Tax Debt Advisors reviews you can trust

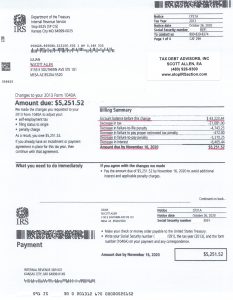

These Tax Debt Advisors Reviews saved Colvin $517,192.

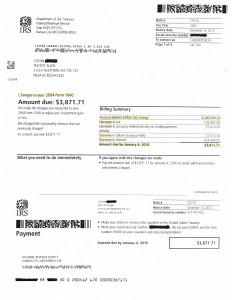

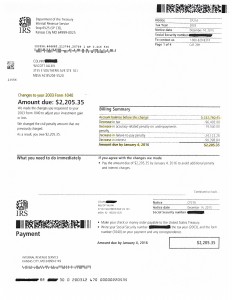

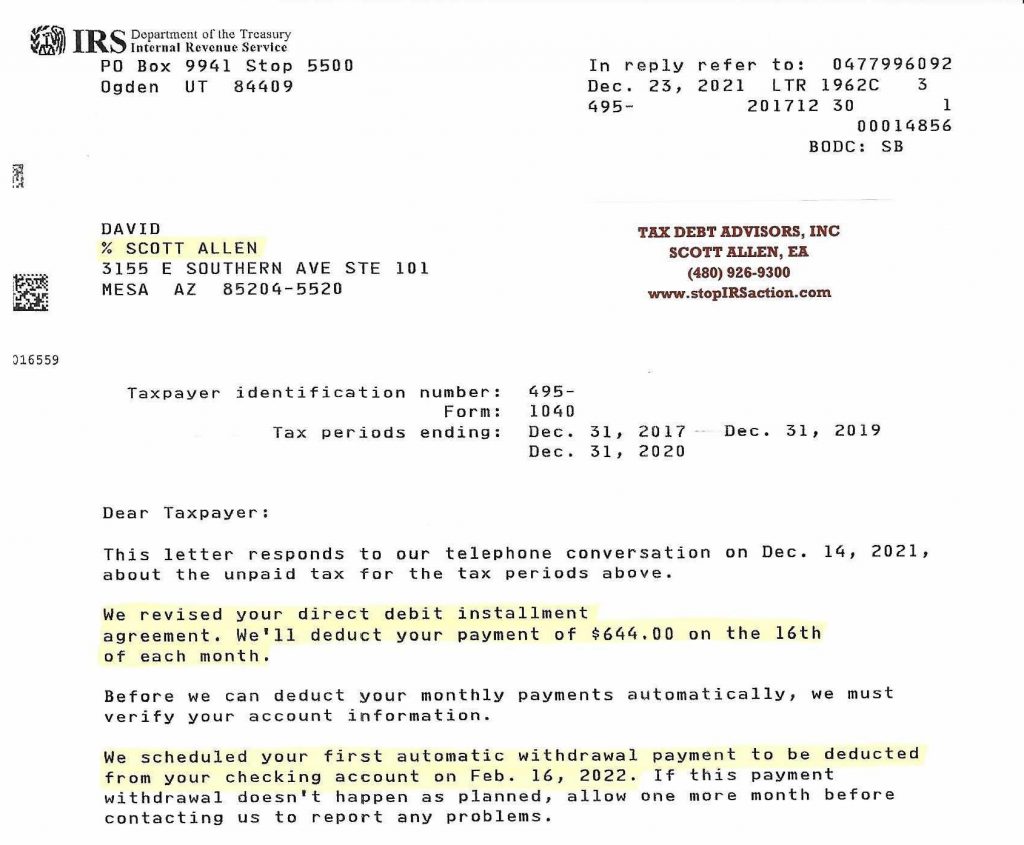

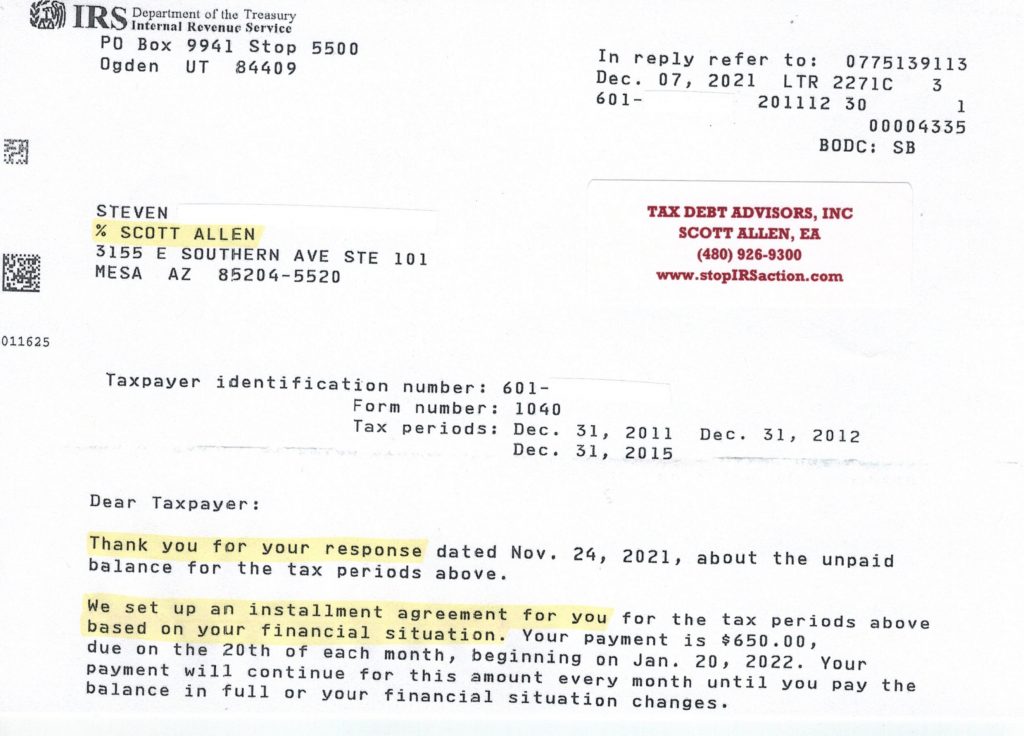

Click and view the two images above to see the work accomplished by Tax Debt Advisors of Mesa AZ.

Before Colvin met with Scott Allen EA he was buried in IRS debt and an IRS Revenue Officer contacting him to collect the debt. He had tried to get the matter resolved a year prior unsuccessfully with an out-of-state company paying them over $6,000.00 and receiving nothing in return. Colvin heard a local radio ad for Tax Debt Advisors earlier this year and knew at that moment that he needed to meet with them to get his IRS problem fixed once and for all. Tax Debt Advisors is a local Arizona company that promises follow through service. This is the best way to get a handle on an IRS problem. You have to be able to meet with your hired representative face-to-face. Also, only pay for services as they are being accomplished. If anybody is requiring a large upfront retainer that means its time to find someone else.

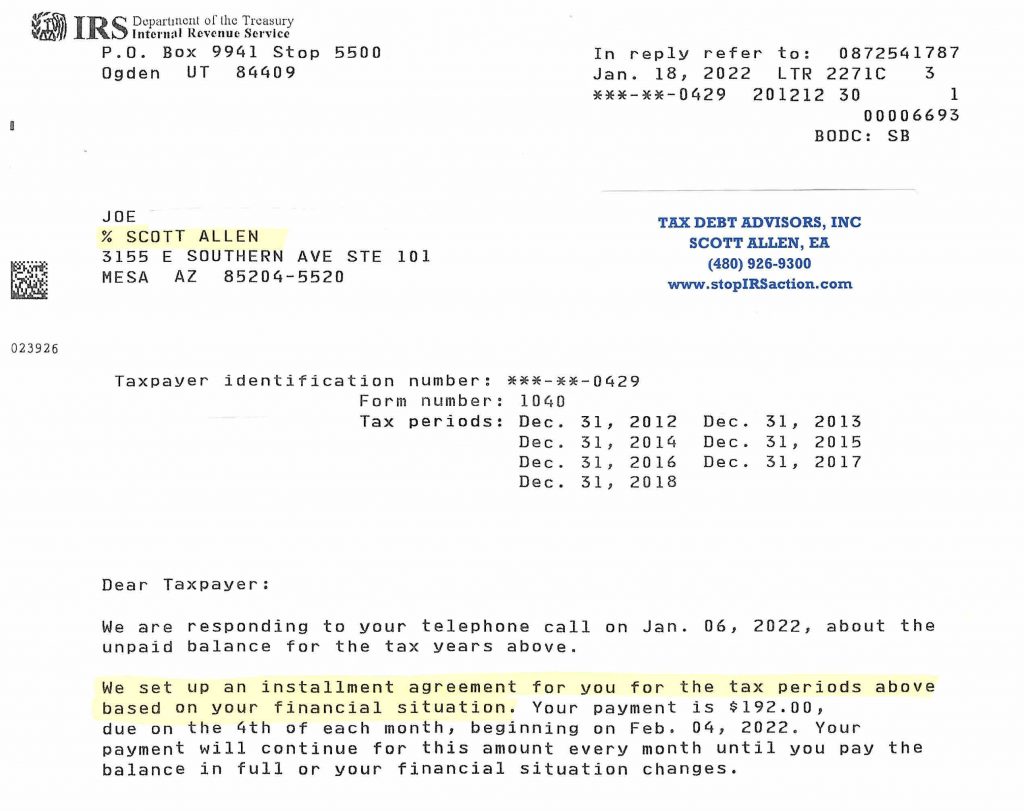

Colvin had several years of unfiled tax returns along with the two pictured above that needed to be fixed through the audit reconsideration unit in Ogden Utah. Now that his IRS debt has been reduced to a manageable amount Scott Allen EA can now negotiate a reasonable payment plan for the client. This is what he is doing for Colvin as we speak. This is the difference getting the right representation can mean. For Colvin is was a $517,192 decision.

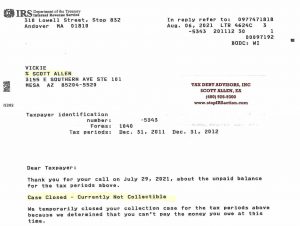

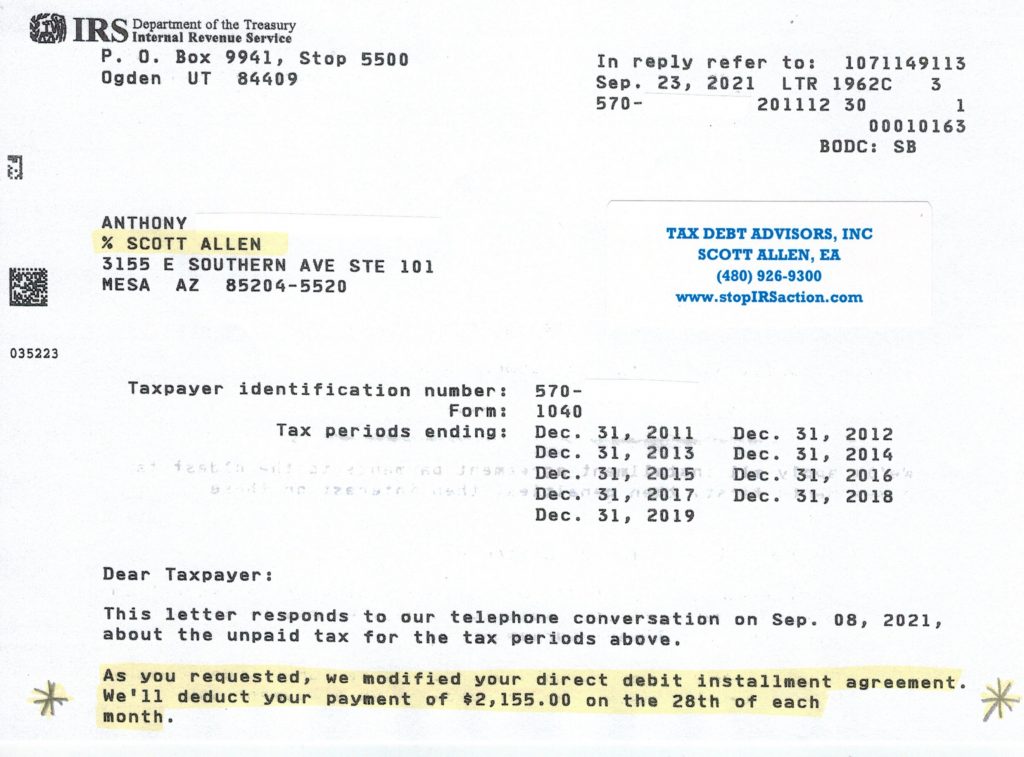

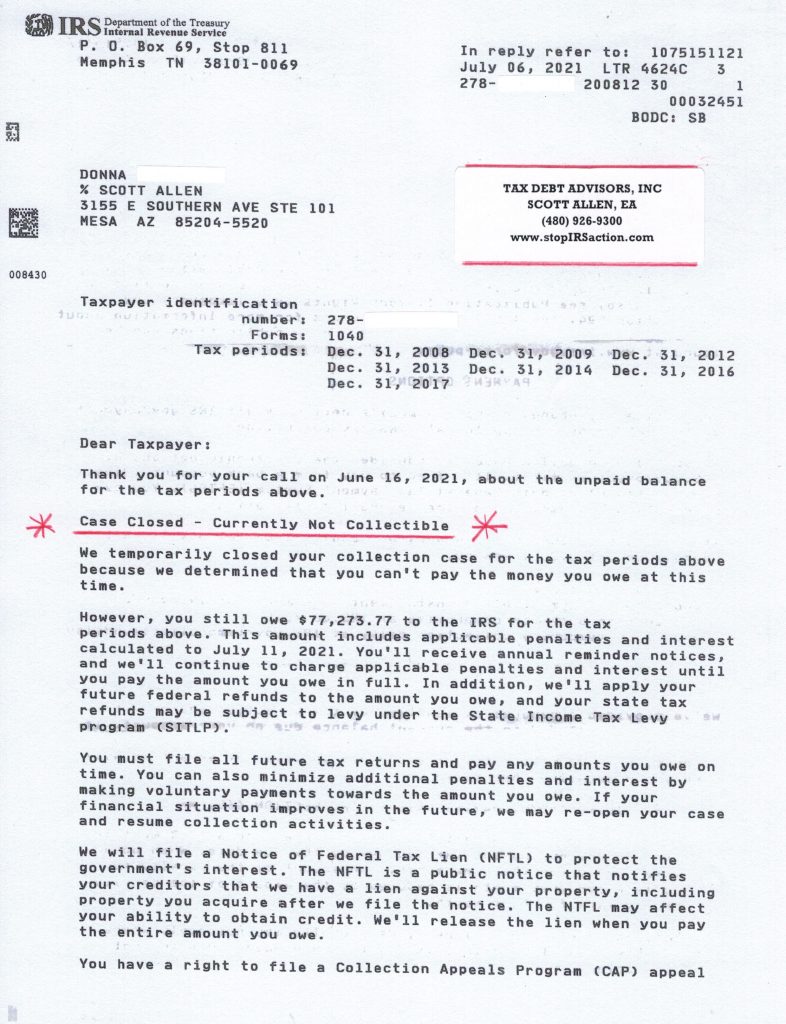

Tax Debt Advisors Reviews saved Vickie over $11,000

Vickie had old IRS debt from 2011 and 2012 that had been hanging over her head for quite some time. She met with Scott Allen EA to see what options were available to her. She heard about him thru his online reviews she read about him and had in her mind taking advantage of the “fresh start program” with the IRS that she hears advertised all the time. Yes, it is a viable option but it is time consuming and is expensive to hire the right representation. After a careful evaluation Scott Allen EA found a better solution. Let’s pay nothing back to the IRS and let it expire. Yes, IRS debts expire and for Vickie the expirations are less than two years away. All she has to do it not incur any future debts on the account and the IRS will put her in a currently not collectible status based upon her financial situation. Paying nothing is always better then paying something. Again, before you rush into a settlement idea its important to look at all the options available first. Scott Allen EA will help you do just that! See the settlement agreement Scott Allen EA negotiated for Vickie below.

Call and meet with Scott Allen EA today regarding your IRS problem. Find out what IRS settlement option is right for you. There is no fluff with Scott Allen EA. He will lead you to the path of greatest success. Tax Debt Advisors reviews are proof of previous results; not solicited statements. Contact Scott Allen EA at 480-926-9300.