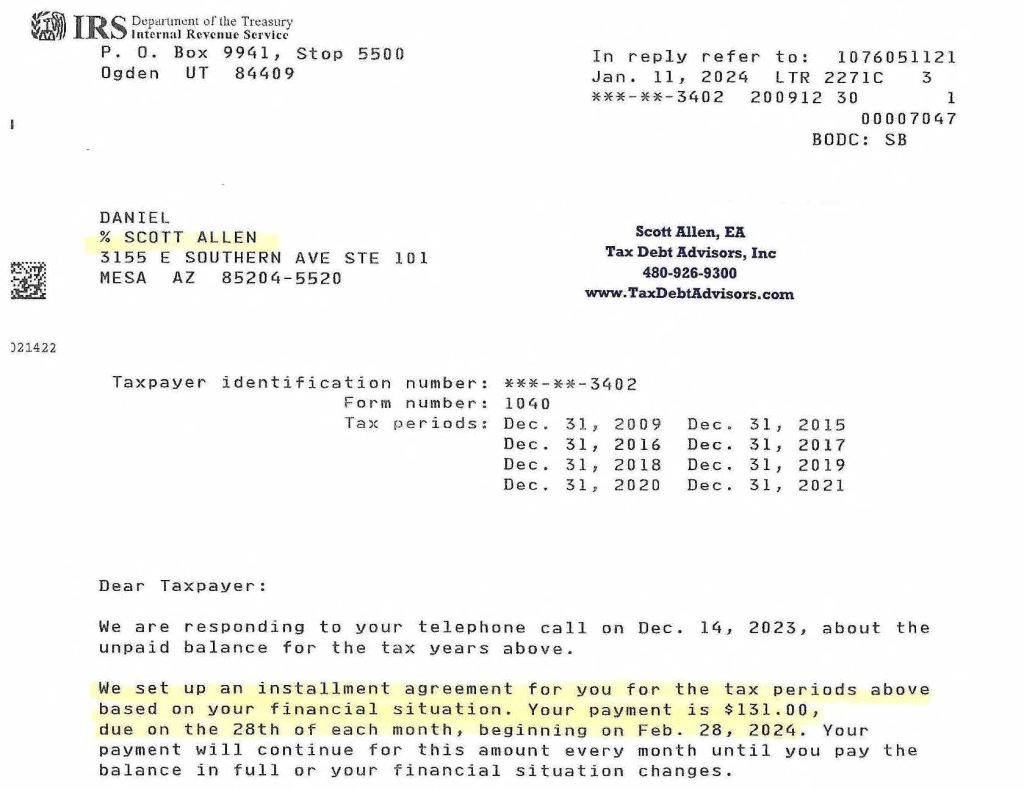

Daniel’s Payment Plan for Mesa AZ IRS Settlement

Finding Relief: How Tax Debt Advisors, Inc. Settled Mesa Resident’s 8 Years of Back Taxes

Tax season can be stressful for everyone, but imagine facing the burden of unfiled tax returns for years on end. This was the reality for Daniel, a Mesa, Arizona resident and father of three, who found himself drowning in a sea of back taxes desperately needed a Mesa AZ IRS Settlement. For eight long years, the weight of unaddressed tax debt loomed large, casting a shadow over his financial security. Fortunately, Daniel discovered Tax Debt Advisors, Inc., a local Mesa firm specializing in helping taxpayers navigate the complexities of IRS issues.

This blog post delves into Daniel’s story, highlighting how Tax Debt Advisors, Inc. secured him a favorable settlement with the IRS, offering a beacon of hope for Mesa residents facing similar challenges. We’ll explore the intricate world of unfiled back taxes, settlement options, and the importance of seeking local expertise when dealing with the IRS.

The Maze of Unfiled Back Taxes

Failing to file tax returns, even unintentionally, can lead to a snowball effect of penalties and interest accumulating over time. The IRS takes unfiled returns seriously, and the consequences can be significant. Late filing penalties can be as high as 25% of the unpaid tax liability, and late payment penalties can add another 1% per month, on top of accruing interest. This can quickly compound the original tax debt, making it even more difficult to manage.

Understanding Your Options: Key to Finding Relief

Thankfully, the IRS offers various solutions for taxpayers facing back tax burdens. These include:

- Filing Delinquent Returns: The first step is to file all outstanding tax returns. Tax Debt Advisors, Inc. can guide you through this process, ensuring accuracy and maximizing deductions to minimize your tax liability.

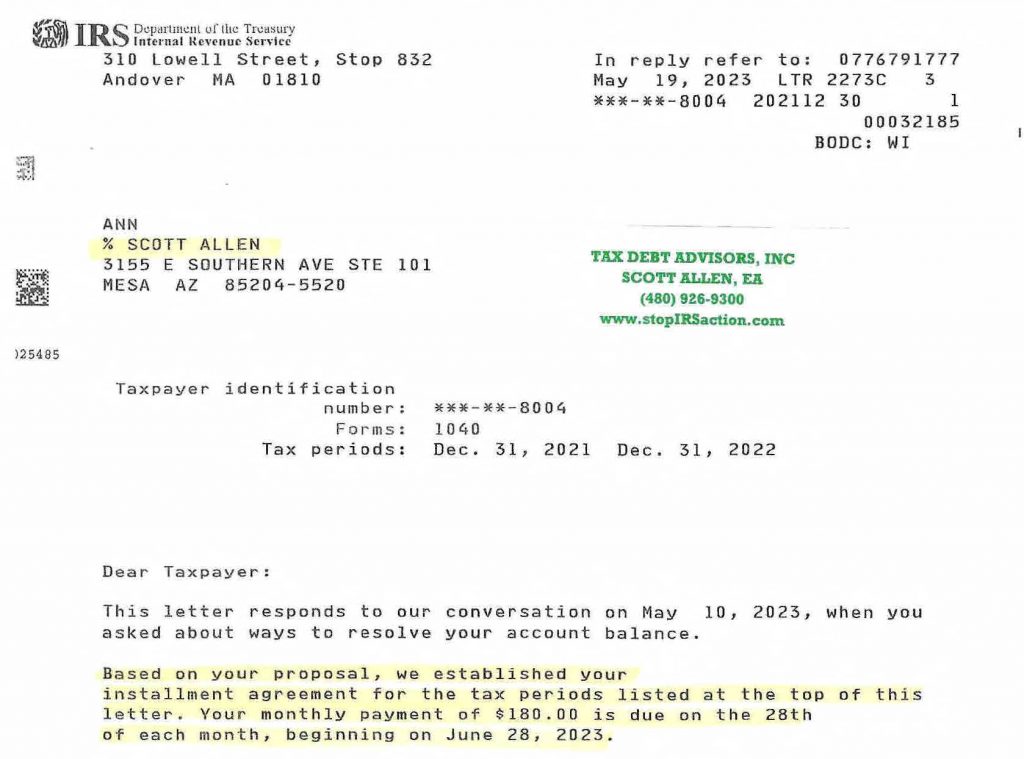

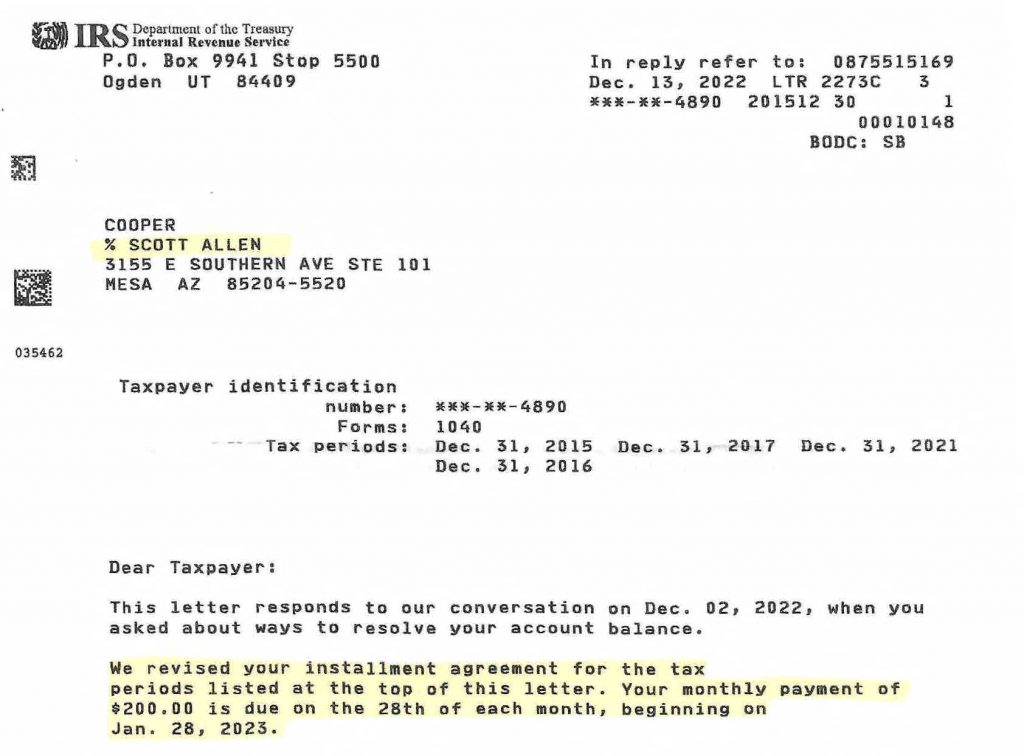

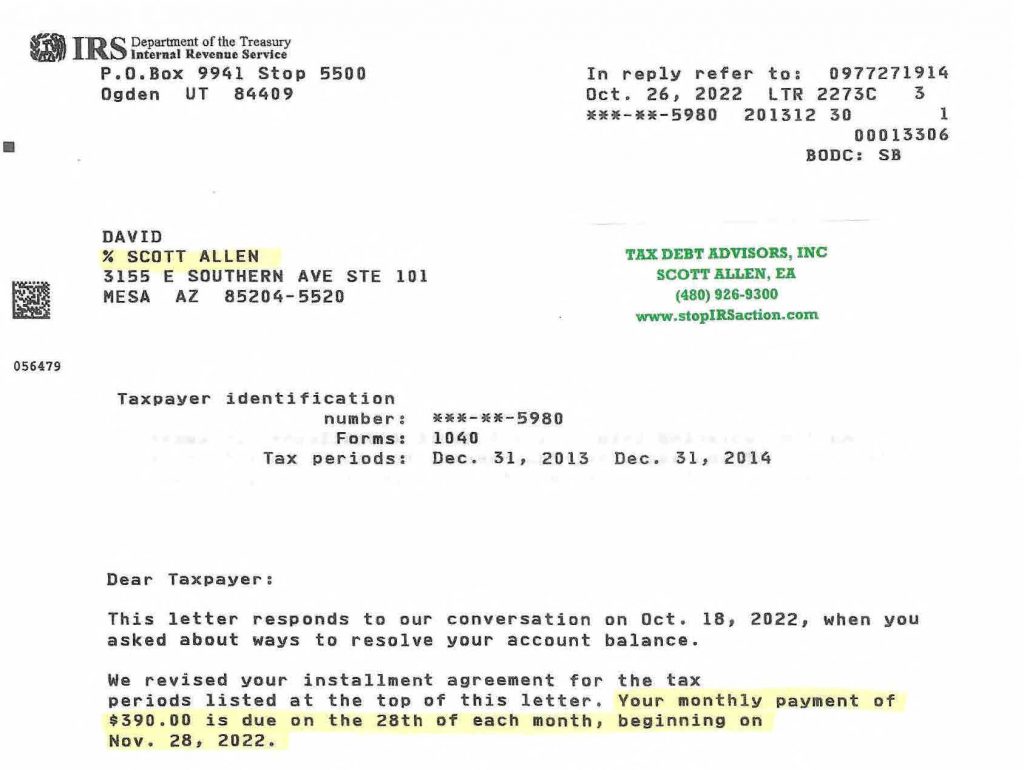

- Payment Plans: The IRS allows taxpayers to establish installment agreements to pay off back taxes in manageable monthly installments. Tax Debt Advisors, Inc. can negotiate these plans on your behalf, advocating for a low monthly payment that fits your financial situation.

- Offers in Compromise (OIC): An OIC allows you to settle your tax debt for a lump sum payment significantly lower than the total amount owed. Qualifying for an OIC requires a financial hardship demonstration. Tax Debt Advisors, Inc. can assess your eligibility and handle the entire OIC application process.

The Power of Local Expertise: Tax Debt Advisors, Inc. to the Rescue

While national 1-800 companies may advertise IRS settlements, their success rates can be underwhelming. These impersonal services often lack the in-depth understanding of local tax laws and nuances that can significantly impact your case. Here’s where a local Mesa firm like Tax Debt Advisors, Inc. shines:

- Personalized Attention: Tax Debt Advisors, Inc. is dedicated to building relationships with their clients. They take the time to understand your unique circumstances and tailor their approach accordingly.

- Local Knowledge: Their experience working with Mesa residents allows them to navigate the local IRS landscape with ease, ensuring the best possible outcome for your case.

- Proven Track Record: Tax Debt Advisors, Inc. boasts a history of successful settlements for Mesa taxpayers. Their dedicated team leverages their expertise to achieve optimal results.

Daniel’s Success Story: A Path to Financial Freedom

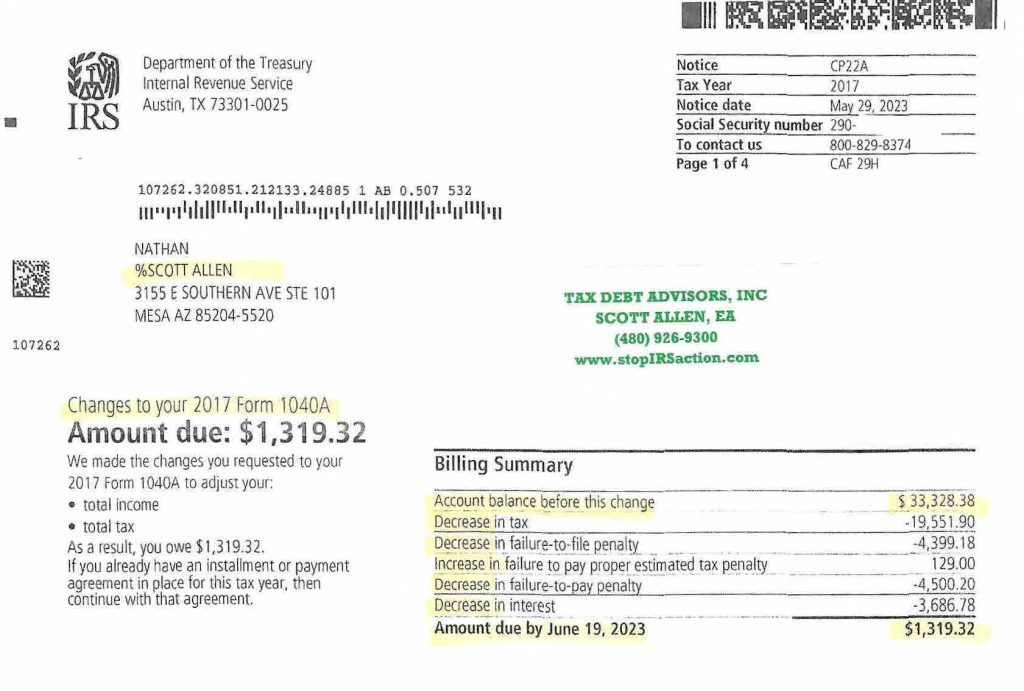

Daniel, burdened by eight years of unfiled returns and mounting tax debt, felt overwhelmed and unsure of where to turn. Fortunately, he connected with Tax Debt Advisors, Inc. After a thorough review of his financial situation, Scott Allen EA determined a payment plan was the most suitable option.

Tax Debt Advisors, Inc. meticulously prepared and submitted a comprehensive application, complete with the required IRS Form 433A, “Collection Information Statement.” This form details your income, expenses, and assets, providing the IRS with a clear picture of your financial hardship.

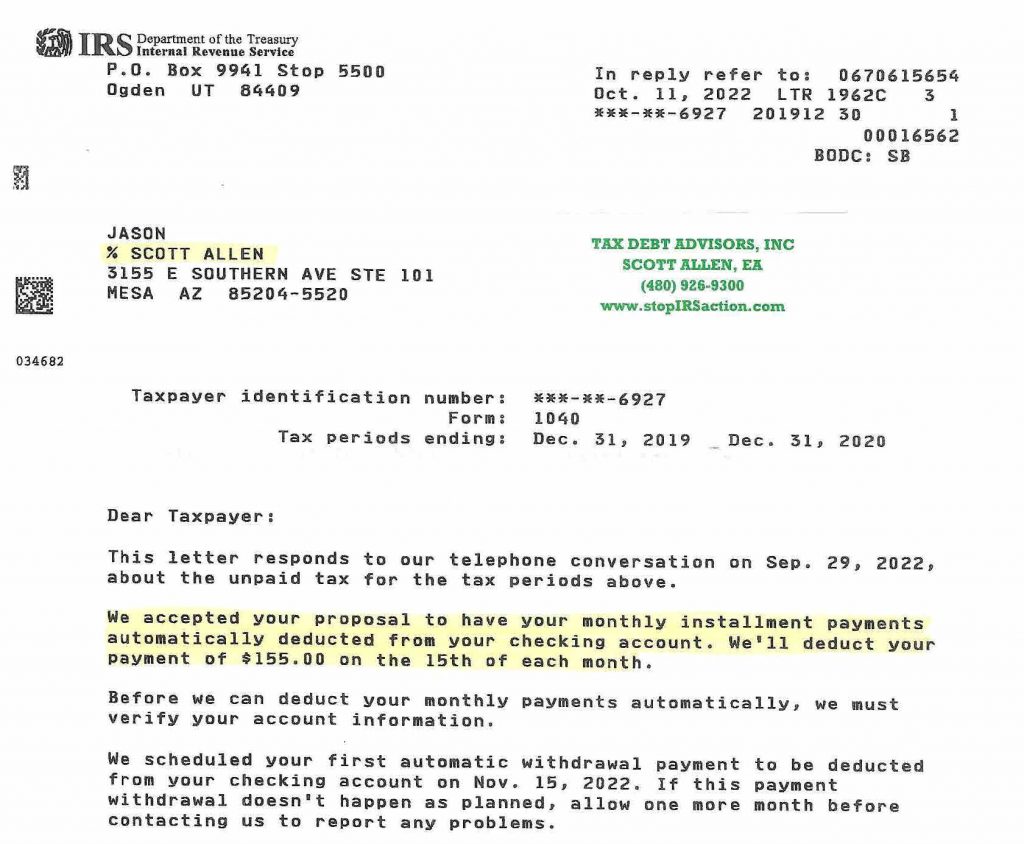

Thanks to Tax Debt Advisors, Inc.’s meticulous approach and in-depth knowledge of local tax regulations, the IRS accepted Daniel’s payment plan proposal offer. His crippling tax debt was settled for a significantly low payment amount, paving the way for a brighter financial future. Remarkably, his monthly payment plan was set at a manageable $131, allowing him to finally breathe a sigh of relief and focus on supporting his family. See his letter of acceptance below from the IRS. This was Daniel’s Mesa AZ IRS Settlement!

Empowering Mesa Taxpayers: Taking Control of Your Financial Future

Daniel’s story serves as an inspiring example of how working with a local tax resolution specialist like Tax Debt Advisors, Inc. can transform a seemingly insurmountable situation. If you’re a Mesa resident facing unfiled returns or tax debt, don’t let the burden weigh you down. Tax Debt Advisors, Inc. is here to help you with you Mesa AZ IRS Settlement too.

Next Steps: Get the Help You Deserve

Tax Debt Advisors, Inc. offers a free consultation, allowing you to discuss your specific tax situation and explore potential settlement options.