Why Tax Debt Advisors Inc. Is Your Best Choice for IRS Offer in Compromise in Chandler AZ

Unlocking Financial Freedom: Why Tax Debt Advisors Inc. Is Your Best Choice for IRS Offer in Compromise in Chandler AZ

Taxation is an inevitable part of our lives, and every citizen has the responsibility to fulfill their tax obligations. However, unexpected financial challenges can lead to tax debt, leaving individuals and businesses struggling to meet their IRS obligations. If you’re facing tax debt issues in Chandler, AZ, there’s a trusted ally you can turn to – Tax Debt Advisors Inc., led by the experienced Scott Allen EA. In this blog post, we will delve into the essential reasons why hiring Tax Debt Advisors Inc. is your best choice for resolving IRS offer in compromise matters in Chandler, AZ.

The Complexity of IRS Offer in Compromise

Before we dive into the reasons to hire Tax Debt Advisors Inc., let’s first understand the complexity of an IRS offer in compromise. An offer in compromise (OIC) is a debt settlement option that allows taxpayers to settle their tax liabilities for less than the total amount owed. However, this process is intricate and involves meticulous documentation, calculations, and negotiations with the IRS.

Here’s why OICs are challenging:

- Eligibility Requirements: Not everyone qualifies for an OIC. The IRS assesses your income, expenses, asset equity, and ability to pay when determining eligibility.

- Complex Financial Analysis: Accurate financial disclosures are crucial. The IRS scrutinizes your financial details to determine the reasonable collection potential (RCP), which forms the basis for your OIC.

- Negotiations with the IRS: Negotiating with the IRS can be daunting. They have stringent rules and regulations that need to be followed precisely.

Given the intricacies involved, seeking professional help is not just advisable; it’s often necessary to navigate the OIC process successfully.

Meet Scott Allen EA

In Chandler, AZ, you’ll find a reliable expert in tax debt resolution – Scott Allen EA. As an Enrolled Agent (EA), Scott Allen is authorized by the U.S. Department of the Treasury to represent taxpayers before the IRS. He specializes in handling IRS offer in compromise cases, making him your go-to choice for resolving tax debt issues in Chandler.

Here are compelling reasons to choose Scott Allen EA and Tax Debt Advisors Inc. for your IRS offer in compromise needs:

1. Expertise in IRS Offer in Compromise

Scott Allen EA has a wealth of experience in handling IRS offer in compromise cases. His in-depth understanding of IRS regulations, tax laws, and negotiation strategies ensures that you have a seasoned expert by your side to navigate the complex OIC process effectively.

2. Tailored Solutions

No two tax debt cases are the same. Scott Allen EA and Tax Debt Advisors Inc. understand this and provide personalized solutions that cater to your specific financial situation. They assess your unique circumstances and craft a tailored OIC proposal that maximizes your chances of acceptance.

3. Maximizing Your Chances of Acceptance

One of the primary reasons to hire a professional like Scott Allen EA is to increase your chances of OIC acceptance. The IRS has strict criteria for approving OICs, and any errors or omissions in your application can lead to rejection. Scott Allen EA ensures that your OIC submission is accurate, complete, and optimized for success.

4. Comprehensive Financial Analysis

Determining the reasonable collection potential (RCP) is a critical aspect of OIC preparation. Scott Allen EA conducts a thorough financial analysis, including income, expenses, and asset equity, to accurately calculate your RCP. This ensures that your OIC reflects your true ability to pay.

5. Effective Negotiations

Negotiating with the IRS can be intimidating, but with Scott Allen EA on your side, you have a skilled negotiator who understands the IRS’s processes and protocols. He will represent you professionally, advocating for the best possible outcome.

6. Stress Reduction

Dealing with tax debt can be incredibly stressful, affecting your overall well-being. Hiring Tax Debt Advisors Inc. allows you to offload the burden of dealing with the IRS, giving you peace of mind and the opportunity to focus on your financial recovery.

7. Save Time and Money

While hiring professional assistance comes with a cost, it can ultimately save you time and money in the long run. By expediting the OIC process and increasing the likelihood of acceptance, you may end up settling your tax debt for a fraction of what you owe.

8. Compliance Assurance

Tax regulations are constantly evolving, and compliance is crucial to avoid future tax issues. Scott Allen EA and Tax Debt Advisors Inc. ensure that your OIC submission and financial disclosures are in compliance with the latest tax laws, reducing the risk of future disputes with the IRS.

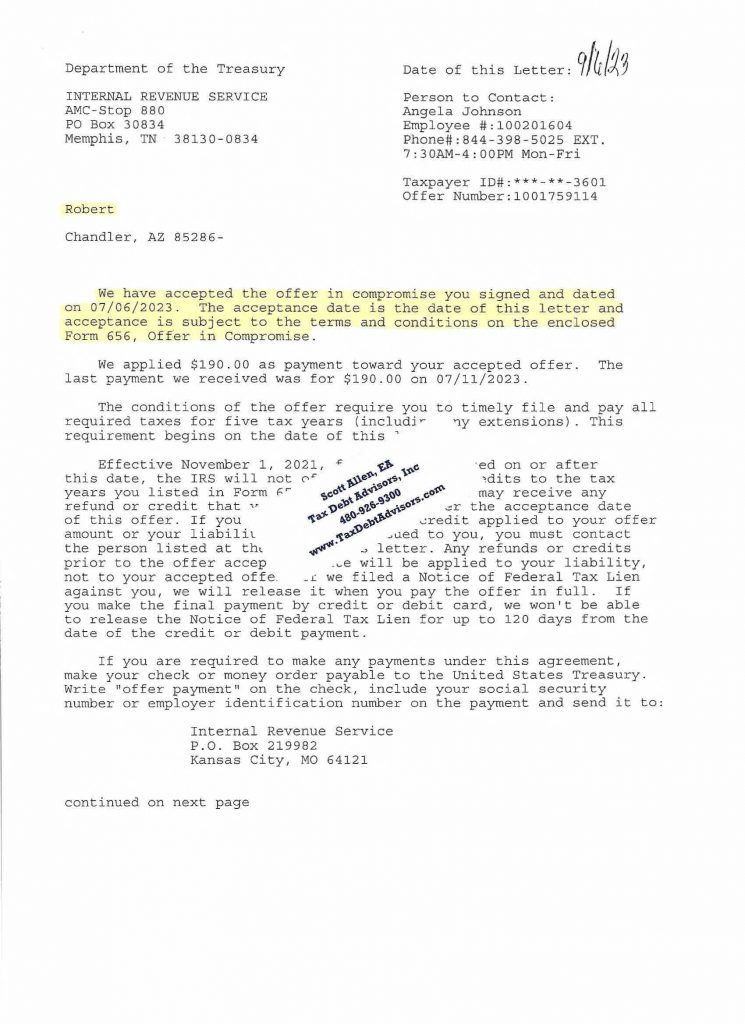

Recent Chandler AZ IRS Office in Compromise Acceptance

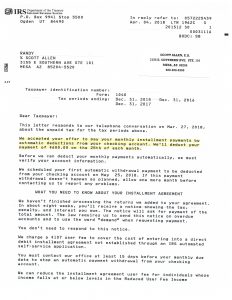

Robert owed the IRS back taxes from 2016 thru 2022. He was basically living paycheck to paycheck now to make ends meet. Paying for rent and gas for his car was a struggle let along trying to pay back the IRS on delinquest taxes. To sum up pretty simply what Scott Allen EA did for him was he settled his $26,000 of back taxes owed into a lump sum settlemetn agreement of $760 (see approval letter below). Yes, you read that correctly. His tax debt was settled for 2.9 cents on the dollar. Every case is unique and different but if you are in a financial hardship it might be worth it to see if Scott Allen EA of Tax Debt Advisors Inc can negotiate an IRS offer in compromise or some other settlement option for you.

Resolving tax debt issues through a Chandler AZ IRS offer in compromise is a viable solution for individuals and businesses facing financial hardship. However, the intricacies of the process demand professional expertise, and that’s where Scott Allen EA and Tax Debt Advisors Inc. shine. By choosing them, you are not just hiring a tax professional; you are investing in your financial future.

Don’t let tax debt weigh you down in Chandler, AZ. Reach out to Tax Debt Advisors Inc. and Scott Allen EA to take the first step toward financial freedom. With their experience, personalized solutions, and dedication, you can trust them to guide you through the IRS offer in compromise process successfully. Your path to a debt-free future starts here.