Should You Opt for Scott Allen EA Over a Phoenix, AZ IRS Tax Attorney?

Why Taxpayers Should Opt for Scott Allen EA Over a Phoenix, AZ IRS Tax Attorney

In the realm of taxation and financial matters, taxpayers often find themselves in challenging situations, such as dealing with IRS levies and garnishments. These circumstances require expert assistance to navigate the complexities of tax regulations and legal proceedings. When facing such challenges in Phoenix, AZ, taxpayers have two primary options: hiring a tax attorney or enlisting the services of Scott Allen EA. While both choices have their merits, this blog delves into why taxpayers should seriously consider Scott Allen EA over a traditional Phoenix, AZ IRS tax attorney when seeking to halt IRS levies and garnishments.

Scott Allen EA, a seasoned Enrolled Agent, possesses an in-depth understanding of tax codes and regulations. With years of experience specializing in IRS matters, including levies and garnishments, Scott Allen EA has developed a deep expertise that is tailored specifically to the needs of taxpayers facing these issues. In contrast, while a Phoenix, AZ IRS tax attorney may have a broader legal background, their specialization might not be solely centered on tax matters. This distinction makes Scott Allen EA a superior choice for those requiring precise and efficient assistance in resolving IRS levies and garnishments.

Hiring an IRS tax attorney in Phoenix, AZ, can be an expensive endeavor due to the hourly rates and legal fees associated with legal representation. On the other hand, Scott Allen EA offers a more cost-effective solution. Enrolled Agents typically charge lower fees than tax attorneys, making their services accessible to a wider range of taxpayers. For individuals and businesses seeking to halt IRS levies and garnishments without breaking the bank, Scott Allen EA presents an attractive alternative. He will always quote you a fixed fee for each step that needs to be done and you will know that up front so there are not any surprises.

One of the key advantages of choosing Scott Allen EA lies in the personalized approach to each client’s case. Scott Allen EA takes the time to understand the unique circumstances of every taxpayer facing IRS levies or garnishments. This personalized attention allows for a tailored strategy that addresses the specific aspects of the case, potentially leading to quicker and more favorable resolutions. While a Phoenix, AZ IRS tax attorney may have a more formalized approach, it might lack the individualized touch that can make a significant difference in resolving complex tax matters. Scott Allen EA will represent you before the IRS from start to finish.

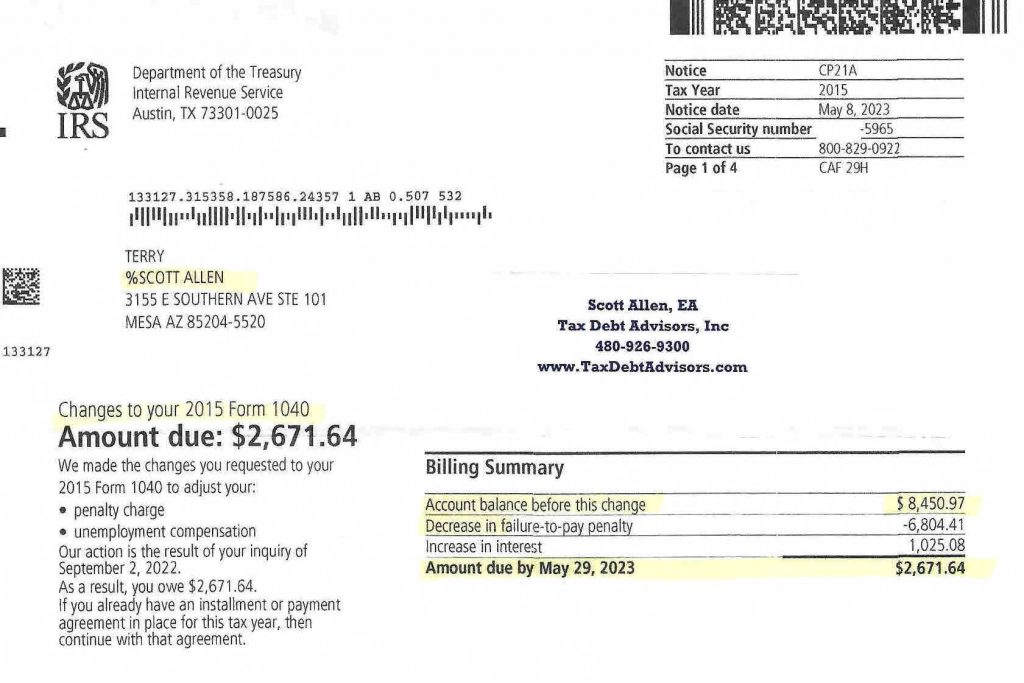

Scott Allen EA boasts a proven track record of successfully helping clients stop IRS levies and garnishments in Phoenix, AZ. With a reputation for delivering results, he has garnered trust and respect within the local community. Clients often share positive testimonials highlighting his dedication, responsiveness, and ability to navigate the intricacies of IRS procedures. While a Phoenix, AZ IRS tax attorney may also have a solid record, Scott Allen EA’s specific focus on tax-related issues gives him an edge when it comes to the nuances of halting IRS levies and garnishments. The image below is an example of Scott Allen EA helping his client be compliant with the IRS and also reducing his overall tax liability. His proven track record is the thousands and thousands of tax liabilities settled and resolved just like this one. Let him to the same for you!

Tax laws and regulations are subject to frequent changes, requiring professionals in the field to stay updated with the latest developments. Scott Allen EA prioritizes ongoing education and training to ensure that his knowledge remains current and accurate. This commitment to staying abreast of changes in tax laws allows him to provide clients with accurate advice and strategies that align with the most recent legal provisions. While IRS tax attorneys also stay informed, their broader legal scope may lead to a less specialized grasp of the evolving tax landscape.

In the realm of IRS levies and garnishments, the choice between hiring a Phoenix, AZ IRS tax attorney and enlisting the services of Scott Allen EA is a crucial one. While both options offer valuable expertise, the specialized focus, cost-effectiveness, personalized approach, proven track record, and up-to-date knowledge that Scott Allen EA brings to the table make him an exceptional choice for taxpayers in need of efficient and effective assistance. Making the decision to work with Scott Allen EA could be the key to resolving IRS levies and garnishments with confidence and success. Give him a call today and setup a free consultation at 480-926-9300.