Everything you always wanted to know about an IRS tax lien in Arizona

What is an IRS Tax Lien?

A tax lien filed by the IRS is public notice to creditors that you owe IRS taxes. This will cause your credit report to decline significantly. A lien is also a claim against all real and personal property that you own that you have title to—mainly you home and vehicles. A lien prevents you from selling an asset like your home and receiving any proceeds from the sale of your home until the amount owed on the lien is satisfied.

Why is a Tax Lien filed?

A tax lien is filed only after the IRS has made a bona fide attempt to collect the taxes owed. Several notices have to be sent warning you about the IRS ability to file a lien against you. These would include a CP-501, CP-503 and a CP-504. Each letter gets more threatening and the final notice also warns that the IRS may levy your bank accounts and/or garnish your wages.

Negative Impact of an IRS Tax Lien?

You will be denied credit when applying for a loan on major purchases such as a vehicle or a home. Increasingly employers will check your credit before making an offer of employment. A tax lien will definitely limit your chances of being hired. An IRS tax lien in Arizona will prevent you from getting a licensed for many professions such as being a financial planner. Even if you clear up an IRS tax lien, it was continue to be on your credit report long after you have resolved the problem.

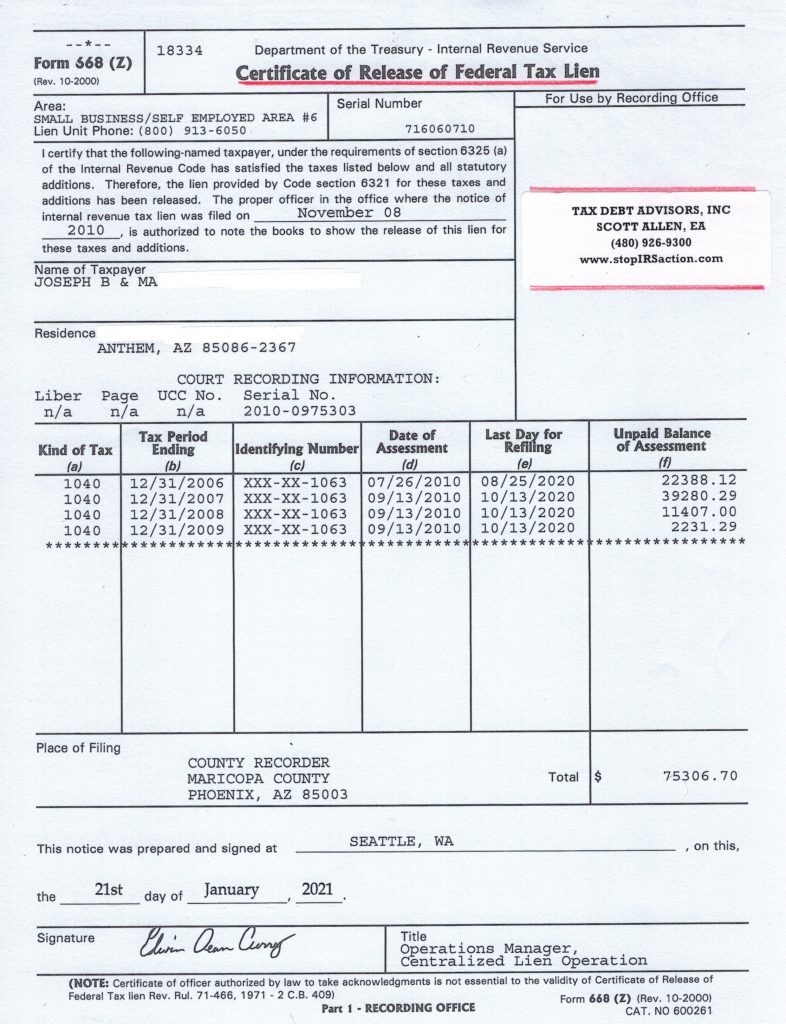

How are IRS Tax Liens Released?

Your tax lien will be removed when the tax, including interest and penalties has been paid in full.

If you have an Offer in compromise accepted and pay the agreed amount, your tax lien will be released.

Once a lien has been filed, you have the right to file an appeal to have a hearing. If you are successful the lien will be removed but the lien will still appear on your credit report.

There is a 10 year Statute of Limitations on IRS tax liens. Tax liens are self releasing and the release date is on the original notice of IRS tax lien you received.

Will filing a Bankruptcy release an IRS Tax Lien?

No. An IRS tax lien in Arizona will survive bankruptcy and continue to be attached to your property until the statute of limitations is satisfied.

Why Call Tax Debt Advisors, Inc.?

IRS tax lien representation will be handled exclusively by Scott Allen E. A. I know how seriously tax liens can wreck havoc on your daily life. The key is to call me before a tax lien is filed. I will work exclusively with you until your tax matter is resolved.

If a tax lien has already been filed, I will help you to get your tax liability settled so that you can get your IRS lien released and your credit can be restored. There are several actions that I will advise you to do with the three major credit bureaus—Experian, TransUnion and Equifax. Even though the tax lien will still be on your credit report, proper action will allow your credit scores to return back to where they were before the IRS filed a tax lien.

IRS Tax Lien in Arizona: IRS help from Tax Debt Advisors, Inc

Mesa, Apache Junction, Avondale, Buckeye, Carefree, Cave Creek, Chandler, El Mirage, Fountain Hills, Gila Bend, Gilbert, Glendale, Goodyear, Komatke, Litchfield Park, Luke AFB, Paradise Valley, Peoria, Phoenix, Queen Creek, Scottsdale, Sun City, Sun Lakes, Surprise, Tempe, Tolleson, Waddell, Whitman, Wickenburg, Youngstown, Flagstaff, Tucson, Payson, Winslow, Sierra Vista, Page, Prescott, Globe, Yuma, AZ

Apache County, Cochise County, Coconino County, Gila County, Graham County, Greenlee County, La Paz County, Maricopa County, Mohave County, Navajo County, Pima County, Pinal County, Santa Cruz County, Yavapai County, Yuma County

www.TaxDebtAdvisors.com

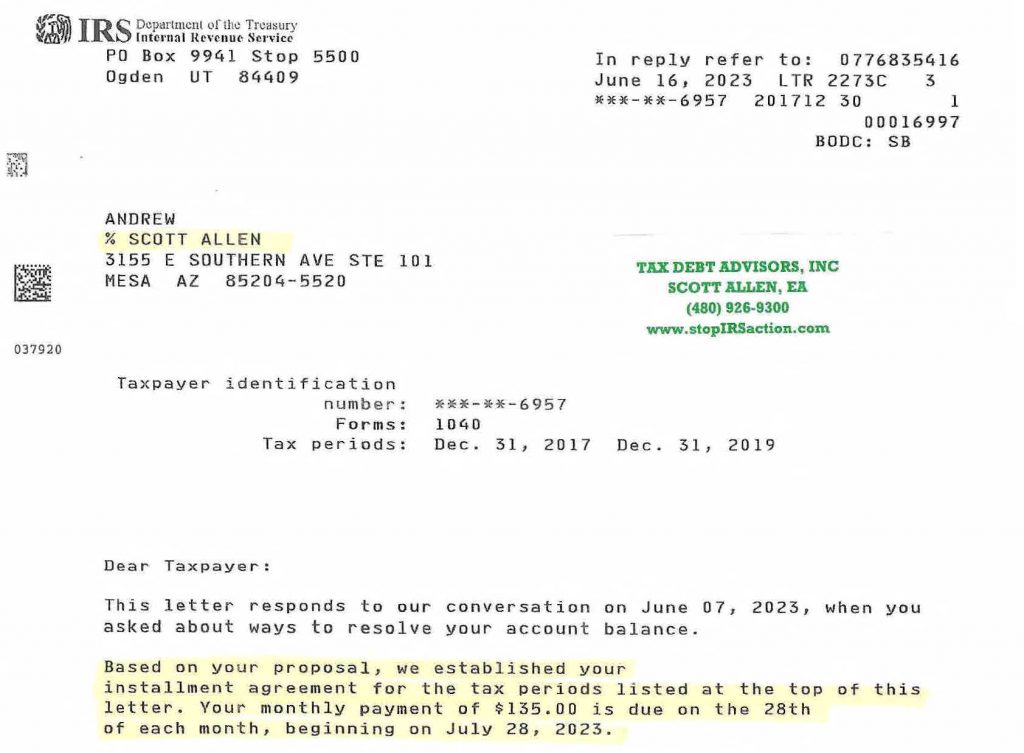

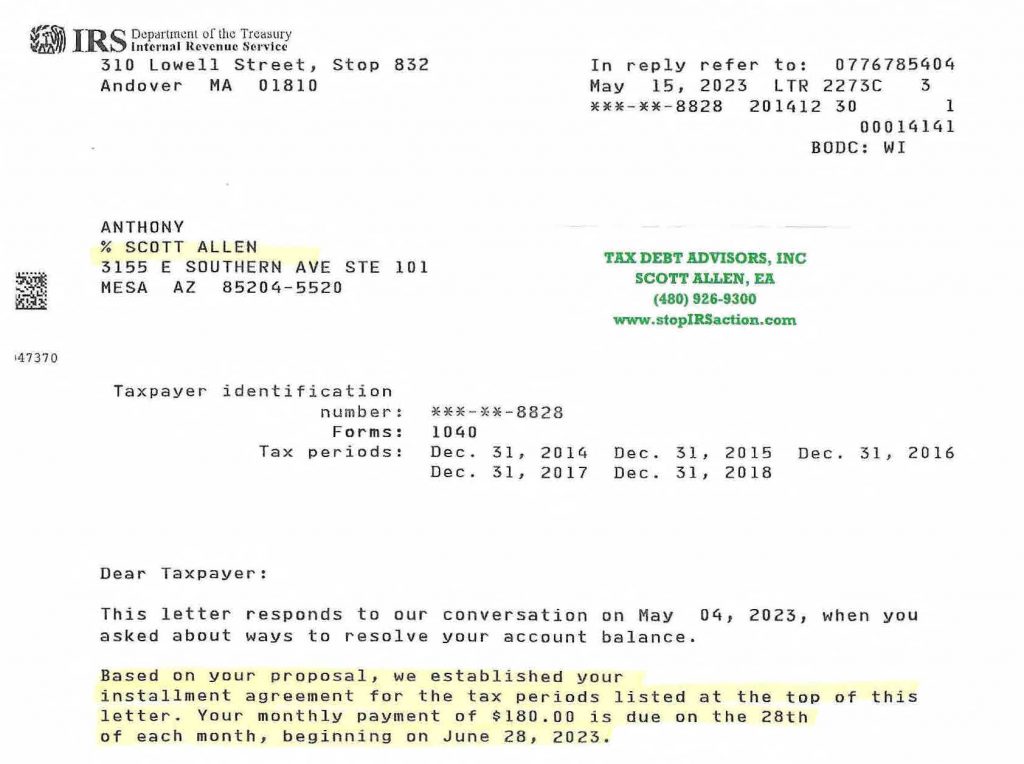

If you need an IRS tax lien released in Arizona give Tax Debt Advisors, Inc a call at 480-926-9300. View a recent IRS tax lien release for a current tax client below.

IRS Tax Lien in Arizona