2018 Phoenix IRS Debt Settlement

2018 Phoenix IRS Debt Settlement

This taxpayer was looking for a 2018 Phoenix IRS debt settlement. She found Tax Debt Advisors online and met with Scott Allen EA for a consultation on her tax matter. All her tax returns were already filed except for the current tax return. That year would not be an issue as it had a refund anyways.

Scott Allen EA was hired to be her power of attorney representative before the Internal Revenue Service. He contacted the IRS initially for two reasons. He needed to first confirm all the issues on the account:

- Verify what years are owed for

- Total amounts owed

- All tax returns were filed.

- Verify where the account assigned at

Upon completing that review Scott and the taxpayer met to begin collecting and evaluating her current financial status. She was in the middle of switching jobs so it was a little difficult getting the most accurate information in a way to relay to the IRS appropriately. However, we got it done and advised her to get into a currently non collectible status for all her back IRS debt.

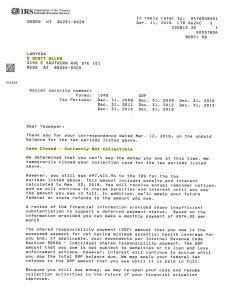

Attached below is the approval notice their clients 2018 Phoenix IRS Debt Settlement. See for yourself the work that Scott Allen EA handled timely and efficiently.

If you are struggling with the IRS on back tax debt or unfiled tax returns consult with a local tax professional whos family company has over 41 years of committed success. Their office is conveniently located in the greater Phoenix area.