Do I Need an Arizona Tax Attorney When the IRS Has Levied My Pay Check?

Settle 13 tax years without an Arizona Tax Attorney

No, this is not a legal matter. The IRS has levied your pay check because you have a tax liability and have not entered into any settlement option. The first step is to file any unfiled tax returns. If all of your returns have been filed, the second step is to enter into a settlement with the IRS. Once you have entered into a settlement with the IRS, the levy on future pay checks will be removed. The IRS will generally keep the amount levied unless your back tax returns show that you have a refund coming, or you can prove that keeping the levied amount would impose a hardship.

Scott Allen E.A. (who is not an Arizona Tax Attorney) can promptly file back tax returns, enter into a settlement option with the IRS, and get the IRS to remove the levy on future pay checks. Call Scott Allen E.A. today at 480-926-9300 for a free consultation. He can start the process immediately and provide the quickest release on your levied pay checks.

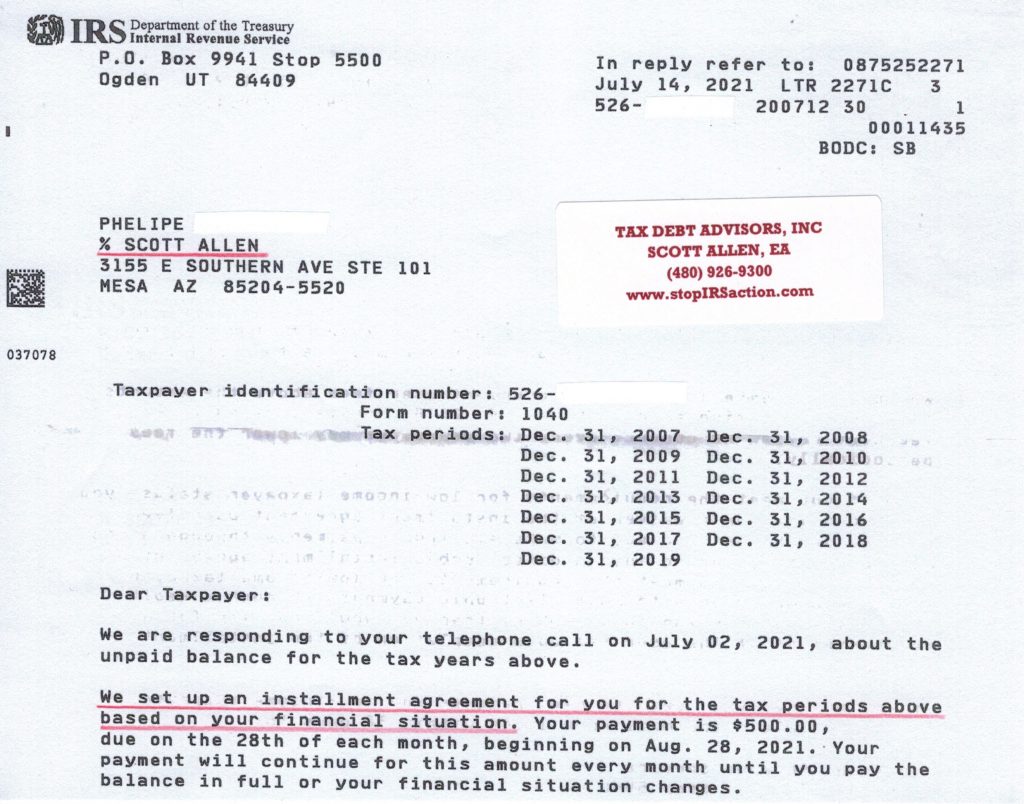

View the notice below to see how Scott Allen E.A. successfully negotiated a low $500/month payment plan for his client. He will work just as hard for you as he did for Phelipe.

3155 E Southern Ave Ste 101 Mesa, AZ 85204