Mesa AZ IRS Tax Attorney or Scott Allen EA for back tax returns

Why Scott Allen EA of Tax Debt Advisors, Inc is the right chose instead of a Mesa Az IRS Tax Attorney for filing back tax returns

- Scope of Practice: Both EAs and tax attorneys are federally authorized tax practitioners who have technical expertise in the field of taxation. However, the scope of their work differs. EAs generally focus more on preparing tax returns and representing clients before the IRS. Tax attorneys, on the other hand, often handle more legal matters like tax controversies, tax fraud cases, and business/corporate issues.

- Cost: Typically, EAs tend to charge less for their services than tax attorneys. If cost is a concern, choosing an EA may be a more economical choice.

- Specialization: EAs are focused on delinquent tax matters, while attorneys may have a broader base of knowledge that includes other areas of law as well. If your primary need is help with filing back tax returns, the specialized knowledge of an EA may be more beneficial.

As for Scott Allen EA of Tax Debt Advisors, Inc., specific advantages may include:

- Experience: If Scott Allen EA has many years of experience, this can be beneficial because he’s likely dealt with a variety of tax situations similar to yours. His family tax practice has been solving IRS problems since 1977.

- Local Knowledge: Being based in Mesa, AZ, Scott Allen EA may have a strong understanding of local and state tax laws in addition to federal ones, which could be advantageous if your tax situation involves state as well as federal issues.

- Reputation: If Scott Allen EA has a strong reputation for helping clients successfully navigate their tax issues, this could suggest he is effective in his work and able to provide good service to his clients.

- Personalized Service: Smaller practices such as Tax Debt Advisors, Inc., may be able to offer more personalized service compared to larger out of state firms or attorneys.

However, these are general considerations. The right choice will ultimately depend on the complexity of your tax situation, the specific expertise and experience of the professionals you are considering, and your comfort level with them. Always conduct your own research, ask questions, and meet with the professional before making a decision. It may be worth consulting with both Scott Allen EA and a Mesa AZ IRS tax attorney to see who you feel more comfortable with and who seems best equipped to handle your specific needs. Scott Allen EA offers a free consultation to sit down and meet with him for 30-60 minutes to discuss your specitive needs to filing back tax returns or settling IRS debts.

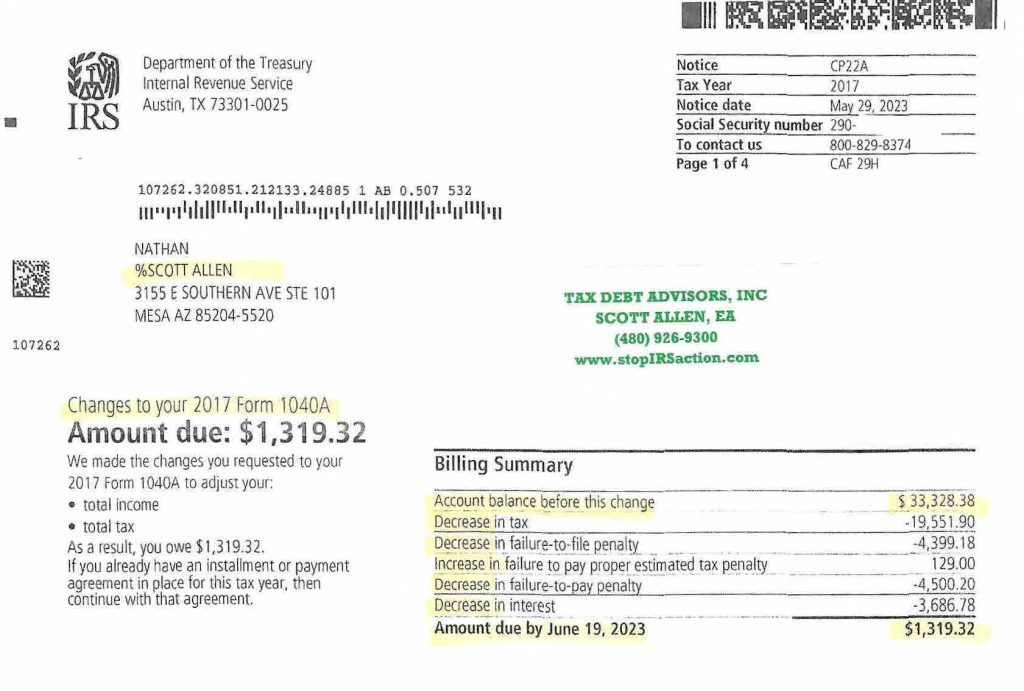

Below is just one recent example of a local Arizona resident hiring Scott Allen EA over a Mesa AZ IRS tax attorney and receiving an excellent outcome. By filing a protest to his 2017 tax return Nathan saved $32,009 in back taxes.