Do I Need an IRS Tax Attorney in Gilbert AZ when I have not paid my IRS 940 Taxes?

Hiring a Gilbert AZ IRS Tax Attorney?

No, this is not a legal matter requiring a Gilbert AZ IRS Tax Attorney. However, you do need IRS help. IRS form 940 is for federal unemployment taxes. They are calculated on the first $7,000 of wages paid to each employee. If you are self-employed your Arizona business is responsible for the payment of unemployment taxes; otherwise the liability will eventually be transferred to the Gilbert AZ business owner—YOU! IRS form 940 can be confusing because not only business employees but unemployment taxes apply to agricultural and farming employees and domestic household employees.

Do not take the filing and payment of unemployment taxes lightly—the IRS doesn’t. The IRS will file IRS tax liens and possibly seize business and personal property to pay off your debt. Scott Allen E.A. has the experience and expertise to settle with the IRS on your IRS Form 940 taxes. Scott is available for a free consultation to see what options are available to settle your IRS tax debt. There are several ways to settle back IRS taxes owed and it is importnat to be aware of all available solutions to you. He can be reached at 480-926-9300. Don’t hesitate to call him over calling a Gilbert AZ IRS Tax Attorney.

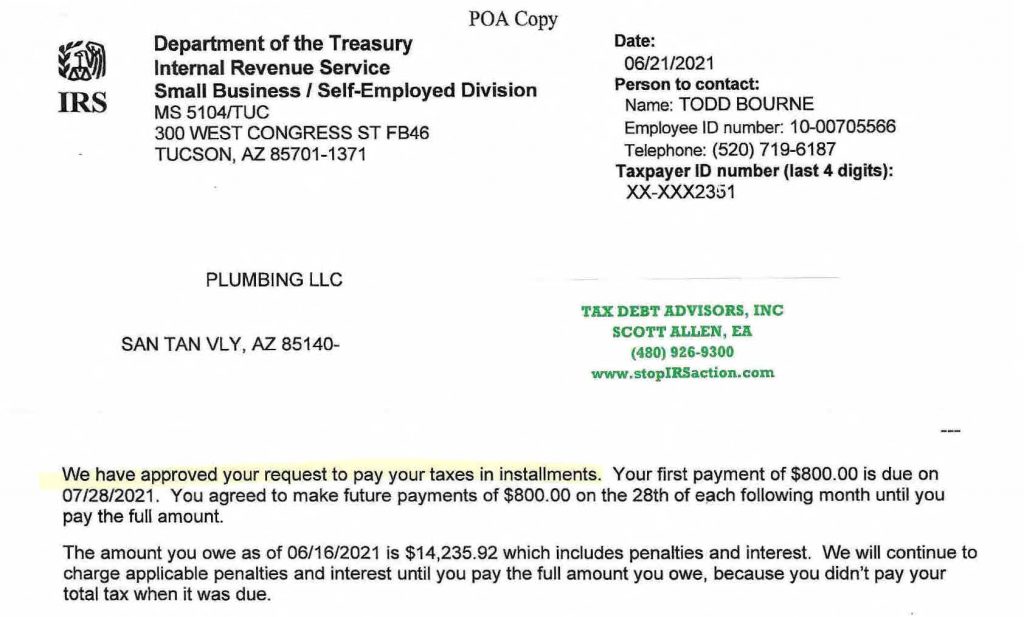

Scott Allen EA of Tax Debt Advisors, Inc was able to to assist XXXXX Plumbing LLC with their IRS 940 back taxes owed and get it settled into a nice monthly payment plan. You can view the approval letter below. Rather then hiring a Gilbert AZ IRS tax attorney this XXXXX Plumbing LLC utilized a local Enrolled Agent. This is just one of thousands of examples where Scott Allen EA have helped other Arizona businesses and taxpayers.