Do I need a Gilbert Tax Attorney to file an IRS Audit Reconsideration?

Gilbert Tax Attorney

No, a Gilbert Tax Attorney is not needed as this is not a legal matter. It is an IRS procedure to correct a substitute for return prepared by the IRS or the results of an audit—usually an audit that you did not attend or have representation in attendance. An IRS Audit Reconsideration will require the taxpayer to provide tax records to substantiate their position. The Audit Reconsideration is for tax matters the IRS has not previously considered.

If you have a tax matter that needs to be re-evaluated by the IRS, the IRS Audit Reconsideration program is an excellent procedure to consider. Scott Allen E.A. has expertise in providing representation on IRS Audit Reconsideration cases that will give you the best chance of eliminating or lowering the tax balance owed. Rather than calling a Gilbert Tax Attorney call Scott Allen E.A. today at 480-926-9300 for a free consultation regarding your options to take advantage of the IRS Audit Reconsideration program.

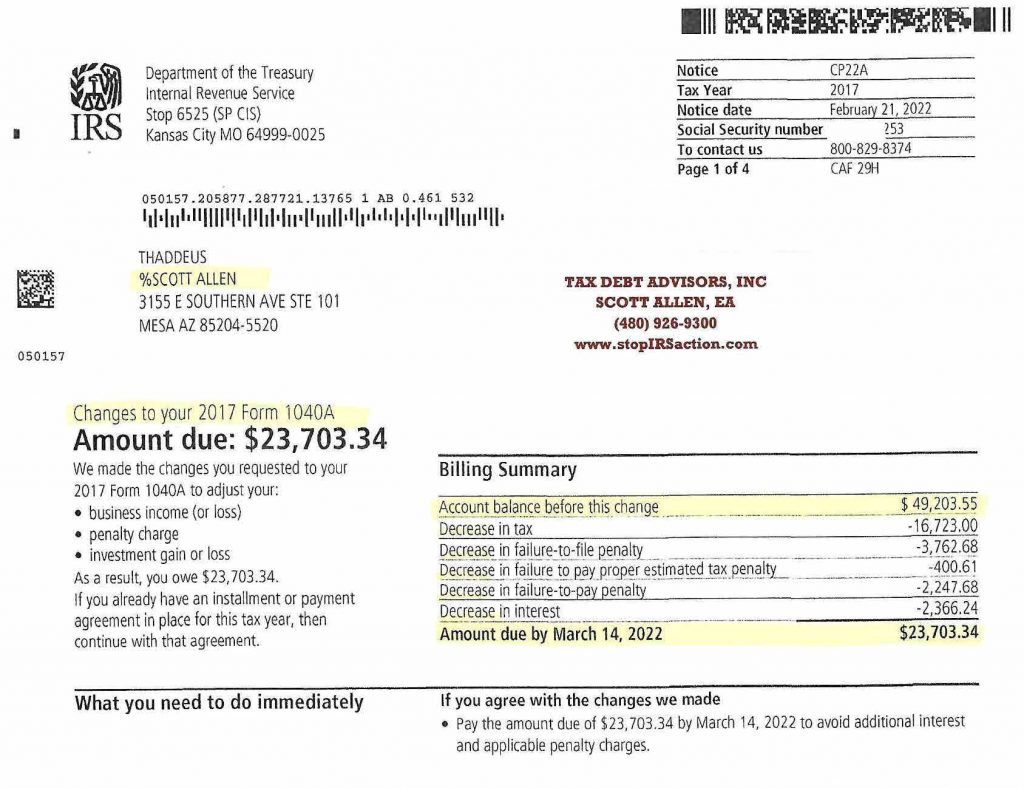

Thad was a victim of an IRS Audit – Substitute For Return. The IRS assessed a tax year and sent him a $49,000 tax bill. Rather then consulting with a Gilbert Tax Attorney he discussed his matter with Scott Allen EA. Scott gave him the peace of mind that he could resolve the matter and reduce the tax bill to the proper amount owed. Scott Allen, a tax preparer near Gilbert AZ prepared the tax return and submitted the protest to the IRS. As you can view from the IRS notice below, the protest was accepted and $26,000 of tax, interest, and penalty was removed. Don’t pretend you can fight the IRS alone. Get it done right and right the first time with Scott Allen EA.