Mistakes Tempe Arizona IRS Tax Attorneys often make

Why using a Tempe AZ IRS Tax Attorney for an IRS audit is a mistake:

When taxpayers get an audit notice from the IRS, panic attacks begin. The first mistake that taxpayers make is that they did something wrong or ever worse, they did something criminal and they contact a IRS tax attorney in Tempe Arizona. We have seen literally hundreds of clients who initially retained a Tempe AZ IRS Tax attorney to represent them in an audit. Tempe AZ IRS Tax Attorney fees for these services averaged 1 to 3 times what we would have charged, if we felt an initial audit representation was even needed.

Most of the time we know before going into an IRS audit what the auditor will accept or reject. If we know we will be successful in the audit we will take on the assignment and do it for significantly less than a Tempe Arizona IRS Tax Attorney. If we know that the auditor will reject our proposal we will have auditor give us an assessment and file an appeal and make our “stand” there. We do not charge to file an appeal and when we represent our clients in Appeals, we know that the Appeals Office has greater latitude to compromise on issues that the auditor does not. The Appeals Office does not want to spend a lot of time on audits and is greatly understaffed for their work load. Because of this, we have the opportunity to save our clients in two ways; less to the IRS and less for representation. REMEMBER THE HIGHER UP YOU GO AT THE IRS, THE CLOSER YOU GET TO “SANTA CLAUS.”

Our fee audits generally runs from $1000 to $1,850.00. A Tempe AZ Tax IRS Attorney will generally charge around $3,000 for an audit and another $3,000 for Appeals. The bad news is that the taxpayer–YOU, often don’t know this when your retain an Tempe AZ IRS Tax Attorney and cannot afford to pay another $3,000 to be represented in Appeals. Now what do you do? That is when we get calls from frantic taxpayers who have exhausted most of their available money for IRS representation and basically gotten nothing.

Also, it is important to know the whole picture before starting representation work before the IRS. For instance, we recently had a client hire an Arizona Attorney for audit representation. He was successful with the audit bringing his debt assessment down from $80,000 to $50,000. But in the process he was getting billed by the Tax Attorney over $8,000 in fees. Afterwards the client came to see us to see what his IRS options were from this point forward. In evaluating his financial situation it was determined that the IRS would put his IRS debt into a Non Collectible Status and pay ZERO dollars on his debt. Whether or not the client owed the IRS $50,000 or $80,000 he still would have qualified for Non Collectible status. What it really worth $8,000 to fight the IRS in an audit? Had the client met with Tax Debt Advisors, Inc. instead of a Tempe AZ IRS Tax Attorney we could have saved the client $8,000 in audit representation fees. For this clients particular case he was charged by our company only $1,650 to have us qualify him for Non Collectible Status with the IRS. As of today he is still in Non Collectible Status with the IRS however his is still making monthly payments to pay off his debt with the IRS Tax Attorney in Tempe he hired. Don’t make costly mistakes.

Make the right choice at the beginning of this process. Before meeting with a Tempe Arizona IRS Tax Attorney contact Scott Allen E.A. at 480-926-9300 and have him evaluate your IRS tax audit at no cost and see what he would recommend. Doing it the right way from the beginning will save you two ways: with the IRS and with retaining a trusted IRS representative. We have represented clients all over Tempe, AZ which include the zip codes such as 85281 and 85283.

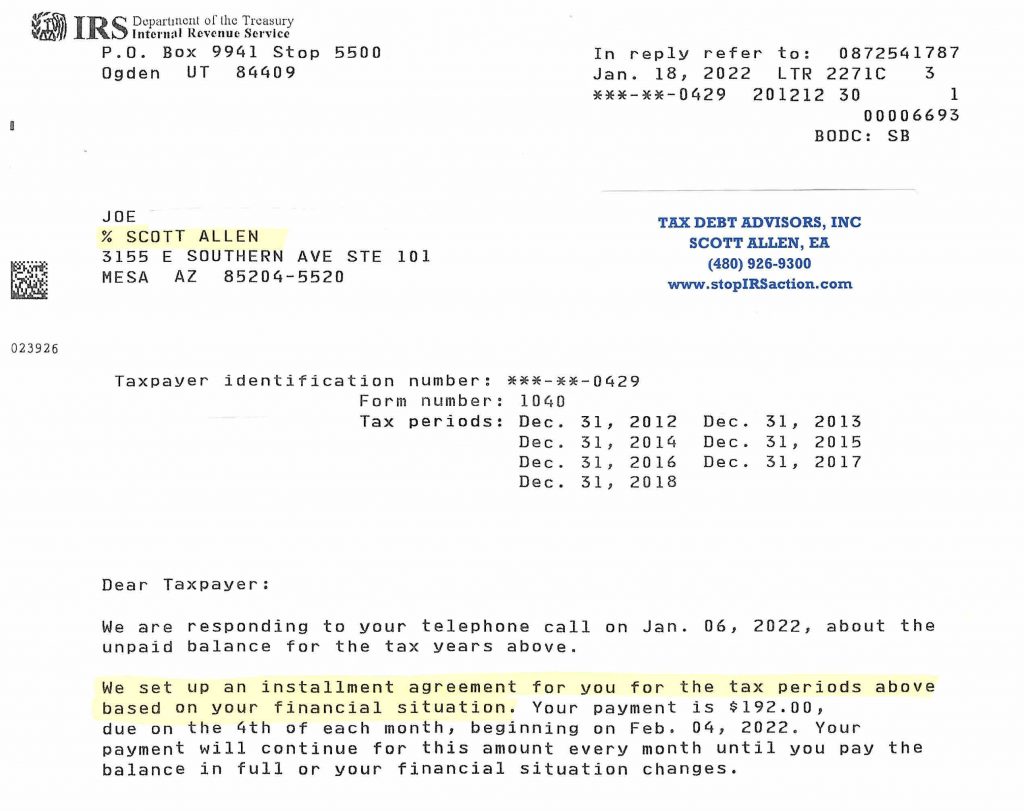

Below is an example (or testimonial) of how Scott Allen EA helped his client Joe settle seven years of back taxes into a extremely low month payment plan. Be represented RIGHT the FIRST time!