Do I Need an IRS Attorney in Mesa AZ if I get an Installment Agreement Default Notice?

IRS Attorney in Mesa AZ

No, this is not a legal matter. However, you will need to provide all of your financial information to determine if you IRS payment plan should remain the same, go up or go down. The IRS will likely require you to have your payments come directly out of your checking account or if you have had a track record of default the IRS may want the payments to come directly from your pay check.

You have 30 days to respond to this notice or levy action will follow. My suggestion is to have a free consultation with Scott Allen E.A. rather than with an IRS Attorney in Mesa AZ. Scott can determine the lowest amount allowed by law that you should pay the IRS. If your financial situation has worsen since the time you entered into your installment arrangement you may qualify for non-collectible status and not be required to make any monthly payment. He will also review all the other settlement options to determine if an IRS installment arrangement is the best option for you. You can reach Scott Allen E.A. at 480-926-9300.

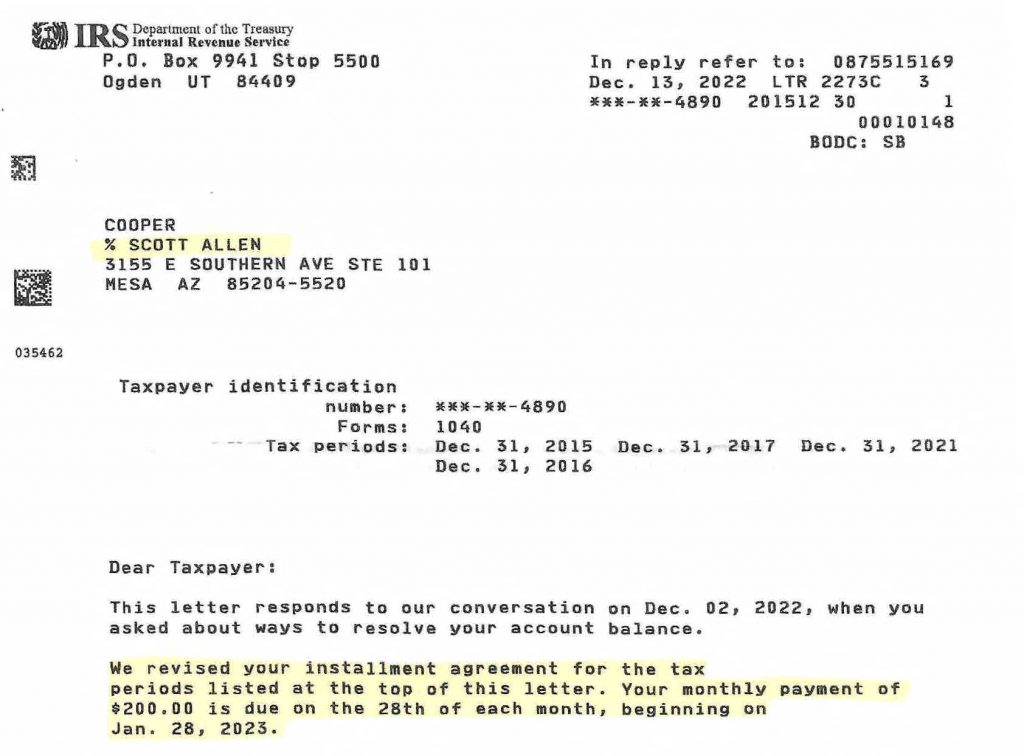

RECENT SETTLEMENT ACCEPTANCE: See how Cooper settled his IRS tax debt without hiring an IRS Attorney in Mesa AZ (view letter below). Scott Allen E.A. was able to represent him before the IRS and negotiate a low $200 per month payment plan on his 2015, 2016, 2017, and 2021 taxes owed. The IRS was being a bit tough with him initially, wanting nearly $400 per month but after Scott evaluated his current financial situation he knew Cooper would qualify for a monthly payment of nearly half of that.

Tax Debt Advisors, Inc. – Since 1977