Opting for Scott Allen EA Over a Gilbert, AZ IRS Tax Attorney

The Wise Choice: Opting for Scott Allen EA Over a Gilbert, AZ IRS Tax Attorney

In the realm of taxation and financial matters, individuals often find themselves navigating a labyrinth of complex rules and regulations. As taxpayers strive to fulfill their obligations while maximizing their benefits, the choice of a tax professional becomes crucial. This blog delves into the compelling reasons why taxpayers should consider enlisting the expertise of Scott Allen EA rather than a Gilbert, AZ IRS Tax Attorney.

A Comprehensive Understanding of Taxation

Scott Allen EA’s profound knowledge of tax codes and regulations stands as a testament to his proficiency in the field. With years of dedicated experience as an Enrolled Agent, he has demonstrated an in-depth understanding of tax law and its intricate nuances. His firm Tax Debt Advisors, Inc has been solving IRS problems since 1977. This comprehensive grasp enables him to provide tailored solutions for a wide range of tax-related concerns. While an IRS Tax Attorney may possess legal acumen, Scott Allen’s specialized focus on taxation equips him to offer more specific and effective guidance. And to be honest 99% of IRS problems arent legal matters that require a Gilbert AZ IRS tax attorney.

Dedicated Expertise

The specialization Scott Allen EA brings to the table is further accentuated by his commitment to continuous professional development. Taxation is an ever-evolving landscape, and Scott ensures that he remains at the forefront of industry trends and legislative updates. This dedication to staying informed guarantees that his clients receive advice based on the latest regulations and potential opportunities. This level of dedication may not always be a hallmark of Gilbert, AZ IRS Tax Attorneys, who may have broader legal portfolios to manage.

Personalized Approach

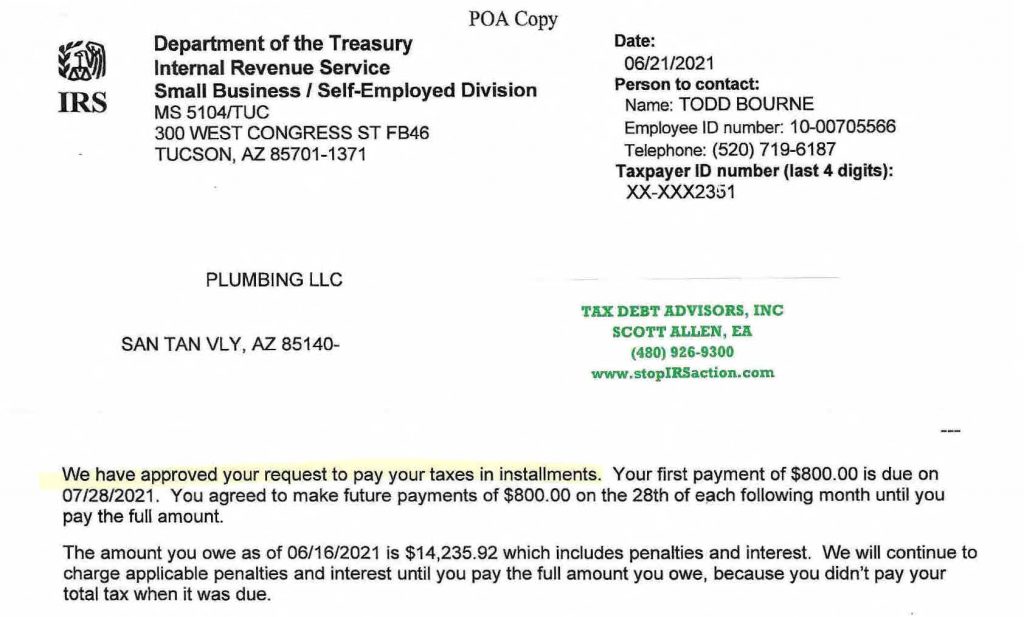

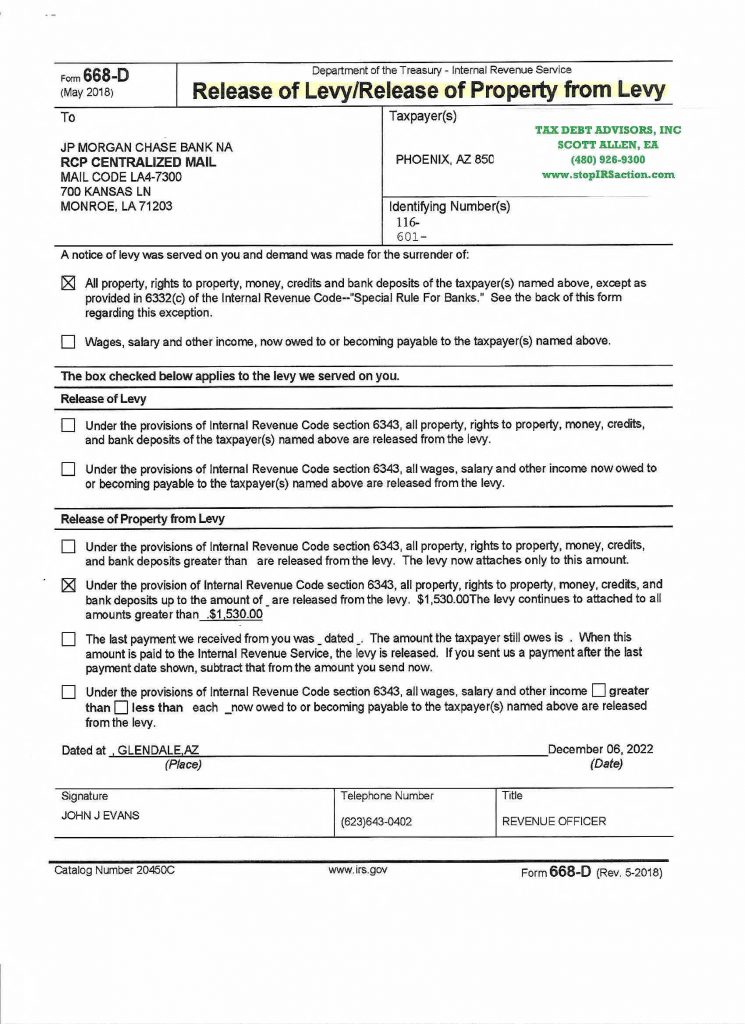

One of the key differentiators of Scott Allen EA is his personalized approach to client service. Each taxpayer’s situation is unique, and Scott understands the importance of tailoring his strategies to individual circumstances. Through thorough assessments and in-depth consultations, he crafts solutions that align with clients’ financial goals and compliance needs. While an IRS Tax Attorney in Gilbert, AZ may offer legal perspectives, the focus may not always be as specialized and tailored as Scott’s approach. Scott Allen, EA will have you sign an IRS power of attorney so he can personally represent you from start to finish and handle all aspects of your IRS problem whether it be filing back taxes, negotiating IRS debts, or representing you in an audit.

Cost-Effective Solutions

Taxpayer-friendly fees combined with high-quality service define Scott Allen EA’s practice. Navigating taxation can be daunting, and the prospect of hiring professional assistance might seem financially intimidating. However, Scott’s commitment to providing cost-effective solutions ensures that taxpayers receive exceptional value for their investment. Gilbert, AZ IRS Tax Attorneys, often operating within a broader legal framework, might not be able to match the efficiency and affordability of Scott’s services in the realm of taxation.

Proactive Issue Resolution

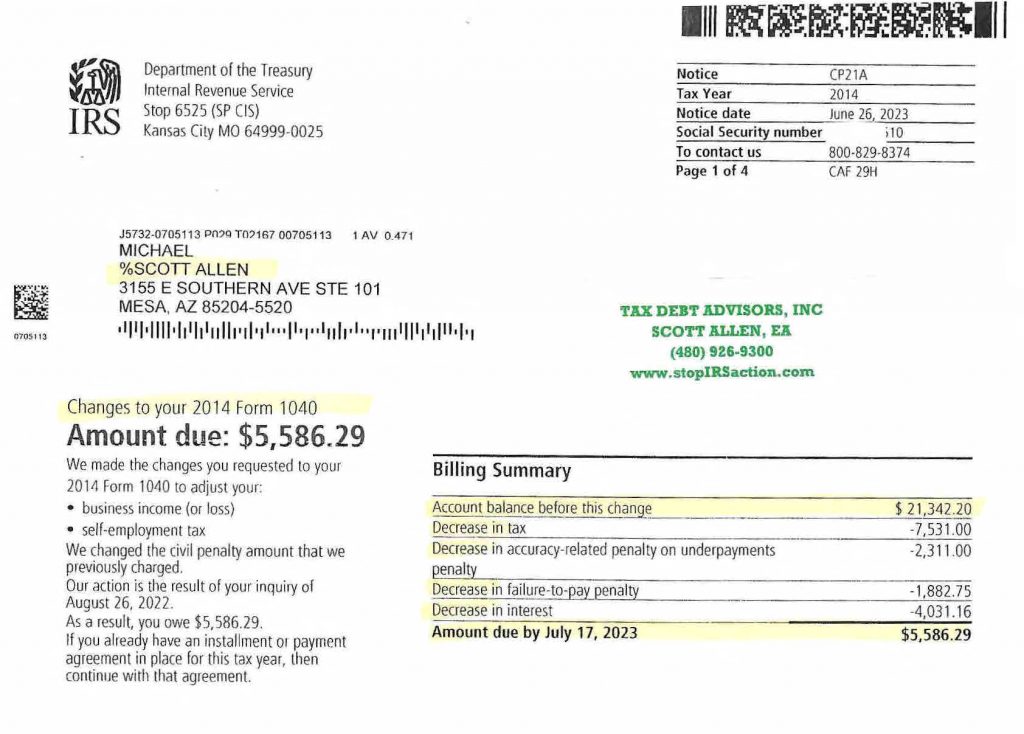

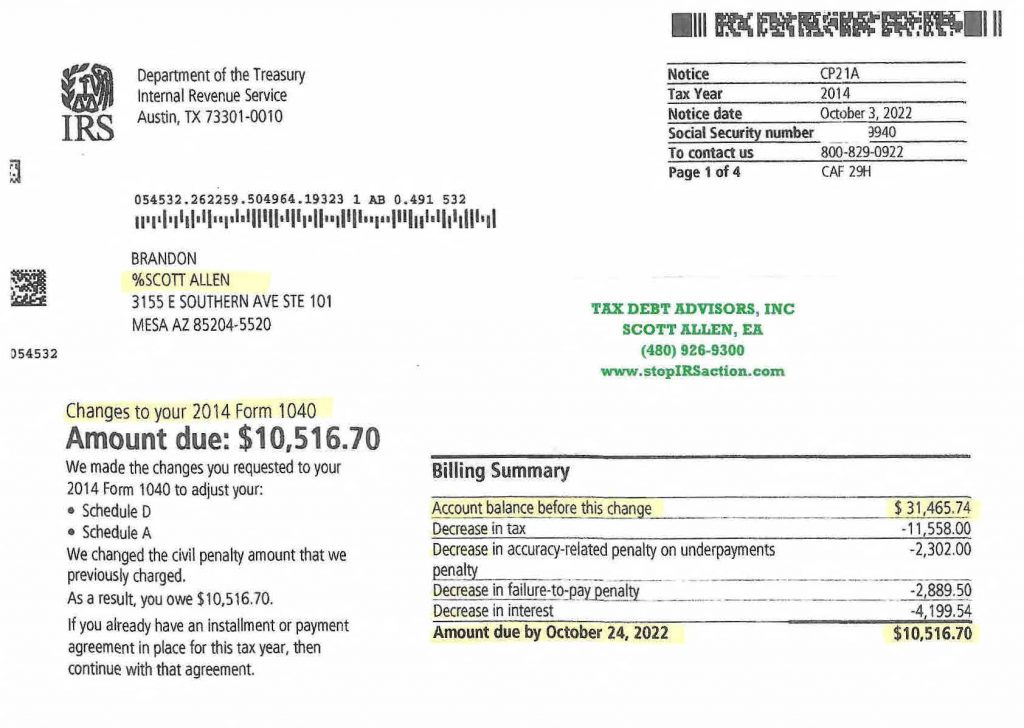

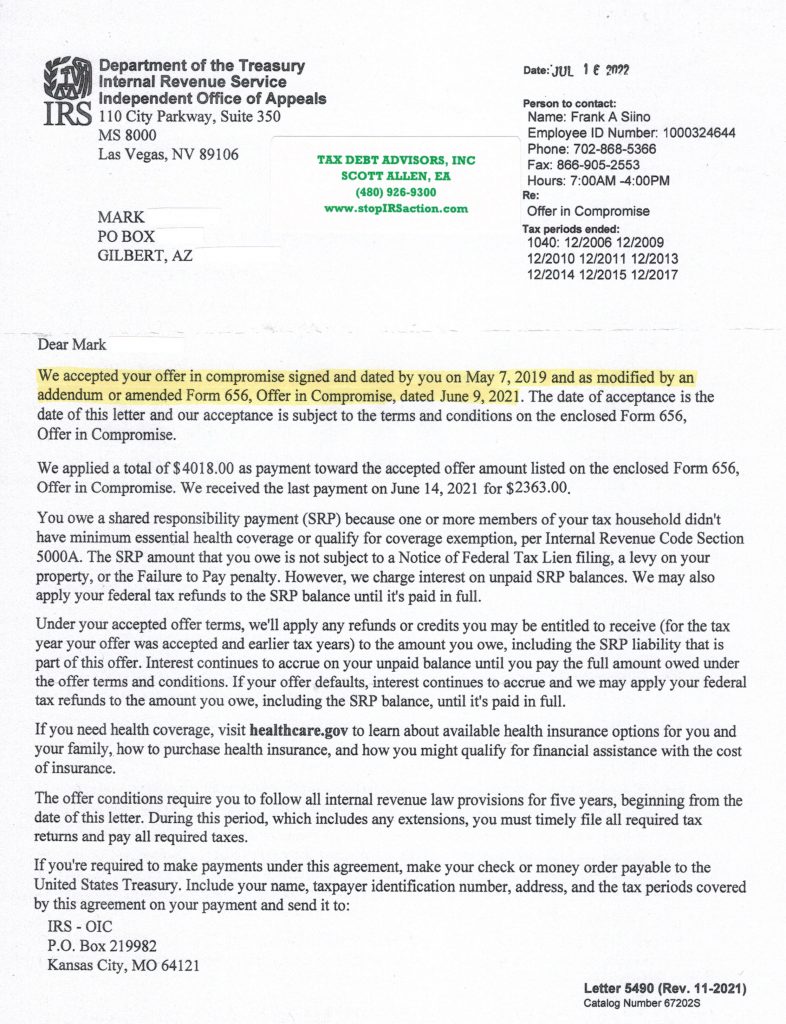

A proactive approach to tax issues can prevent complications and potential disputes down the road. Scott Allen EA excels in this aspect by identifying potential red flags before they escalate into major problems. His strategic insights and meticulous review of financial records empower clients to address concerns in their early stages. While IRS Tax Attorneys in Gilbert, AZ may excel in dispute resolution, Scott’s focus on proactive IRS and tax specific solutions adds another layer of security for taxpayers. Below is a recent example of Scott Allen EA being proactive and protesting a back tax issue from 2024. Protesting this SFR return that was originally prepared by the IRS resulted in saving over $15,000 for his client Michael.

Integrity and ethical conduct form the cornerstone of Scott Allen EA’s practice. His reputation for honest and transparent dealings has garnered trust from a diverse clientele. This level of trust is essential in the realm of taxation, where sensitive financial matters are often at stake. While Gilbert, AZ IRS Tax Attorneys undoubtedly uphold ethical standards, Scott’s specialization and reputation in taxation underscore his commitment to maintaining the highest level of integrity.

The decision to enlist a tax professional is pivotal for any taxpayer. While a Gilbert, AZ IRS Tax Attorney may offer legal expertise, the specialized knowledge, dedicated focus, personalized approach, cost-effective solutions, proactive resolution, and strong ethical standing that Scott Allen EA provides make him an optimal choice for addressing taxation concerns. With Scott Allen EA, taxpayers can rest assured that they are receiving guidance from a seasoned Enrolled Agent who not only understands tax law but also prioritizes their unique financial well-being. Call him at 480-926-9300.