In some cases, bankruptcy may be an option to deal with tax debt. Tax Debt Advisors can provide guidance on whether bankruptcy is a viable solution for your specific circumstances.

g. Tax Liens and Levies: If the IRS has placed a tax lien on your property or is threatening wage garnishment or bank levies, Tax Debt Advisors can work to release the lien or negotiate with the IRS to prevent further collection actions.

-

The Process of Working with Tax Debt Advisors

When you decide to work with Tax Debt Advisors in Mesa AZ to address your tax debt, you can expect a structured process that aims to provide the best resolution for your situation:

a. Free Consultation: The first step is to schedule a free consultation with Tax Debt Advisors. During this consultation, you’ll discuss your tax debt, financial situation, and goals with a tax professional.

b. Document Gathering: You’ll be asked to provide necessary financial documents, such as tax returns, income statements, and expenses. This information will be used to assess your eligibility for various tax resolution options.

c. Analysis and Strategy Development: Tax Debt Advisors will carefully evaluate your financial information to develop a tailored strategy to resolve your tax debt. This may include filing back tax returns, negotiating with the IRS, and exploring the most suitable resolution options.

d. Negotiation and Implementation: Once a strategy is in place, Tax Debt Advisors will negotiate with the IRS on your behalf to secure the best possible outcome. They will handle all communication with the IRS, allowing you to focus on your financial stability.

e. Resolution and Compliance: As your tax debt situation is resolved, you will be guided on how to remain compliant with your tax obligations moving forward. This ensures that you do not find yourself in a similar situation in the future.

-

Benefits of Working with Tax Debt Advisors, Inc.

Choosing to work with Tax Debt Advisors offers several benefits that can significantly improve your financial situation:

a. Expertise: The team at Tax Debt Advisors includes professionals experienced in tax delinquencies and financial management, ensuring that you receive knowledgeable and effective guidance. It is a local family owed company.

b. Reduced Stress: Dealing with the IRS and tax debt issues can be stressful. Tax Debt Advisors handle the complexities, allowing you to focus on your daily life.

c. Tailored Solutions: The firm provides personalized solutions that take into account your unique financial situation and goals.

d. Reduced Financial Burden: By minimizing penalties and interest and negotiating favorable settlement options, Tax Debt Advisors can save you money in the long run.

e. Legal Protection: Working with tax professionals ensures that you have the right legal protection and representation in dealings with the IRS.

-

Real Success Stories

To illustrate how Tax Debt Advisors, Inc. has helped individuals and businesses in Mesa, Arizona, let’s take a look at a couple of real success stories.

Case 1: John’s Back Taxes Resolved

John, a small business owner, had fallen behind on his taxes due to a difficult year for his company. He owed a substantial amount to the IRS and was facing financial hardship. Tax Debt Advisors helped John file his back taxes and negotiate a favorable installment agreement with the IRS. This allowed him to make affordable monthly payments and maintain his business operations while settling his tax debt over time. With the assistance of Tax Debt Advisors, John regained control of his finances and avoided severe penalties and legal consequences.

Case 2: Sarah’s Offer in Compromise Accepted

Sarah was a single mother struggling with a substantial tax debt from a previous business venture. Her income was limited, and she couldn’t afford to pay the full amount she owed. Tax Debt Advisors worked with Sarah to prepare and submit an Offer in Compromise, requesting a reduced settlement amount. After careful negotiation and documentation, the IRS accepted the offer, allowing Sarah to pay a significantly reduced sum to clear her tax debt. With this resolution, Sarah was able to move forward with her life and focus on providing for her family.

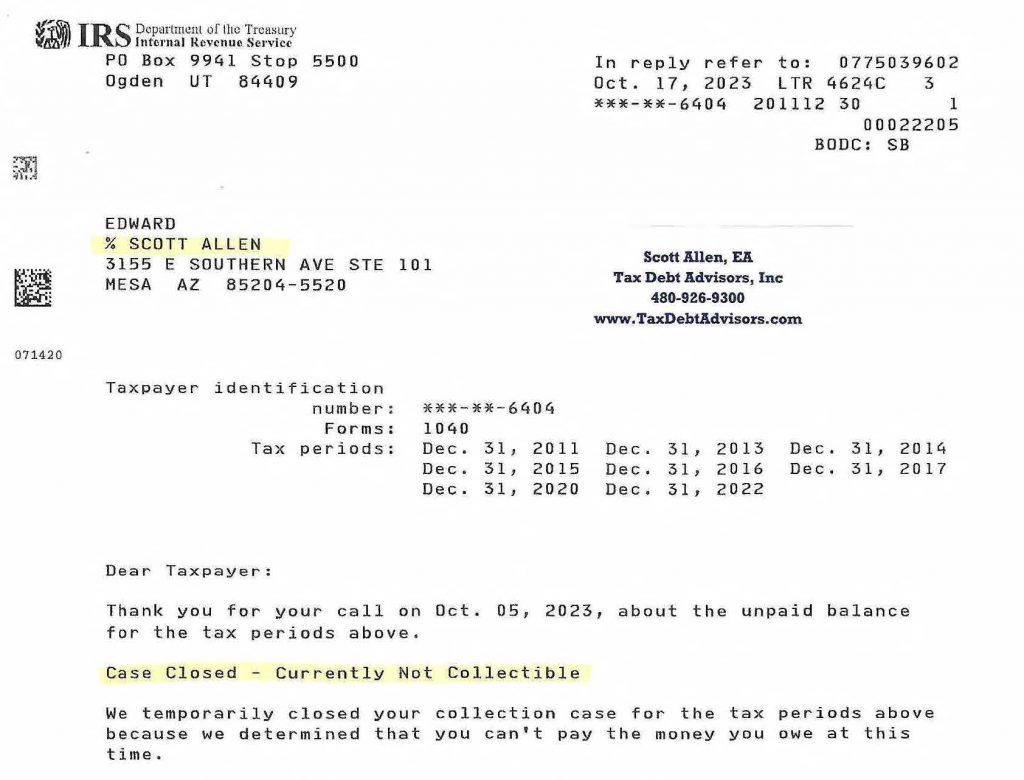

Case 3: Edward’s Currently Non Collectible Ctatus Accepted

Edward was a struggling taxpayer who owed the IRS over $50,000 for multiple years. Based upon a detailed evaluation of his current financial status, Scott Allen EA with Tax Debt Advisors negotiated all of the years into the currently non collectible status. With this agreement Edward does not have to make ANY payments on his back taxes owed. He is bacially settling all of his back tax debt for $0.00. He is just going to let the statute of limitation run out and let the debts expire. See his approval letter below.

-

Common Questions About Tax Debt Advisors

Let’s address some common questions individuals may have about working with Tax Debt Advisors, Inc.

Q1: How much does it cost to hire Tax Debt Advisors?

A1: Tax Debt Advisors offers a free initial consultation to assess your situation. They will then provide a clear and transparent fee structure based on the complexity of your case and the services required. The cost is discussed upfront, and there are no hidden fees.

Q2: How long does the tax resolution process take?

A2: The duration of the tax resolution process can vary depending on the complexity of your case, the specific resolution option chosen, and the responsiveness of the IRS. While some cases can be resolved relatively quickly, others may take several months or even a year to reach a resolution.

Q3: Can Tax Debt Advisors help with state tax debt?

A3: Yes, Tax Debt Advisors can assist with both federal and state tax debt issues. They have experience working with various state tax agencies to help individuals and businesses resolve their state tax debt.

Q4: What happens if I don’t address my tax debt?

A4: Ignoring your tax debt can lead to severe consequences, including legal action, wage garnishment, bank levies, and property liens. It’s crucial to address tax debt issues promptly to avoid these negative outcomes.

-

Conclusion

Tax debt can be a daunting and overwhelming issue, but it’s one that can be effectively addressed with the right assistance. Tax Debt Advisors, Inc., located in Mesa, Arizona, provides the expertise and guidance needed to file back tax returns, negotiate with the IRS, and settle tax debt through various resolution options.

Whether you’re an individual facing a personal tax debt crisis or a business struggling to meet your tax obligations, Tax Debt Advisors can develop a customized strategy to help you achieve financial stability and resolve your tax debt efficiently. Don’t let tax debt hold you back or lead to legal consequences. Seek professional help and take control of your financial future with Tax Debt Advisors, Inc.

By working with experienced professionals like Tax Debt Advisors, you can regain your peace of mind and move forward with confidence, knowing that your tax debt is being addressed effectively and in a manner that’s aligned with your unique financial situation and goals.