Removing IRS tax interest: Can it be done?

It is not Necessary To Use A Scottsdale AZ IRS Tax Attorney to Remove Interest

The IRS takes a tough position on removing interest and therefore it is rare that our firm will charge a fee requesting interest abatement. Interest can be abated if it is due to an error by an employee of the IRS. It is much harder to seek interest abatement claiming the IRS employee delayed the process of processing the tax assessment unless it is obvious the “ball was dropped” when your case was transferred to another employee at the IRS.

If a return is amended and the balance is lowered, the interest due will also be lowered along with any penalties. If a return is filed to lower a balance due on an IRS substitute for return the same will be true. If you want a correct assessment of whether you should seek professional guidance on interest abatement, call Scott Allen E.A. at 480-926-9300 and schedule a free consultation to determine if your case has merit.

Compare Tax Debt Advisors, Inc. services with any Scottsdale AZ IRS tax attorney today! www.TaxDebtAdvisors.com

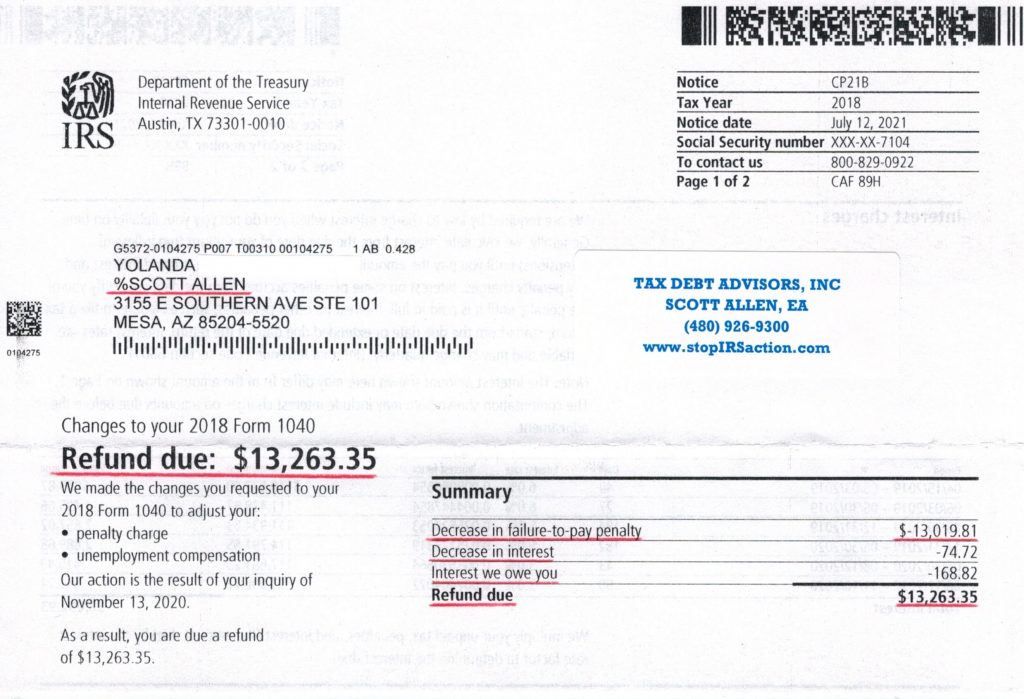

Take a look at what Scott Allen E.A. was able to do for his client, Yolanda. Thru the proper abatement process he was able to get the IRS to abate $13,019 of penalties and $243 of interest. It is important to know that not every case is the same and not everyone qualifies for abatement. To find out if you are a candidate or if you have other issues with the IRS that needs representation give Tax Debt Advisors, Inc a call today. They have been solving IRS problems since 1977.