Ways to stop IRS garnishment Phoenix AZ

Stop IRS Garnishment Phoenix AZ

If you are facing an IRS garnishment in Phoenix, AZ, you are not alone. Many people find themselves in this situation, and it can be a very stressful and overwhelming experience. However, there are steps you can take to stop IRS garnishment Phoenix AZ and get back on track financially.

What is an IRS Garnishment?

An IRS garnishment is a legal process that allows the IRS to collect a debt by taking money directly from your paycheck or bank account. The IRS can garnish up to 25% of your disposable income, which is the amount of money you have left after taxes and other mandatory deductions.

How Can I Stop an IRS Garnishment?

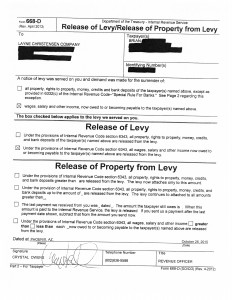

There are a few ways to stop an IRS garnishment. One way is to pay the debt in full. Another way is to make a payment arrangement with the IRS. You can also request a Collection Due Process hearing, which is a chance to appeal the garnishment. Seek out professional help before filing a CDP hearing and it is usually best to file that with the help of a licensed professional as well.

How to Make a Payment Arrangement

If you cannot pay the debt in full, you can make a payment arrangement with the IRS. To do this, you will need to fill out Form 9465, Installment Agreement Request. You can find this form on the IRS website.

When you fill out Form 9465, you will need to provide information about your income and expenses. You will also need to choose a payment plan that you can afford. The IRS offers a variety of payment plans, including monthly payments, biweekly payments, and quarterly payments.

Once you have submitted Form 9465, the IRS will review your request and send you a letter confirming your payment plan.

This form usually works when a taxpayer only owes for only one year or owes less then $10,000. If you have more complex issues a payment plan negotiation will usually require more then just a Form 9465.

How to Request a Collection Due Process Hearing

If you disagree with the IRS’s decision to garnish your wages, you can request a Collection Due Process hearing. To do this, you will need to fill out Form 12153, Collection Due Process Hearing Request. You can find this form on the IRS website.

When you fill out Form 12153, you will need to provide information about the debt that is being garnished. You will also need to explain why you disagree and why the IRS should stop IRS garnishment Phoenix AZ.

The IRS will review your request and send you a letter confirming your hearing date.

How to Get Help with an IRS Garnishment

If you are facing an IRS garnishment, there are a few resources that can help you. The IRS offers a variety of help options, including:

- The Taxpayer Advocate Service: The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers who are facing financial hardship. You can contact the Taxpayer Advocate Service by phone at 1-877-777-4777 or online at www.irs.gov/taxpayer-advocate.

- The IRS website: The IRS website has a wealth of information about IRS garnishments, including how to stop a garnishment, how to make a payment arrangement, and how to request a Collection Due Process hearing. You can find the IRS website at www.irs.gov.

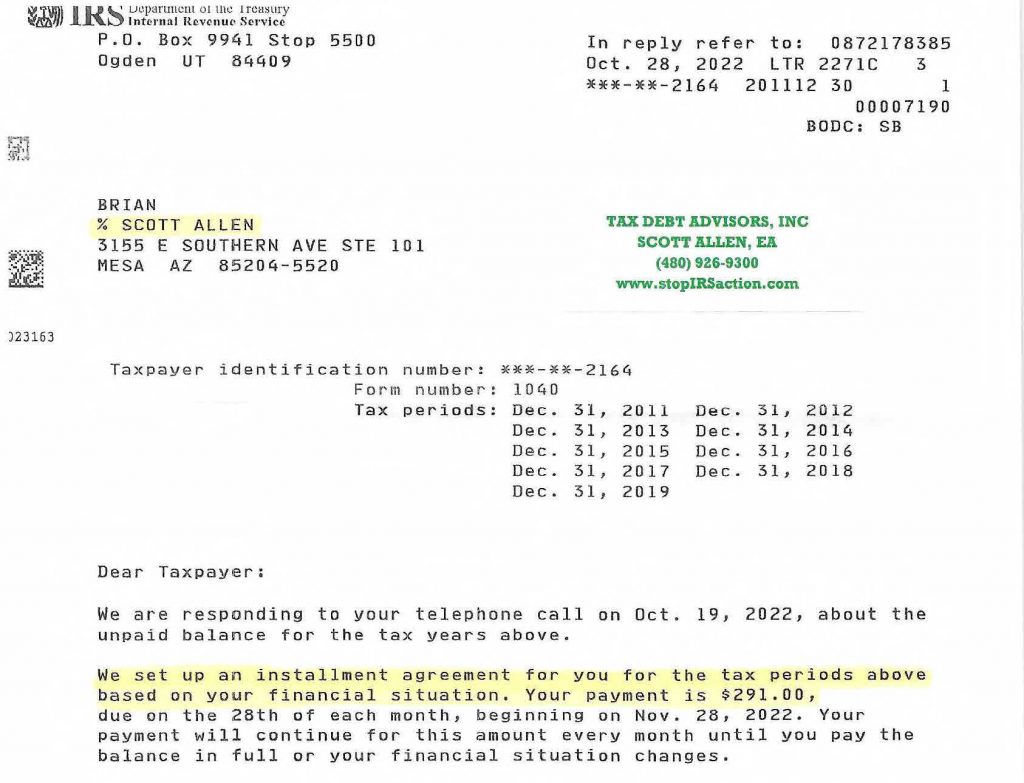

- A tax professional: A tax professional can help you understand your options and develop a plan to stop the garnishment. Scott Allen EA has the experience and expertise to help you stop IRS garnishment Phoenix AZ and to help with unfiled taxes returns or negotiating an IRS payment plan. Long story short Scott Allen EA can represent you from start to finish as your power or attorney so you don’t have to deal with the IRS on your own.

Conclusion

If you are facing an IRS garnishment, there are steps you can take to stop the garnishment and get back on track financially. There are a variety of resources available to help you, including the IRS, the Taxpayer Advocate Service, and tax professionals such as Scott Allen EA with Tax Debt Advisors, Inc.