Phoenix Arizona IRS Levy Release: Get Back on Track

Phoenix Arizona IRS Levy Release: Stop IRS Action and Get Back on Track

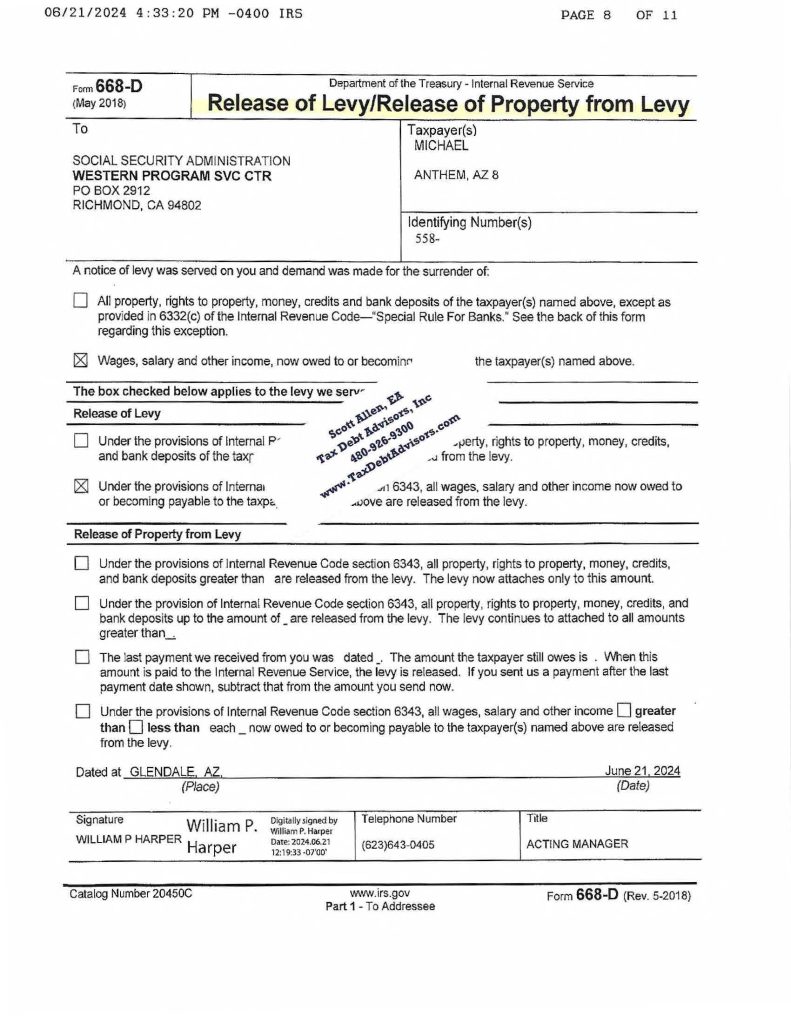

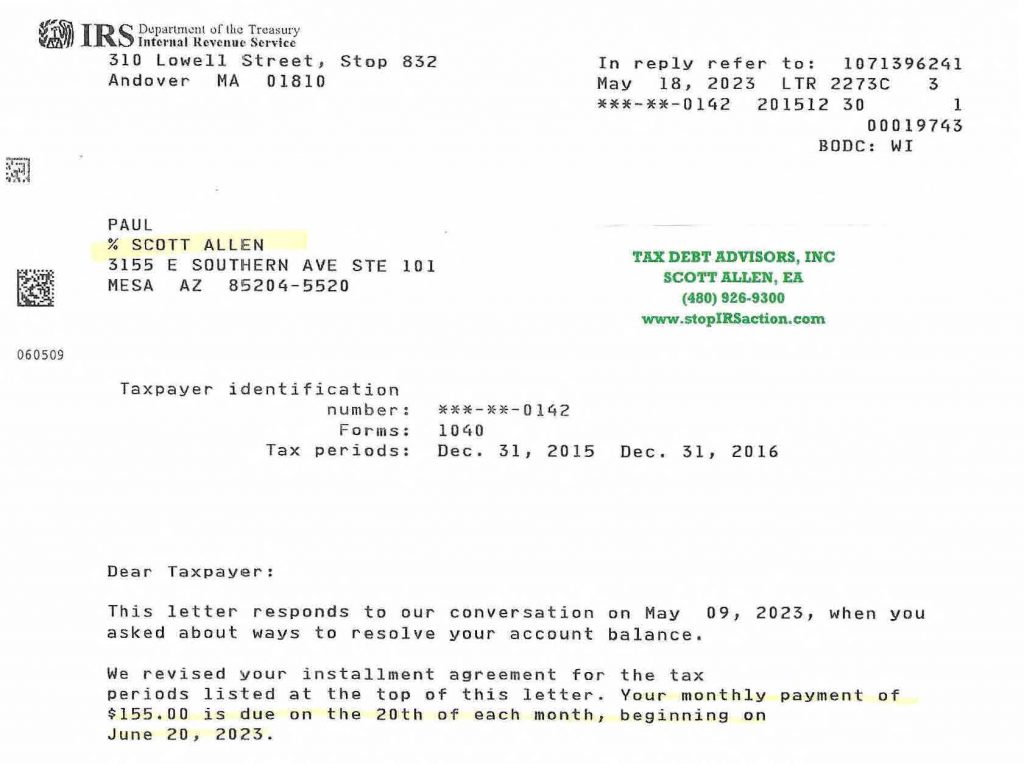

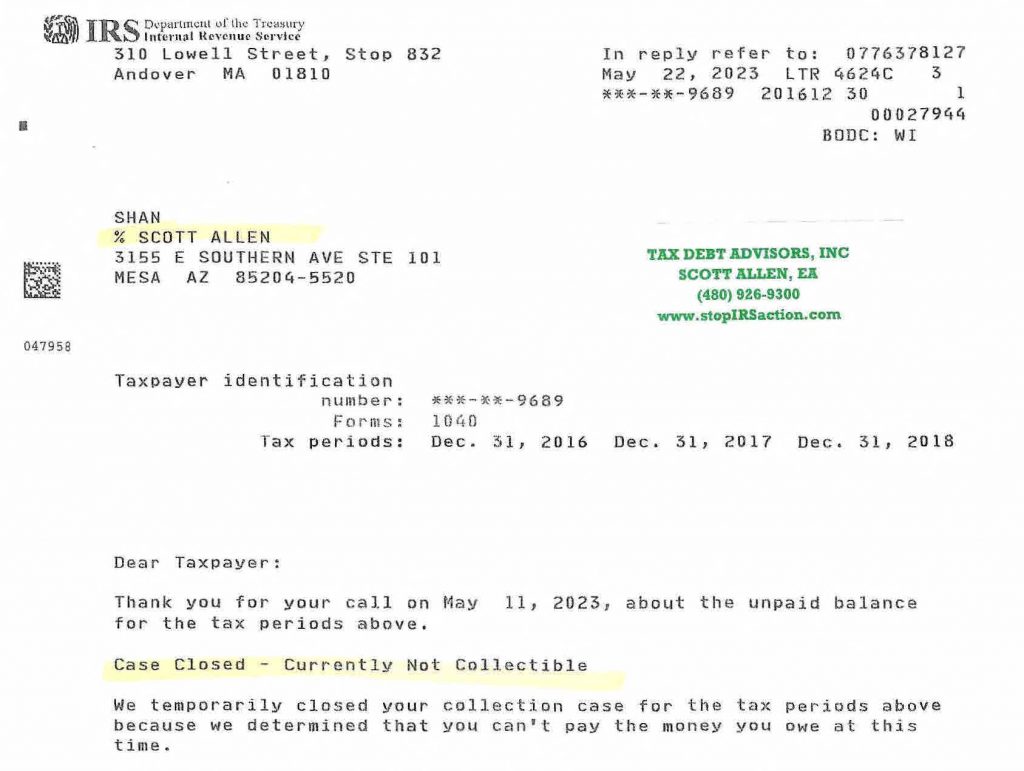

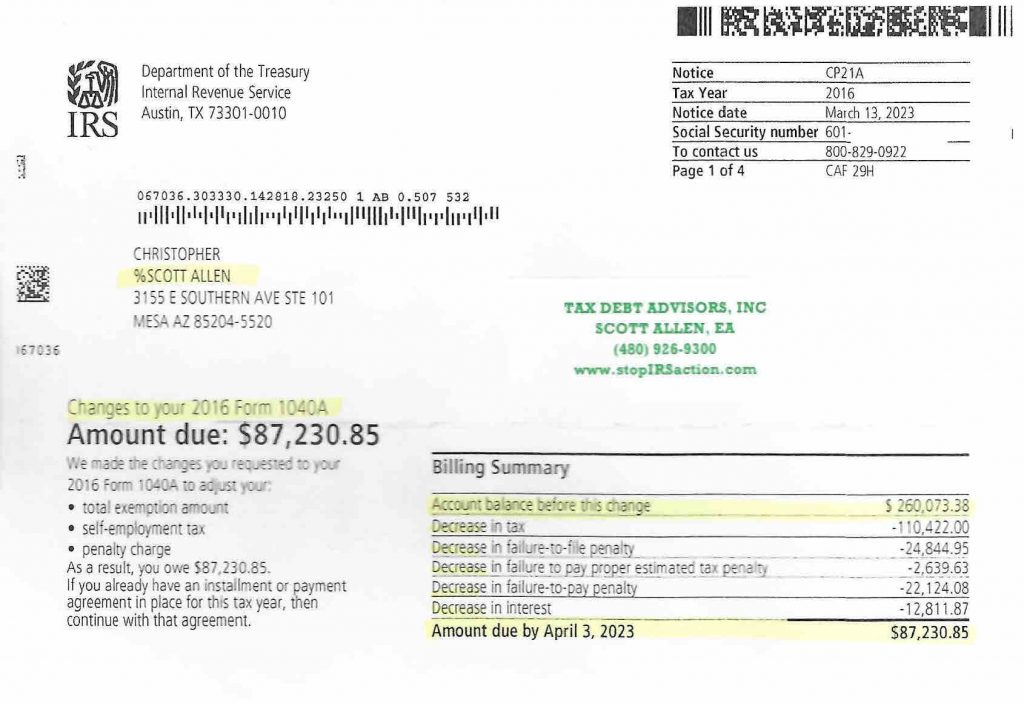

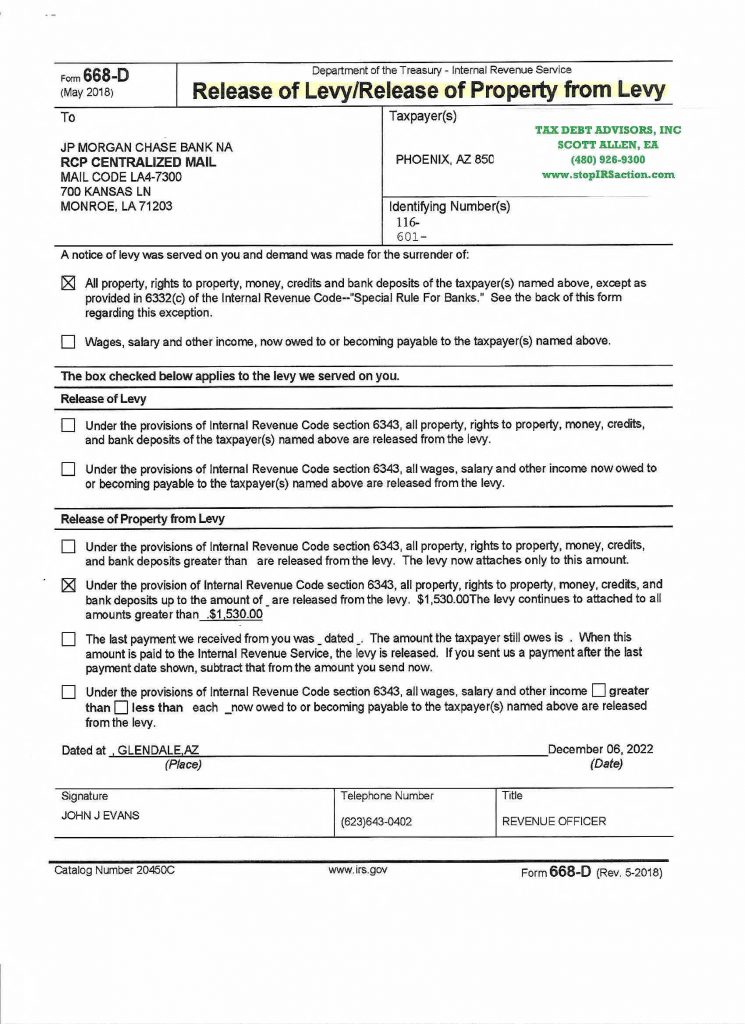

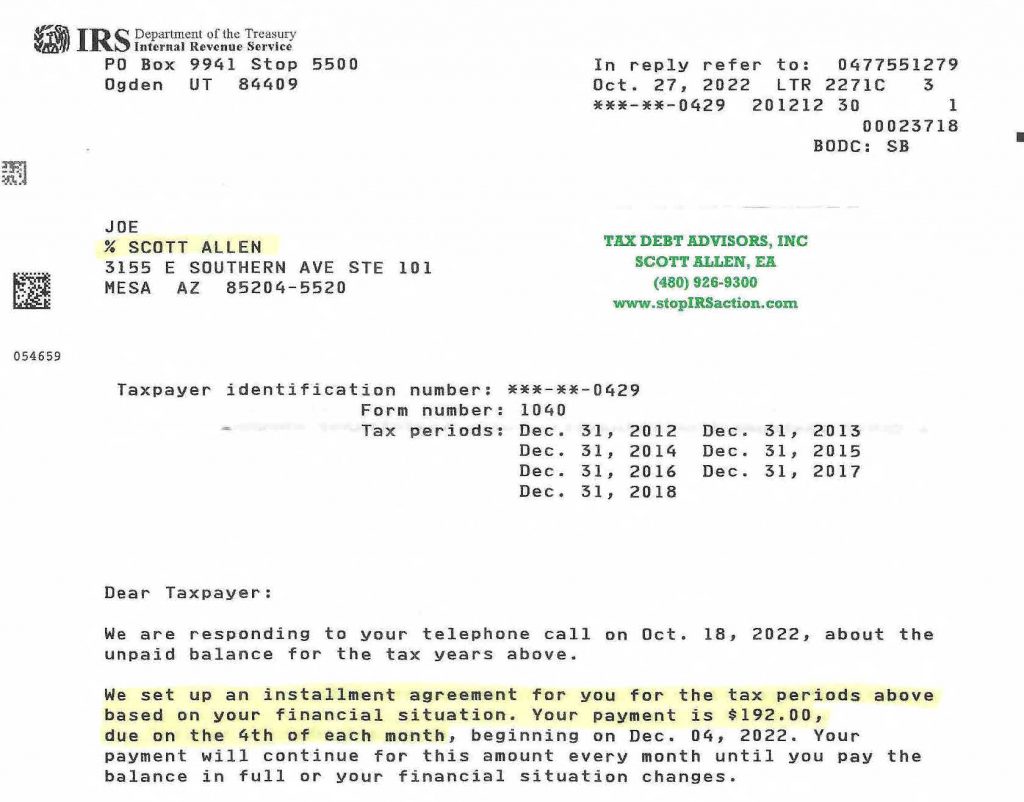

Facing IRS tax problems can be incredibly stressful. Unpaid taxes can quickly snowball with penalties and interest, leading to serious consequences like wage garnishments, bank levies, and even asset seizures. If you’re a resident of Phoenix, Arizona, and find yourself dealing with an IRS levy notice, you don’t have to face it alone. Tax Debt Advisors, Inc., a team of experienced tax professionals, can help you navigate the complexities of IRS regulations and achieve a Phoenix Arizona IRS levy release just like they did for their client Michael. Below is Tax Debt Advisors, Inc getting a levy stopped for Michael on his social security income. Yes, the IRS can even levy social security income.

What is an IRS Levy?

An IRS levy is a legal seizure of your assets to satisfy outstanding tax debt. The IRS can levy your wages, bank accounts, or even retirement funds. This can have a devastating impact on your financial stability.

Taking Action to Stop an IRS Levy

There are ways to stop an IRS levy, but acting quickly is crucial. Here’s what you can do:

-

Request a Collection Due Process Hearing: You have the right to request a hearing within 30 days of receiving the levy notice. At this hearing, you can explain your financial hardship and negotiate a payment plan or even an offer in compromise (OIC) to settle the debt.

-

File Form 911, Application for Relief from Levy: This form allows you to request a delay or release of the levy. You’ll need to demonstrate financial hardship or that releasing the levy will allow you to pay the debt in full more quickly.

-

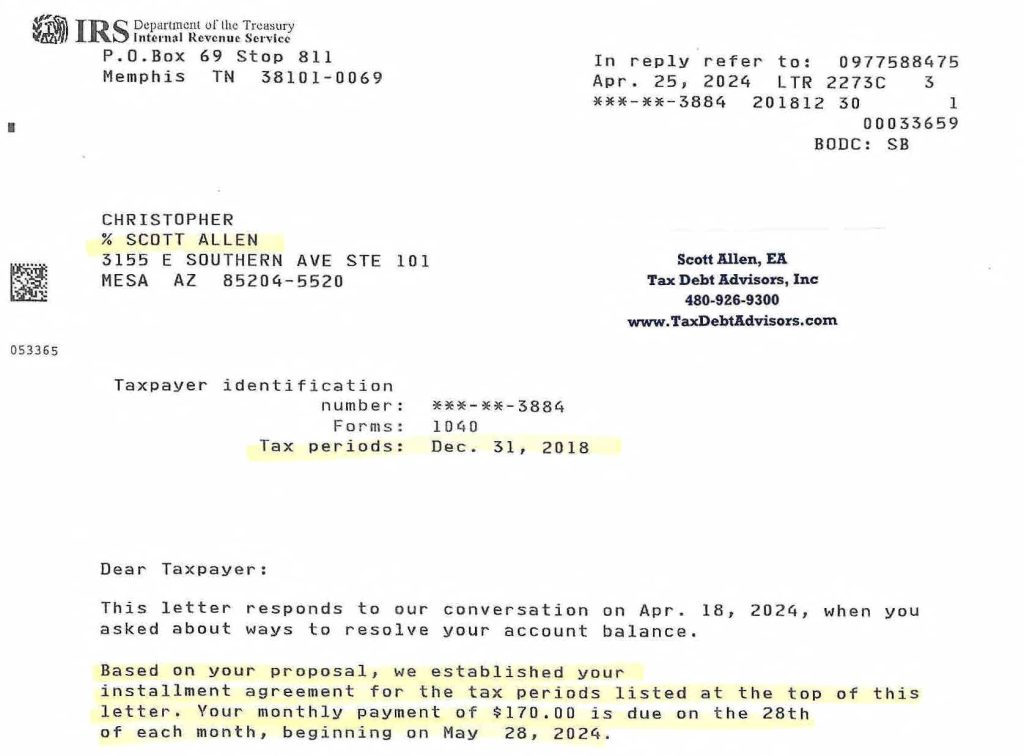

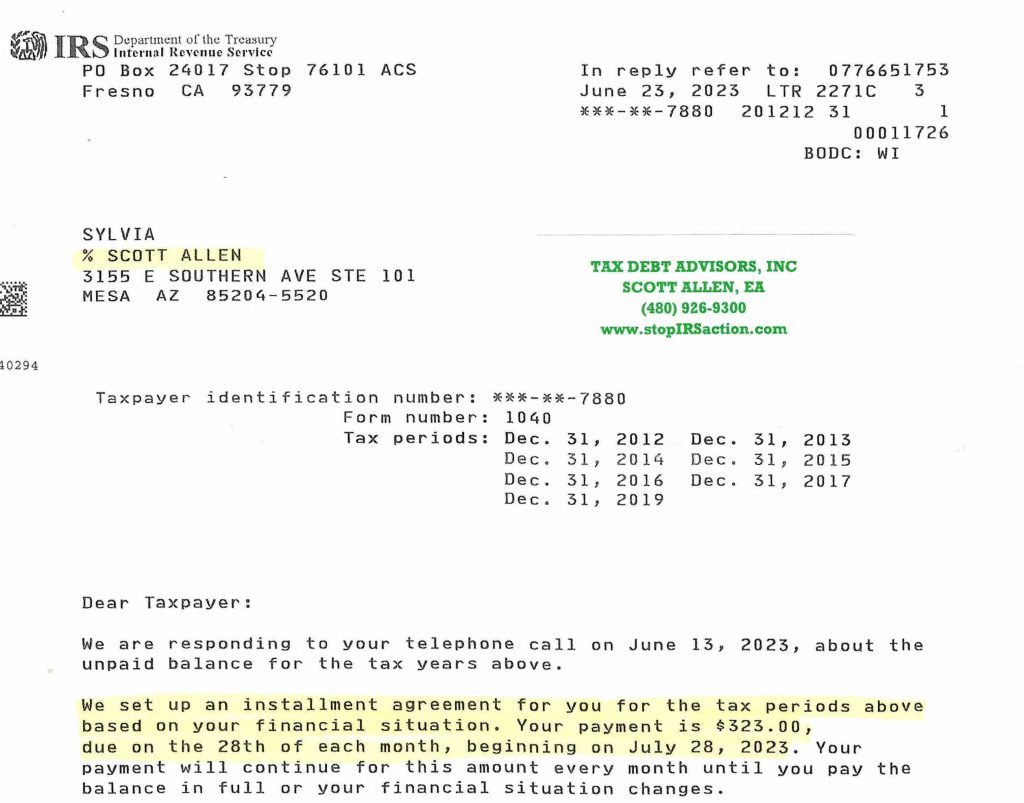

Negotiate a Payment Plan: Working with the IRS to establish a manageable monthly payment plan can prevent further collection actions, including a levy.

Why You Need Tax Debt Advisors, Inc.

Navigating the complex IRS bureaucracy and successfully stopping a levy can be daunting. Hiring Tax Debt Advisors, Inc. puts a team of experienced tax professionals on your side. Here’s how they can assist you:

-

Review Your Case: Tax Debt Advisors will take the time to understand your specific tax situation, including the amount of debt owed, penalties, and past communication with the IRS.

-

Handle All Communication with the IRS: Tax Debt Advisors will become your primary point of contact with the IRS. They’ll handle all communication, ensuring deadlines are met and paperwork is filed correctly.

-

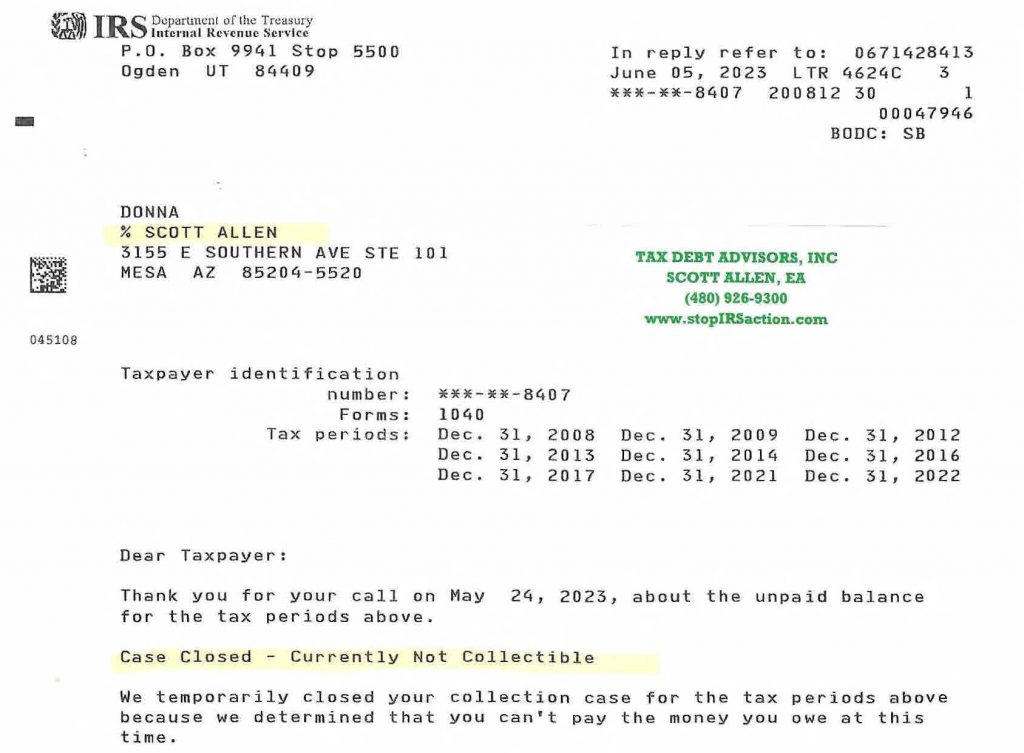

Negotiate on Your Behalf: Skilled negotiators, Tax Debt Advisors will work tirelessly with the IRS to explore options like installment agreements, penalty abatements, or OICs, significantly reducing your overall tax burden.

-

Represent You at Collection Due Process Hearings: If a hearing is necessary, Tax Debt Advisors will represent you before the IRS. They will present your case persuasively and advocate for a favorable outcome.

-

Develop a Tax Compliance Plan: Getting you back on track requires a solid plan. Tax Debt Advisors will help you understand your future tax obligations and guide you in implementing strategies to avoid future issues.

Benefits of Working with Tax Debt Advisors, Inc.

The benefits of hiring Tax Debt Advisors, Inc. extend far beyond stopping an IRS levy. Here are some key advantages:

-

Reduced Stress: Knowing you have a team of experienced professionals handling your tax problems allows you to focus on your life and business.

-

Increased Savings: Tax Debt Advisors will aggressively pursue options to minimize your overall tax liability, potentially saving you thousands of dollars.

-

Improved Tax Compliance: By creating a personalized tax compliance plan, you’ll be equipped to avoid future problems with the IRS.

-

Faster Resolution: Tax Debt Advisors’ expertise can accelerate the process of resolving your tax issue, allowing you to move forward with peace of mind.

Getting Started with Tax Debt Advisors, Inc.

If you’re a resident of Phoenix, Arizona dealing with an IRS levy, Tax Debt Advisors, Inc. can help. Their team understands the complexities of IRS regulations and is committed to achieving a successful Phoenix AZ IRS levy release for you.

Call Tax Debt Advisors, Inc. today for a free consultation. Don’t let IRS problems control your life. Take control and get back on track with the help of experienced tax professionals.