Do I need an Arizona IRS Tax Attorney for IRS Tax Relief Programs?

No, IRS tax relief programs are not a legal matter. Your Arizona IRS Problem can be resolved without going through an Arizona IRS Tax Attorney. The most common tax relief programs are:

- Installment Arrangements

- Current Not Collectible Status (CNC)

- Offer in Compromise

- Filing Delinquent returns

- Protesting Substitute for Returns

- Penalty Abatement

- Qualifying Taxes for Discharge in Bankruptcy.

Scott Allen E.A. has expertise in helping you choose the best option and getting the IRS to accept that option. Before speaking with an Arizona IRS tax attorney call Scott Allen E.A for a free consultation at 480-926-9300. Scott will make today a great day for you.

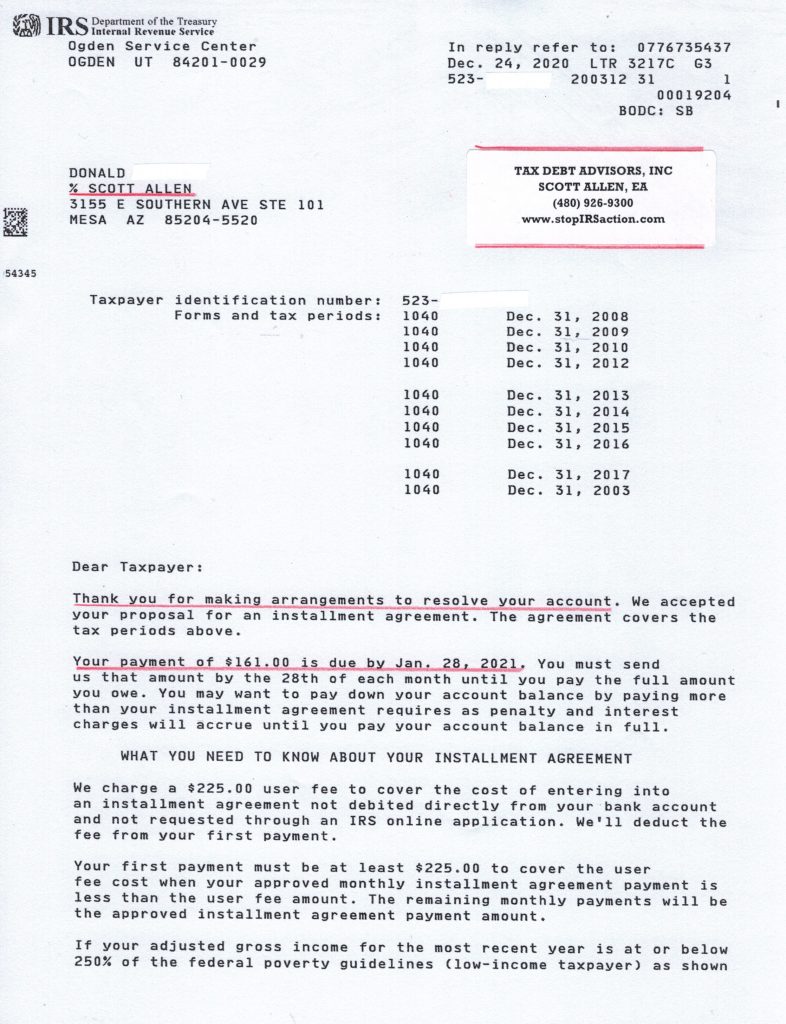

Below is an example of a settlement option that was successfully negotiated by Scott Allen E.A. Don had ten years of back IRS taxes owed. He needed an aggressive settlement and needed it done quickly. Scott was able to wrap up all that IRS tax debt into one low monthly payment plan of $161 per month.